It's still early, but Intuitive Surgical (ISRG 3.56%) stock could be on track to turn in its best performance of this decade. Shares of the robotic surgical systems company are up nearly 50% so far in 2017, well above the end-of-year gains for all but one year since 2010.

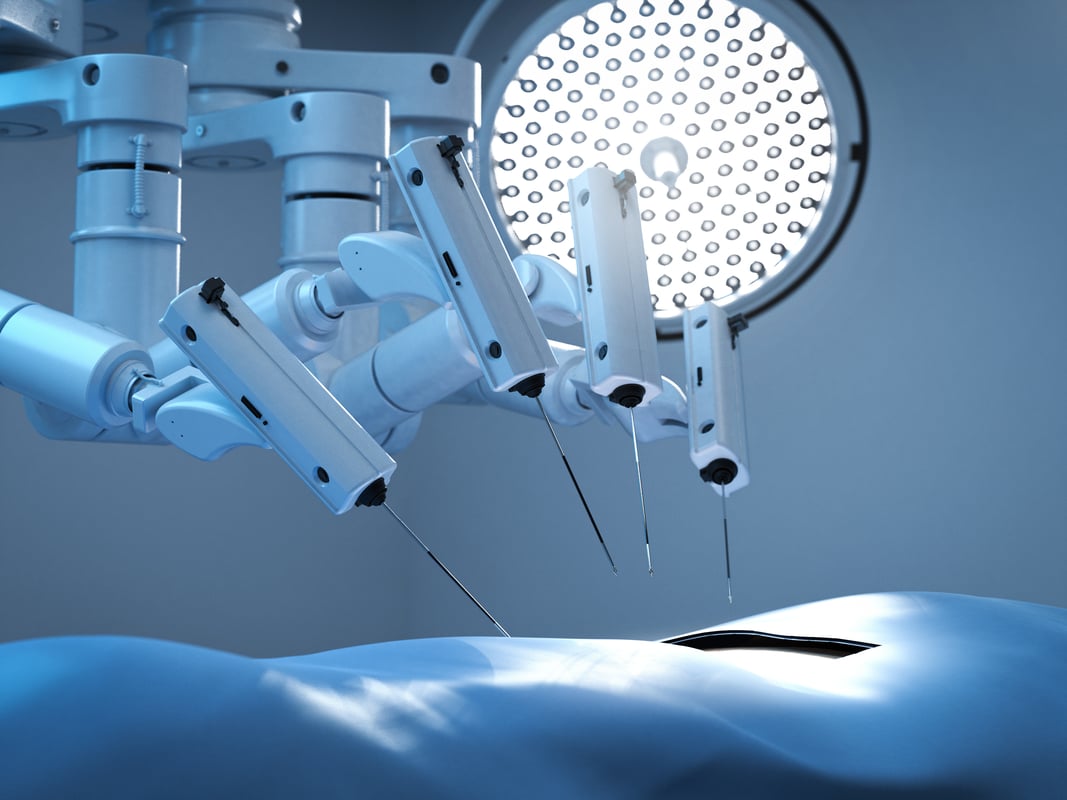

Robots are all the rage these days, although Intuitive Surgical's da Vinci surgical system might not meet the purists' definition of robot. But public interest in robots doesn't fully explain why Intuitive Surgical stock has taken off this year. The following three charts, though, tell the story of the company's current -- and potentially future -- success.

Image source: Intuitive Surgical.

1. Tremendous earnings growth

There's not much that drives a stock higher than solid earnings growth. And Intuitive Surgical has certainly enjoyed earnings growth in recent years.

ISRG Net Income (TTM) data by YCharts.

It's important to note that the company's sales have also grown during the last three years thanks to increasingly more procedures performed by da Vinci systems, but not nearly as much as earnings have. There are two key reasons for this. First, Intuitive Surgical's gross profit has improved because revenue outgrowth outpaced the cost of that revenue. Second, the company has done a great job at keeping selling, general, and administrative expenses under control.

Can Intuitive Surgical keep the momentum going? Probably so. Wall Street analysts think the company will grow earnings over the next five years at an average annual rate of 11% -- higher than Intuitive Surgical's growth over the last five years.

2. Impressive recurring revenue

A great business is one that can count on money coming in the door year in and year out. That's the scenario for Intuitive Surgical. Roughly 71% of the company's revenue last year was from recurring sources.

Data source: Intuitive Surgical investor presentation. Chart by author.

The company's recurring revenue rate in the first quarter of 2017 was even better -- 77%. As the da Vinci install base grows, so do sales of instruments and accessories and service contracts.

3. Huge growth opportunities

Intuitive Surgical continues to experience most of its procedure volume growth from the U.S.; gynecology (particularly hysterectomies), general surgery, and urology are the company's focus areas. However, there could be plenty of room for growth.

Data source: Agency for Healthcare Research and Quality, Intuitive Surgical 10-K. Chart by author.

Intuitive Surgical doesn't currently address many of the top surgical procedures with da Vinci. Others, including Mazor Robotics (MZOR +0.00%), target some of the types of procedures that da Vinci doesn't, such as spine and brain procedures.

So far, Intuitive Surgical has talked mainly about improving its technology in its core markets. And there are significant opportunities to grow market share in those areas -- especially with international growth. At some point, though, the company could eye some of the procedures that aren't currently at the top of its list.

It could look to develop its own capabilities. Perhaps an easier path would be to acquire a smaller company. Buying Mazor would be less likely because of its relationship with Medtronic (MDT +0.46%). However, Globus Medical (GMED 2.51%), which also is focused on developing robotic surgical systems for spine surgeries, could be a possibility down the road.

Looking ahead

Intuitive Surgical has a lot of things going for it. However, there are some risks investors should note. Potential competition from other major players is one threat. Medtronic, for example, plans to launch its own robotic surgical system in 2018 that will target some of the same procedures that da Vinci currently performs.

Perhaps the more immediate risk is that the stock is priced to perfection. Intuitive Surgical shares currently trade at nearly 35 times expected earnings. Any bump in the road for the company will probably feel like a crater to shareholders. Still, though, with the long-term growth prospects ahead of Intuitive Surgical, I suspect this stock will enjoy plenty more good years ahead.