Robotic surgical pioneer Intuitive Surgical, Inc. (ISRG +0.78%) has had quite a run lately. So far this year, shares are up 56%, and over the past three years, the stock has more than doubled. With shares near all-times highs at close to $1,000 per share, a side effect of the company's good fortune is that it has recently announced plans for a 3-for-1 stock split in early October.

While the move is largely a non-event (and I'll explain why in a moment), it does highlight the impressive nature of Intuitive Surgical's recent results and presents a great opportunity to review the specifics of the split and understand why the company would take such a step.

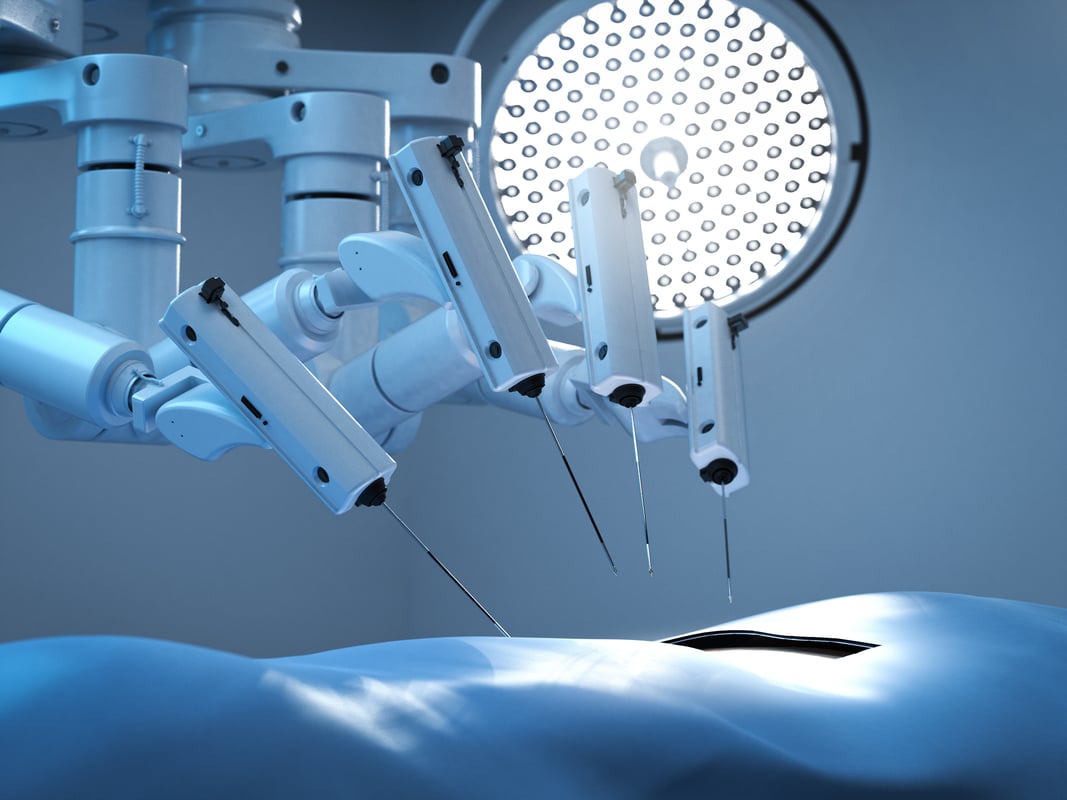

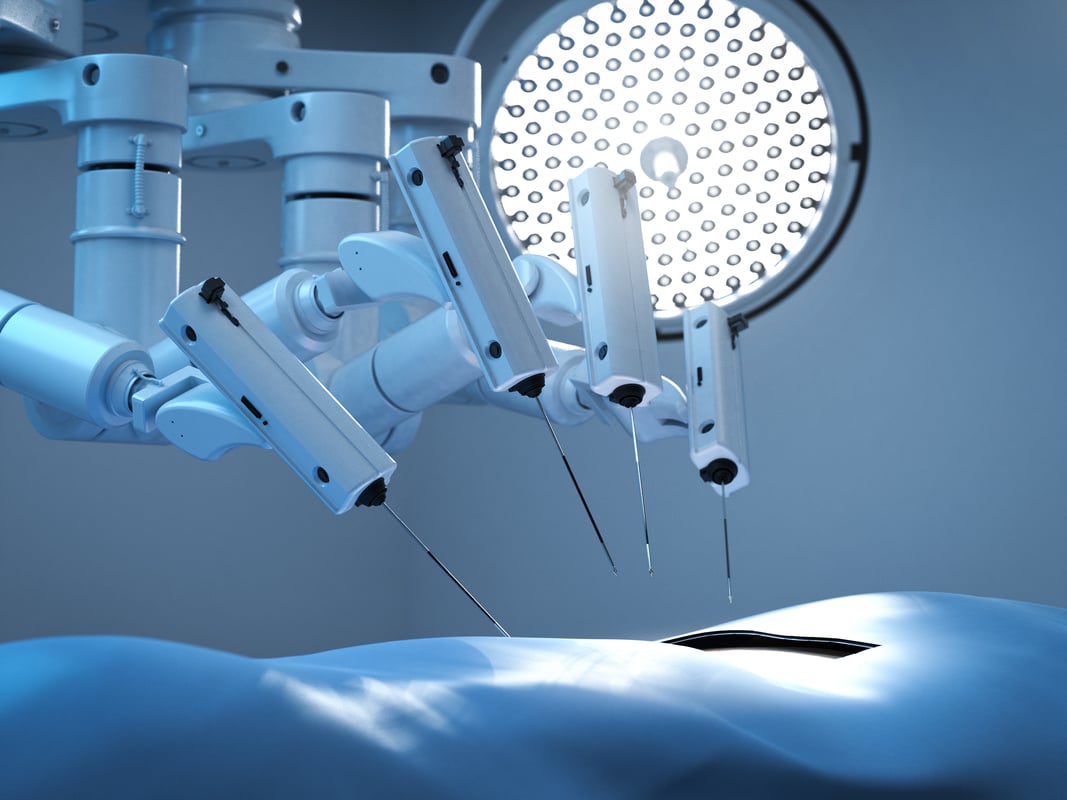

What will Intuitive Surgical's stock split mean to investors? Image source: Intuitive Surgical.

The details

Intuitive Surgical's stock split, which will be subject to shareholder approval at a company meeting on Sept. 22, would be effective on Oct. 6, for shareholders of record as of Sept. 29. If approved, it will entitle each stockholder to two additional shares for each one held.

A stock split, however, doesn't change the financial value of the investment. As an example, if a shareholder owns 10 shares of Intuitive Surgical that traded for $999 before the 3-for-1 split, afterwards they'll own 30 shares worth $333 apiece. The total value of the investment will still be $9,990. From the company's perspective, with 100 million shares outstanding before the split, it will have 300 million outstanding after and will maintain the same market cap near $37 billion.

Then why bother?

Since the stock split doesn't have a material effect on a shareholder's ownership of the company, why would a company even bother to split its shares?

In years gone by, stock splits were viewed as a way to keep shares affordable to the individual investor. In the days before discount brokers and low trading commissions, investors were required to buy in lots of 100 shares each. High-priced shares would make stock purchases unaffordable for the majority of investors and discourage them from investing, so most companies kept share prices low to attract stockholders.

These days, investors can buy individual shares and even partial shares of stock from discount brokerages, and commissions have fallen to a range of $4 to $5 per trade. However, there are still a few reasons to keep shares prices from becoming too costly.

One of those reasons involves the options market. For those unfamiliar with options, each contract is based on an underlying investment in 100 shares of stock. If those shares are too costly, it discourages options investors.

Additionally, shareholder psychology must be taken into account. Some investors may not look at any other information and perceive a stock trading near $1,000 per share as being "more expensive" than lower-priced shares of another company without considering the other financial metrics necessary to make such a determination.

Intuitive Surgical revealed its motivation in a regulatory filing with the SEC, where the company stated, "The Board of Directors believes that the stock split would make our shares more affordable and attractive to a broader group of potential investors, increase liquidity in the trading of our common stock, and increase the attractiveness of our employee equity awards."

Fueling the rally

In its most recent financial release, Intuitive Surgical reported revenue that increased by 13% year over year and net income that increased 20% over the prior-year quarter. The amount of recurring revenue from service, instruments, and accessories grew to 71% of total revenue. The base of installed systems numbered over 3,800 when last reported in September 2016. As that base continues to grow, so, too, should the recurring revenue generated by supporting those systems.

Long-term investors should remember that a stock split has no financial impact on their investment. While there may be a short-term price increase resulting from the increased demand, it will be the performance of the company the dictates the ultimate trajectory of the stock.

And lately, that performance has been excellent.