Conglomerate 3M (MMM -1.05%) has a wide variety of businesses that span several different sectors of the economy. From its much-lauded Post-It Notes to important niche offerings in fields like technology, healthcare, energy, and aerospace, 3M has been able to use its innovation to grow and share its profits with investors through rising dividends. With a solid dividend yield and good prospects ahead, investors want to know whether they can rely on 3M's dividend going forward. The following analysis looks at 3M and the aspects that can tell you whether the dividend is likely to be safe in the future.

Dividend stats on 3M

|

Current Quarterly Dividend Per Share |

$1.175 |

|

Current Yield |

2.3% |

|

Number of Consecutive Years With Dividend Increases |

59 years |

|

Payout Ratio |

52% |

|

Last Increase |

February 2017 |

Data source: Yahoo! Finance. Last increase refers to ex-dividend date.

A solid dividend yield

Dividend investors like high yields, but stocks that have dividend yields that are too high can indicate heightened risks in some cases. 3M's dividend yield of 2.3% is far from overextended, yet it's also above the overall market average. The yield is also comfortably in the range that 3M has seen over the past five years, which has climbed as high as 3% and fallen to as little as 1.8%. With the yield comfortably in the middle of that range despite a stock price near all-time highs, 3M's dividend yield doesn't show any warning signs for investors.

Image source: 3M.

Payout ratio

3M currently pays out just over half of its earnings in the form of dividends. That isn't troublesome, as it gives the company plenty of leftover money to use either for strategic investments or to reinvest into its own business. One thing to note, however, is that 3M has allowed its payout ratio to rise over the past several years, with levels more typically in a range of around 35% to 40% during the early 2010s. Investors will want to keep an eye on future payout ratios to make sure that dividend growth doesn't outpace earnings growth over the long haul.

Dividend growth

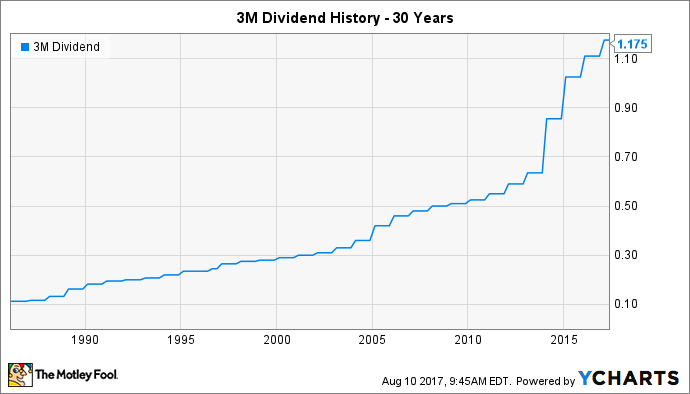

3M has demonstrated a strong commitment to dividends over its history. The company has had more than a century of uninterrupted quarterly payments, and for 59 straight years, it has made annual boosts to its payout. That has ensured that investors continue to get rewards for their long-term investments regardless of whether the company has been booming or has suffered inevitable cyclical downturns.

MMM Dividend data by YCharts.

As you can see, 3M has seen much of its dividend growth come in quick bursts. The mid-2010s brought accelerating growth, although increases over the past couple of years have slowed from what shareholders saw previously. Nevertheless, with 3M's most recent dividend boost of 6%, the conglomerate has sustained its reputation as a Dividend Aristocrat with the staying power to keep growing.

What's ahead for 3M's business?

One key aspect of understanding 3M is that its business rarely produces the blockbuster growth that investors see from faster-growing segments of the economy. Instead, 3M tends to pride itself on steady growth trends that are sustainable for decades at a time.

3M's most recent performance illustrates the company's philosophy. In the second quarter of 2017, 3M saw just 2% revenue growth, and that increase came from a balanced approach that included roughly 4% gains in organic growth for the company's industrial business, 3% in safety and graphics, 2.5% in healthcare, and 0.7% for the consumer division. 3M has seen outpaced gains from its electronics business, which posted double-digit percentage rises in organic sales. Yet even though some worry that electronics might be carrying the company forward single-handedly, 3M's longer-term history shows that it typically finds sectors in which to concentrate efforts, taking advantage of opportunities until they play out and then moving on to other strong prospects.

A safe dividend

No stock is a sure thing, but 3M has a safe dividend at this point. With solid prospects for measured growth and plenty of margin of safety to sustain its dividend payouts even if the company hits a short-term earnings slump, 3M is in position to extend its long streak of rising dividends and keep shareholders happy well into the future.