Midstream oil and natural gas pipeline giant Kinder Morgan Inc (KMI 0.33%) recently announced some positive news -- big dividend hikes in each of the next three years. If that has you feeling bullish on Kinder, then you'll love high-yielding pipeline partnerships Magellan Midstream Partners, L.P. (MMP +0.00%) and Enterprise Products Partners LP (EPD 0.13%). They both offer higher yields today and impressive histories of distribution growth.

A distribution growth machine

One of the exciting things about Kinder Morgan's dividend news is that it's planning to hike its dividend 60% next year, 25% in 2019, and another 25% in 2020. That's huge growth, but there's a slight catch: The company is coming back from a 75% distribution cut at the start of 2016. Magellan Midstream Partners, on the other hand, has increased its distribution every year for 17 years running.

Image source: Getty Images.

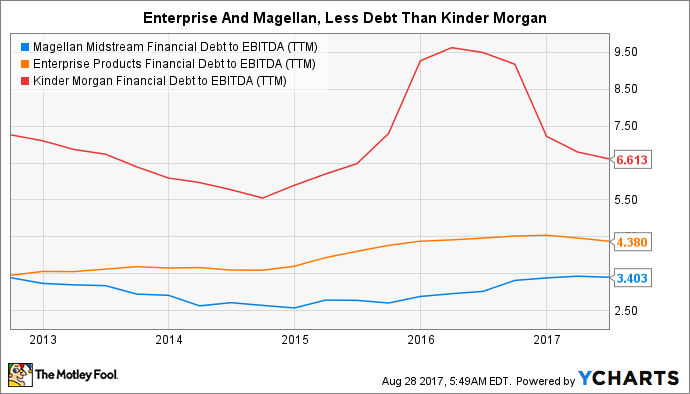

It's gearing up for more hikes, too. Right now the $15 billion market cap partnership has around $1 billion in growth projects planned. And it's looking at another $500 million worth of potential additions to that figure. With a debt-to-EBITDA ratio of around 3.4 (Kinder Morgan's is 6.6), it has relatively low leverage, which means Magellan shouldn't run into any problems covering its distribution. Note that it covered the distribution by 1.2 times in the second quarter, providing ample margin for safety.

Distribution growth at Magellan, meanwhile, is expected to be 8% in each of the next two years. However, over the past decade annualized distribution growth has been around 11%, with higher numbers over the trailing three- and five-year periods. So 8% is the target, but if things go well, it could easily be a higher number. Magellan's current yield, meanwhile, is roughly 5.3% compared to Kinder Morgan's 2.6%. Using today's stock price, it won't be until 2019 that Kinder Morgan approaches the yield offered by Magellan.

Slow and steady

The other intriguing partnership is Enterprise Products Partners. This $55 billion market cap midstream partnership is just as large and diversified as Kinder (which has a $42 billion market cap) in case Magellan's relatively small size has you worried. And it currently yields around 6.5%. Using today's stock price, Kinder Morgan won't come close to that until 2020, after all three of its planned dividend hikes.

MMP Dividend Per Share (Quarterly) data by YCharts.

But between now and then Enterprise is likely to have increased its distribution at least 12 times. That's because it is working on a streak of 52 consecutive quarterly distribution hikes (the partnership's annual streak is 20 years and counting). With a coverage ratio of 1.2 times, there's a margin of safety and ample room for continued hikes. The average annualized increase over the trailing decade, however, is roughly 5%. That's a bit slower than Magellan, but if you're looking to maximize income, the higher yield today should be of keen interest. And, importantly, the distribution is growing faster than the historical growth rate of inflation.

MMP Financial Debt to EBITDA (TTM) data by YCharts.

As for the future, you should expect roughly 5% distribution growth, on average. That's backed by around $9 billion in growth projects that are currently on the books. It's debt-to-EBITDA ratio of 4.4, meanwhile, is higher than Magellan's but much lower than Kinder Morgan.

Kinder Morgan cut its dividend because it was short on cash to fund its growth projects. Enterprise has managed to keep increasing its distribution every quarter despite investing in its business and opportunistically acquiring assets.

The Foolish takeaway

If you read about Kinder Morgan's planned dividend hikes and got that bullish feeling, you should step back and consider higher-yielding Magellan and Enterprise. In addition to higher yields, they have more impressive distribution histories than Kinder, solid growth plans, and less onerous debt burdens. It's not that Kinder's dividend plans aren't signs of a confident company -- they are. But for those in search of yield, I think you'll love Enterprise and Magellan even more.