At the end of 2016, I expected IBM (IBM +2.63%) to have another quietly transitional year in 2017. Big Blue had some big growth drivers up its sleeves, but these game-changers often take a while to mature.

"As a shareholder myself, I could live with another couple of years at lower prices so that the reinvested dividends can buy more stock at lower prices, but I'll also cheer when the big breakthrough finally arrives," I said.

That's exactly what we got. As 2017 winds down, IBM shares have lost 7% of their value this year -- missing out on the 19% gain for the S&P 500 market index. But the stock may have bounced off a long-term bottom here, and 2018 is starting to look downright exciting for IBM investors.

Here's why.

What's the story?

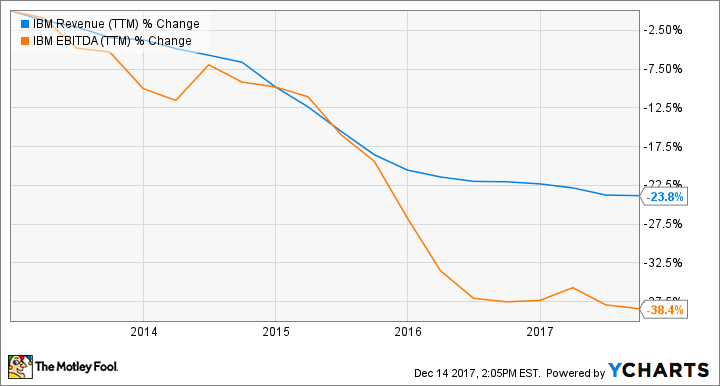

Over the last five years, IBM has doubled down on its so-called strategic imperatives while shedding operations with lower long-haul growth prospects. This relentless focus on artificial intelligence, cloud computing, data analytics, and social networks has often left IBM investors frustrated by shrinking annual revenues and lower bottom-line profits.

Those perpetual declines stabilized in 2017, giving IBM a solid platform from which it can launch back into positive growth trends:

IBM Revenue (TTM) data by YCharts.

October's third-quarter report saw strategic imperatives collecting 46% of IBM's total sales, heading further upward at an annual growth pace of 11%. Updated full-year guidance pointed to 3% top-line growth in the fourth quarter, which would be the first venture into positive year-over-year revenue growth since the first quarter of 2012.

A refreshed lineup of mainframe systems helped IBM kick-start its growth engines this year, but that's far from all.

Looking ahead, the company is diving even deeper into its strategic imperatives. Buzzwords like the Internet of Things and blockchain technologies are more than empty platitudes for this company, which is establishing itself as an early leader in these exploding opportunities.

Image source: Getty Images.

What's next?

Management already describes IBM as a "cognitive solutions and cloud platform company." That battle cry will be IBM's effective mission statement for the next several years, maybe even decades. This company has come a long way from the typewriters and mechanical calculators on which it was built, making several dramatic strategy changes along the way. Here's the next one, and it looks like 2017 set the stage for some raging growth in 2018 and beyond.

The stock is trading at historically low valuations while dividend yields have settled near 20-year highs.

I'd call that a fantastic buy-in window, and I'm not alone. Rock-star Morgan Stanley analyst Katy Huberty set her price target for IBM at $192, leaving room for a 25% single-year gain. Even bearish analysts like Barclays' Mark Moskowitz have been grudgingly raising their price targets as IBM's big bet on strategic imperatives finally looks ready to bear profitable fruit.