Intuitive Surgical (ISRG +0.68%) recently provided investors with its third-quarter financial report card, and the company delivered high marks for system placements and sales and procedure growth. Net income increased, too. But there are a few caveats investors should know about. Is this robotic surgery stock still a buy?

Digging into the details

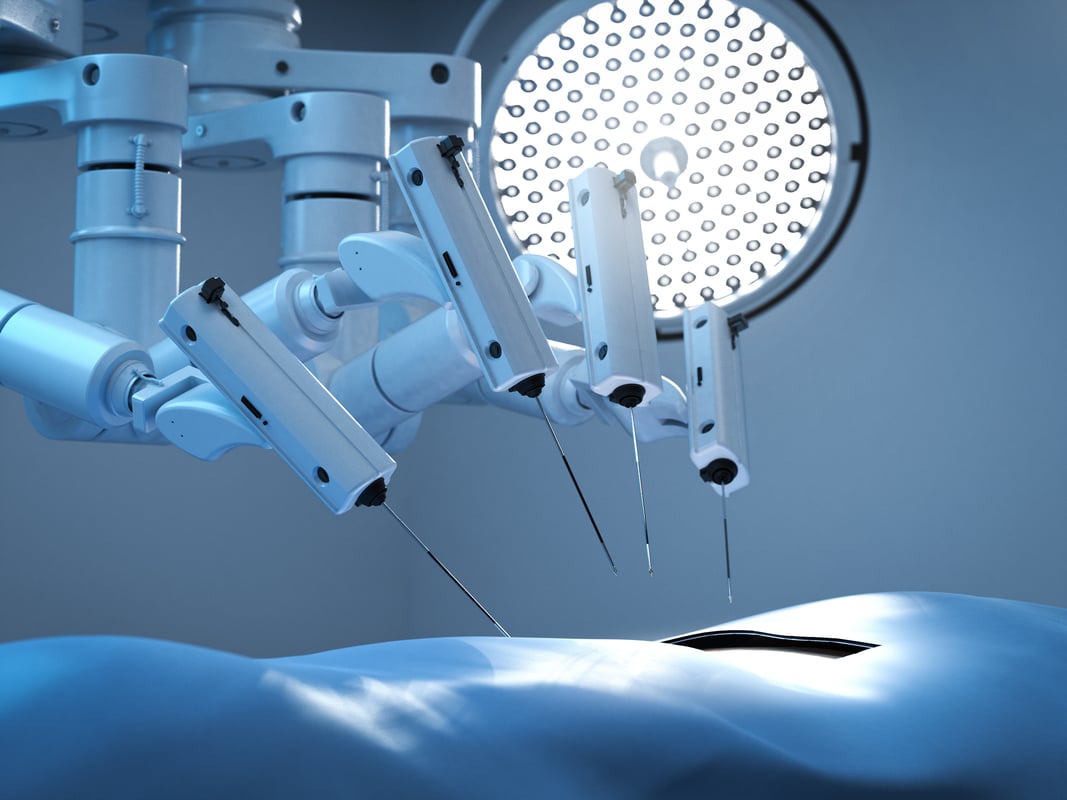

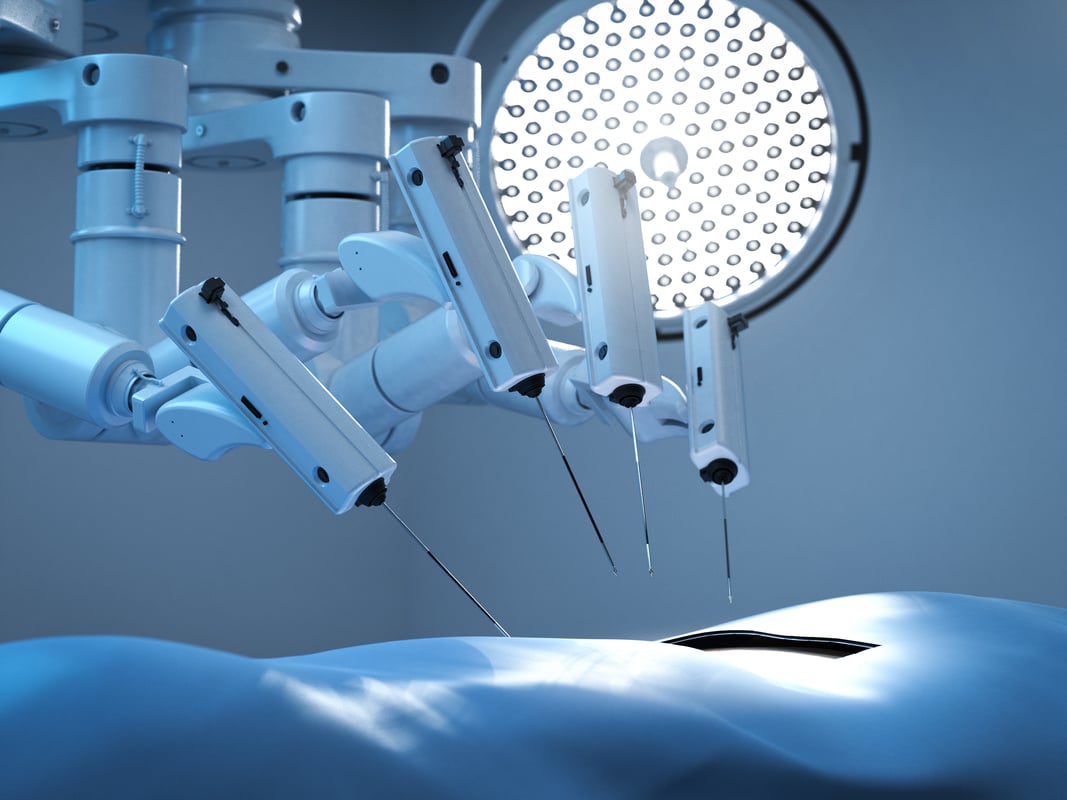

Surgeons are already commonly using Intuitive Surgical's da Vinci system to assist them during urological procedures, and increasingly, they're using the system to help them perform general surgery, including colorectal and hernia procedures.

IMAGE SOURCE: GETTY IMAGES.

As a result, hospitals are buying more da Vinci systems and procedure volume is growing. In the third quarter, the number of systems shipped to surgery centers increased 26%, to 169, and procedure volume grew 15% year over year.

System sales, instrument and accessory sales, and service revenue all improved in the quarter. Total revenue was $806 million, up 18% from last year. System sales contributed $258 million, and instrument and accessory revenue grew in line with procedure volume, to $401 million. Service revenue was the laggard, but it still improved 13%, to $147 million.

As for the bottom line, net income clocked in at $297.5 million, up from $211 million in Q3 2016, and adjusted earnings per share increased to $2.77 from $2.06 last year.

There are some disclaimers associated with these numbers, however -- namely, the net income increase wasn't because Intuitive Surgical spent less per dollar of sales on selling, general, and administrative expenses (SG&A). In fact, the company spent more for every dollar of revenue on that line item in the third quarter than last year. Research and development expenses also increased as a percentage of revenue from last year, but that's less worrisome because innovation is critical to expanding da Vinci's use.

In the following table, I'm including some line items from the company's Q3 income statement that are important to understanding Intuitive Surgical's numbers last quarter.

| Metric | Q3 2017 | Percentage of Sales | Q3 2016 | Percentage of Sales |

|---|---|---|---|---|

| Revenue (millions) | $806.1 | $682.9 | ||

| Operating expenses: | ||||

| Selling, general, and administrative | $204.8 | 25.41% | $168.0 | 24.60% |

| Research and development | $83.4 | 10.35% | $62.6 | 9.17% |

| Total operating expenses | $288.2 | 35.75% | $230.6 | 33.77% |

| Income from operations | $278.6 | 34.56% | $256.4 | 37.55% |

| Net income | $297.5 | 36.91% | $211.0 | 30.90% |

Data source: Intuitive Surgical's third-quarter income statement. Chart by author.

As you can see in the above table, operating income as a percentage of sales decreased from last year, so net increasing net income wasn't due to operating efficiencies. Instead, it was because of tax items. GAAP and non-GAAP earnings per share were boosted by a one-time tax benefit of $0.59 in the quarter. As a result, the company went from spending $55.8 million on income tax last year to enjoying an $8.1 million benefit for income taxes in Q3, 2017.

| Metric | Q3 2017 | Q3 2016 |

|---|---|---|

| Income tax (benefit) expense | -$8.1 | $55.8 |

Data source: Intuitive Surgical's third-quarter income statement. Chart by author.

What's the takeaway?

Investors should be particularly happy with Intuitive Surgical's rising system placements because these additional systems should translate into more procedures and higher recurring revenue in the future. The 15% procedure growth is also bullish.

The rate remains nicely above the 9% to 12% growth-range forecast at the start of the year, despite decelerating slightly quarter over quarter, and it led management to increase its range for procedure growth to between 15% to 16% this year from between 14% to 15% exiting Q2.

The uptick in SG&A as a percentage of sales isn't great news because ideally, sales growth is leveraged against fixed costs for margin expansion. Instead, margin declined last quarter year over year. However, there's bound to be lumpiness in these metrics as the company grows, so it can be helpful to step back and consider a longer-term comparison.

For example, Intuitive Surgical's Q3 2017 revenue was 36.6% higher than Q3 2015, and its 34.6% operating margin handily outpaced the 32.2% rate from two years ago. The following chart adds a bit of additional perspective on how growing use of its surgical robots has translated into growth over time. While net income faces headwinds from higher operating expenses this year, I think this chart shows why you might not want to worry too much about it.

ISRG Revenue (TTM) data by YCharts.

Overall, I believe there's a massive opportunity for Intuitive Surgical's sales to expand as it moves into additional procedure indications. This remains one of my favorite stocks to own in long-term growth portfolios.