Being one of the biggest solar manufacturers in the world should be a strength at this point in the solar industry. But for JA Solar (NASDAQ: JASO) the position hasn't led to a valuable company or a business that appears to have any real chance at long-term profitability.

Second quarter results released this week showed why JA Solar and other large competitors like JinkoSolar (JKS 0.28%), Canadian Solar (CSIQ +4.50%), and Hanwha Q-Cells (HQCL +0.00%) are in a tight spot in a highly competitive solar market.

Image source: Getty Images.

This is as good as it gets

I think it's important to understand how good second quarter market conditions were for solar manufacturers. U.S. developers were buying all the modules they could ahead of potential tariffs later this year and Chinese developers were rushing to complete projects before solar feed-in tariffs were reduced, resulting in high demand and rising module prices. Conditions were ripe for every major solar manufacturer to crush expectations in the quarter. And that's what makes JA Solar's results so disappointing.

Total shipments of 2.4 GW was impressive, but revenue of $878.1 million means sales were just $0.37 per watt. That's a low price given strong market conditions and the measly 12.9% gross margin the company generated was disappointing as well. The poor margin resulted in just $19.9 million in net income in a quarter that should have been ideal conditions for making money.

The problem here is that if shipments fall to 1.6 GW to 1.7 GW in the third quarter, as expected, it'll be all but impossible to make money. Pricing won't be as favorable and lower volumes will mean underutilized equipment and less margin to cover operating expenses.

Why solar manufacturers are in trouble

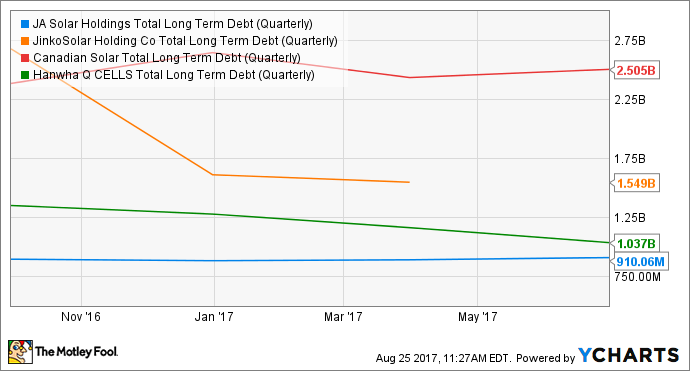

Compounding problems for all of these manufacturers is that they all own aging solar equipment that needs to be upgraded. Multi-crystalline solar cells that dominated the last decade are no longer the most cost efficient for many solar projects and as costs come down mono-PERC solar cells -- which are more efficient and a different material construction -- are becoming the new industry standard. According to PV-Tech, the seven biggest solar manufacturers in the world, which includes JA Solar, JinkoSolar, Canadian Solar, and Hanwha Q-Cells, will spend over $2.5 billion on capital equipment upgrades in both 2017 and 2018. It'll be hard to pay for those upgrades if the core business isn't making money.

Even after upgrades are completed it's not clear that there will be much margin improvement or differentiation over competitors who are making the same modules with similar equipment. It's a vicious cycle solar manufacturers are in.

Can anyone make money in solar energy?

Chinese solar manufacturers are literally crushing each other because they're being so competitive in building capacity and selling panels differentiated mostly on price. That dynamic makes it difficult to make money and will ultimately make it hard to justify taking on even more debt to continue buying next generation manufacturing equipment.

JASO Total Long Term Debt (Quarterly) data by YCharts

Unless there's a surprise surge in solar module demand in the second half of the year or supply somehow comes offline, it's hard to see how Chinese solar manufacturers are going to make money. And with solar module prices only heading lower long-term, it's hard to see how they'll ever turn to long-term profitability.