Fitbit (FIT +0.00%) dominated the early rounds of the wearable tech surge, and the success sent its revenue and profits soaring from 2012 to 2015. Yet the company quickly lost its momentum last year as cheaper devices flooded the market.

Now the fitness tracker specialist needs a string of product wins to recapture its leadership position as demand shifts toward higher-end smartwatch devices.

Image source: Getty Images.

Investors will get important clues on whether Fitbit's rebound strategy is working when the company posts its third-quarter results on Wednesday, Nov. 1.

By the numbers

|

Metric |

Q3 2017 Guidance |

Q3 2016 |

Year-Over-Year Change |

|---|---|---|---|

|

Revenue |

$380 million to $400 million |

$504 million |

(23%) |

|

Earnings per share |

($0.05) to ($0.02) |

$0.19 |

N/A |

Change is from the midpoint of guidance. Data source: Fitbit financial filings.

CEO James Park and his executive team are projecting a brutal 23% sales decline this quarter as revenue falls to below $400 million from $500 million in the prior-year period. The bad news is that result would imply more market share losses. However, it would also mark the first time since 2015 that its sales growth has improved rather than worsened -- an important first step in any turnaround.

Profits trends are also expected to be negative, but not quite as bad as before. Fitbit is calling for its adjusted losses to shrink to about $0.03 per share from $0.08 in the second quarter of the year.

Behind the numbers

Looking beyond those headline trends, shareholders will get a few numbers that will help them judge whether Fitbit's refreshed product portfolio is resonating with consumers. That list includes gross margin, which ideally will remain comfortably above 40% of sales.

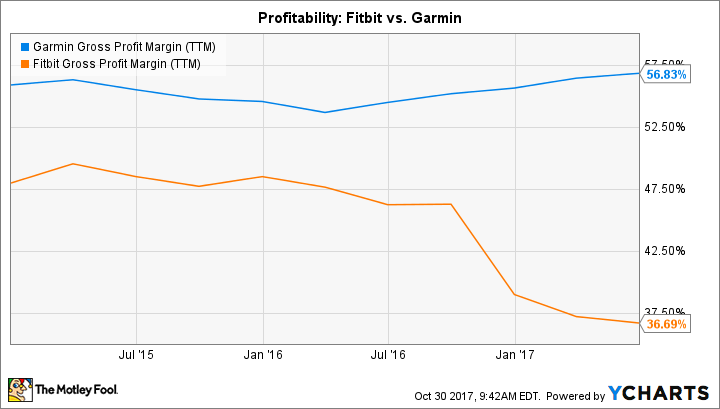

Rival Garmin (GRMN 0.38%), after all, enjoys a 56% profit margin on its fitness devices. Fitbit can't hope to approach that figure until its business stabilizes, but an improving gross profit margin would suggest its devices are finding good traction heading into the holiday season. Gross margin is running at 42% through the first half of the year, but executives have said they expect it to rise to as high as 44% for the full year.

GRMN Gross Profit Margin (TTM) data by YCharts.

Also keep an eye on the pace of device sales. Fitbit moved 3.4 million of its products last quarter to beat management's expectations and help the company improve its inventory position. Average selling prices ticked higher as well, crossing $100 per device. Shareholders would love to see continued improvements on both of these metrics.

Holiday quarter forecast

A big portion of Fitbit's sales and profits come from the holiday quarter, and so any update to its short-term forecast is likely to draw most of investors' interest this week. As of early August, management expected a wide range of potential sales results for the full year, between $1.55 billion and $1.7 billion. That prediction implies that the fourth quarter will bring in somewhere between $500 million and $700 million.

Any adjustments Park and his team make to that range will mostly be a function of how Fitbit's latest device releases, including the Ionic smartwatch, are being received by retailers today as they fill up their inventories ahead of the holiday season crush. After that comes the hard part as Fitbit aims to earn full price sell-through on those devices in a market that's packed with smartwatch competition from Garmin, Apple, and many other rivals in the wearables industry.