Wheaton Precious Metals Corp (NYSE: WPM) is a unique way to invest in the gold and silver space. Its top- and bottom-lines are tied to the sale of these precious metals, but it doesn't own or operate a single mine. And then there's its dividend, which doubled in a single quarter in 2013 only to be cut, in little increments, by more than 60% over the next year or so. It's on the rise again, but why? And what should you expect from here? This is what you need to know about Wheaton Precious Metals and its dividend history to answer questions like these and to decide if this dividend paying precious metals investment is right for you.

What Wheaton does

The first thing to understand about Wheaton is that it's not a miner, it's a precious metals streaming company. That means it pays cash up front to miners for the right to buy silver and gold at reduced prices in the future. Miners use the cash to shore up their balance sheets or, more often, build new mines or expand existing ones. Wheaton provides access to cash when other options, like banks and selling stock and bonds, aren't desirable.

Image source: Getty Images

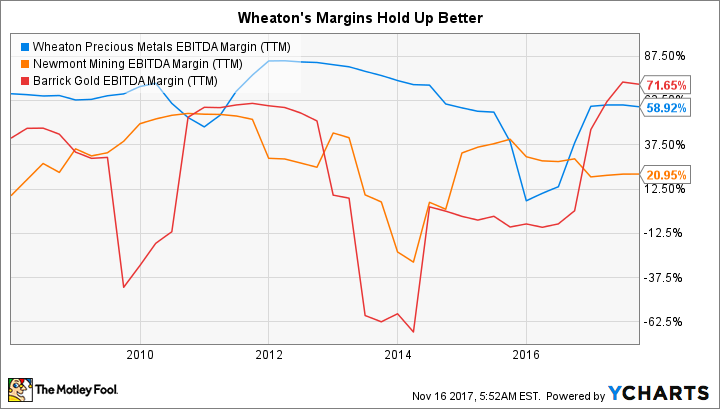

The benefit for Wheaton is locked-in low prices for silver and gold. It pays around $4 an ounce for silver and $400 an ounce for gold, both well below current spot prices. These low prices help keep Wheaton's margins wide in both good years and bad, when miners' margins are likely to be dipping into the red. In fact, bad years for miners are actually an opportunity for Wheaton to grow, because that's exactly when they are likely to be most desperate for Wheaton's cash.

With that as a backdrop, you might expect Wheaton's dividend to be fairly stable over time -- like streaming competitors Franco-Nevada Corp (FNV +1.40%) and Royal Gold, Inc. (RGLD +2.33%), which have increased their dividends annually for 10 years and 16 years, respectively. But that's not the case. Wheaton's dividend has gone up and down, often dramatically.

A moving target

The reason Wheaton's dividend changes year in and year out is that it is tied to the company's financial performance. The quarterly dividend per common share is set at 30% of the average cash generated by Wheaton's operating activities over the previous four quarters (divided by the number of shares outstanding). Recently, management decided to bump that cash generation payout from 20% -- a move that upped the dividend by over 40% in a single quarter.

| Year | Dividend |

| 2017 | $0.33 |

| 2016 | $0.21 |

| 2015 | $0.20 |

| 2014 | $0.26 |

| 2013 | $0.45 |

| 2012 | $0.35 |

| 2011 | $0.18 |

Data source: Wheaton Precious Metals Corp.

Wheaton isn't the only one to do a variable dividend in the precious metals space, but it is a different structure. Newmont Mining Corp's (NEM 0.04%) dividend, by comparison, is tied directly to the price of gold. With Newmont's dividend, you can get some sense of what it will be in a given quarter by watching gold prices. Wheaton's business could be impacted by factors that you couldn't foresee or put a dollar value on that might push the dividend higher or lower, including the issuance of new shares to fund streaming deals that aren't yet contributing to revenues. (Franco-Nevada and Royal Gold's dividends, meanwhile, are left totally to the board of directors' discretion.)

In general, however, Wheaton's shareholders will be rewarded with dividend hikes when the streaming company is doing well, and they will share in the pain, via dividend cuts, when things aren't going well. Many would prefer the slow and steady increases provided by Franco-Nevada and Royal Gold, but Wheaton's policy can provide an interesting level of diversification to an income portfolio.

WPM EBITDA Margin (TTM) data by YCharts

Gold and silver prices tend to rise when other assets are struggling. That makes sense since investors often seek out a store of wealth in turbulent times. So Wheaton's dividend could be on the rise in the difficult markets that might force other companies to cut their disbursements. This is a slightly different view of diversification, but it could provide you with a little positive news in a market correction.

What to expect from here?

Because Wheaton's dividend is designed to be variable, you should always expect... variability. It will go up when the company is doing well, and drop when it's not doing as well. The payout ratio, meanwhile, is always going to be a little off because the dividend is tied to cash flow, not earnings. So don't pay too much attention to that metric, it won't give you a clear idea of where the dividend is going.

In the end, however, Wheaton provides investors a different way to get exposure to precious metals. And since its business model provides relatively wide margins through good markets and bad, it's a desirable alternative to a miner that has to deal with the vagaries of operating mines. In fact, if you are looking at Newmont because of its gold-linked dividend, you might want to consider Wheaton instead.