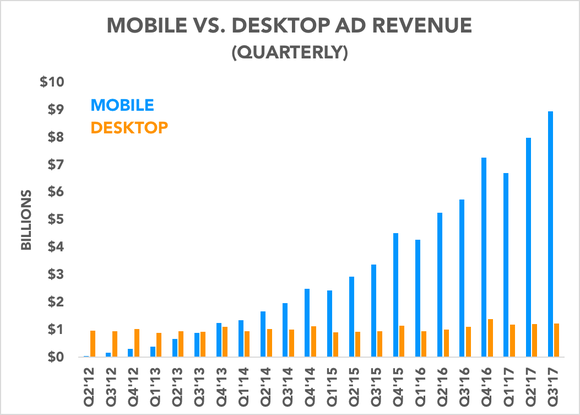

As expected, mobile was the big driver of Facebook's (FB 2.50%) third-quarter earnings release earlier this week, driving a whopping 88% of all ad revenue during the quarter. With total ad revenue coming in at $10.1 billion, mobile ad revenue was approximately $8.9 billion during the quarter.

Desktop ad revenue continues to take a back seat to the mobile ad business, while payments revenue continues to be insignificant. I track and analyze Facebook's mobile-centric metrics every quarter, so it makes sense to provide investors with an update.

It's all about mobile. Image source: Facebook.

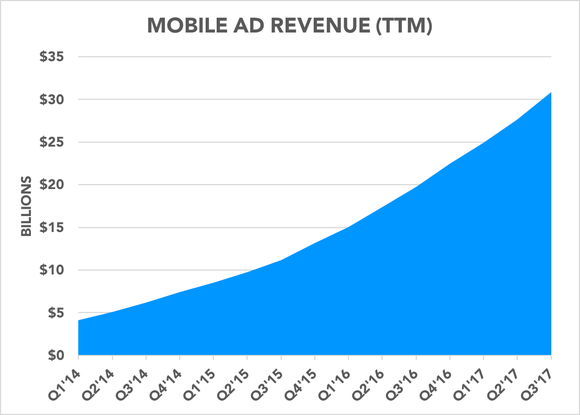

$30 billion and counting

If you translate Facebook's mobile ad business into absolute dollars on a trailing-12-month (TTM) basis, the social network has hit a new high -- $30.8 billion in TTM mobile ad revenue:

That's a pretty meaningful milestone considering the fact that mobile was a huge overhang following Facebook's initial public offering just five years ago, when the company derived virtually no revenue from mobile and its ability to execute on the transition was a huge risk factor.

Mobile percentage is plateauing, which is fine

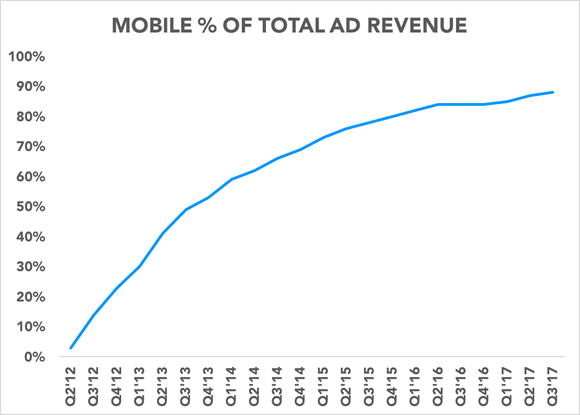

As for how that mobile percentage has changed over the years, it's been hovering near 90% for quite some time:

Data source: SEC filings. Chart by author.

It's possible that Facebook is running into a natural ceiling with this metric, which is fine. While the majority of usage now comes from mobile, there will always be users who access the social network via desktop browsers, so it's unlikely that mobile would ever represent 100% of ad revenue.

Dollars and sense

If you look at that desktop ad business, it looks mostly stable in dollar terms, with quarterly revenue consistently between $1 billion and $1.4 billion in recent quarters. The overall size of the desktop ad business hasn't really deviated much over the past five years, while the mobile ad business has clearly skyrocketed:

Data source: SEC filings. Chart by author.

None of this is news to investors; Facebook's incredibly successful transition to mobile has driven the investing narrative in recent years. That's precisely why shareholders should keep a close eye on how the mobile business is faring, including these quarterly updates that take a closer look at the mobile-centric metrics. By the look of things, mobile is still going swimmingly.