What happened

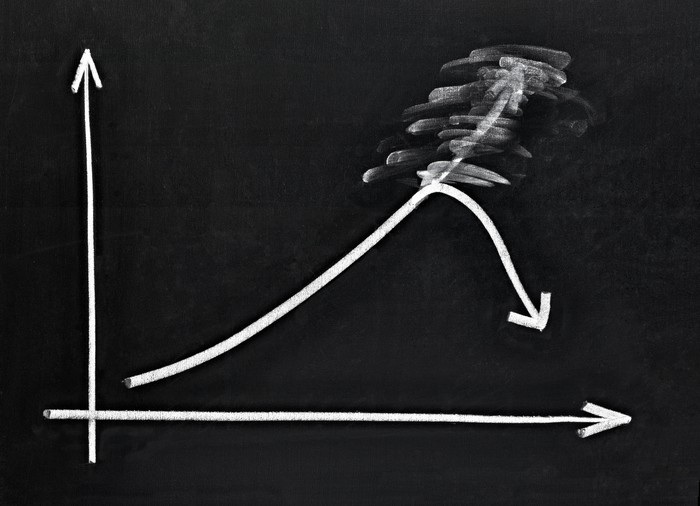

Shares of diversified fertilizer producer and distributor Mosaic Co. (MOS 1.00%) dropped nearly 13% last month, after the release of second-quarter 2017 earnings on the first day of August. There was good news and bad news in the update, but investors appear to have been fixated on the new full-year 2017 financial guidance management provided.

Although the ranges for selling volumes were "narrowed," in management's words, the high end of each range was reduced compared with the last reported guidance ranges. That was all Mr. Market needed to lower Mosaic Co. stock to levels last seen all the way back in 2006.

Image source: Getty Images.

So what

Mosaic Co. turned in a solid second quarter of 2017 compared with the year-ago period. However, the first-half 2017 results still fell short of the same span from 2016. Revenue was about equal in the first six months of this year compared to last year, but operating income dropped 29%. A large benefit from foreign currency transactions in the first half of 2016 led to an even worse year-over-year comparison for net income, which dropped 61% this year.

The all-important-and-quite-disappointing guidance ranges for full-year 2017 sales volumes were handed down as follows:

- Potash volumes of 8.1 million to 8.6 million metric tons (MT), compared with the previous range of 8.0 million to 8.75 million MT.

- Phosphate volumes of 9.5 million to 10 million MT, compared with the previous range of 9.5 million to 10.25 million MT.

- International distribution volumes of 6.75 million to 7.25 million MT, compared with the previous range of 7 million to 7.5 million MT.

Why do these matter so much to Mr. Market? Since the company has really only kept pace with previous-year revenue by churning out higher production volumes, any reduction in expected sales volumes hints that revenue and earnings will continue to head lower compared with previous periods.

The updated guidance is not what investors were expecting, but the good news from the second quarter still shouldn't be completely dismissed. Potash and phosphate selling prices -- the primary nutrients the company sells -- are holding their ground better than nitrogen fertilizer prices. Meanwhile, the company's exports are turning in a solid performance in 2017 -- and that's before the Vale Fertilizantes acquisition has closed. Once the dust settles, the move promises to create a fertilizer powerhouse in South America, which is the fastest growing agriculture market in the world.

Now what

Shareholders are understandably frustrated, especially considering Mosaic Co. stock is at historic lows. Management is doing everything it can to control the factors it has influence over, but the current down cycle continues to be full of surprises and drag on longer than anyone thought possible. The good news is that the company has remained profitable. The bad news is investors may need to get used to lower levels of profitability for the foreseeable future.