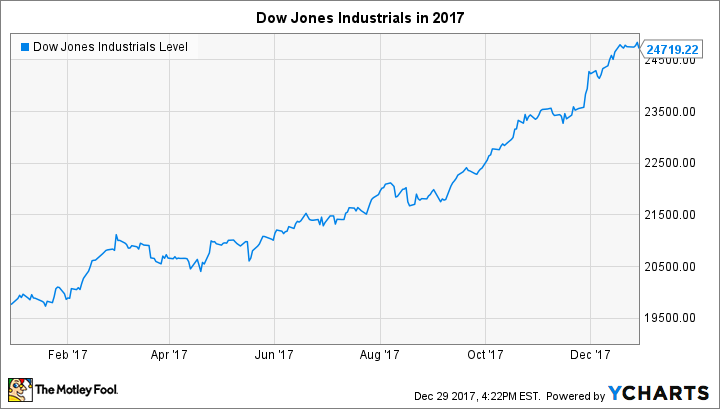

The Dow Jones Industrials (^DJI 0.17%) posted its best gain ever in point terms, and its more than 25% advance its strongest showing since 2013. For the most part, 2017 was a calm year for the markets, and despite dozens of all-time record highs set over the course of the past 12 months, the Dow's gains came largely from small upward movements that added up to big returns.

Yet despite the lack of meaningful corrections during 2017, the Dow did still have occasional downdrafts. The average's biggest daily loss of 373 points came on May 17, and although the move lower was short-lived, it showed just how fragile bull market sentiment can be over short periods of time. Let's look more closely at the Dow's worst day of the year and what investors can learn from it.

A new president causes momentary panic

The election of President Donald Trump in 2016 marked a historic and largely unexpected moment for the U.S., and many in his administration credit the Dow's big rise in 2017 in large part on White House policies that have led to wins like the recently passed tax reform law. The year has also had controversial moments involving the president, and what happened in mid-May rattled the markets to the core.

One issue that has persisted ever since the president took office is whether members of the Trump campaign colluded with Russian officials prior to the 2016 election. Over the course of the year, various new items have surfaced that have lent credibility to the allegations, at least in the eyes of market participants.

Several things happened on May 17 with respect to the investigation that set the stage for a big sell-off on Wall Street. First, reports surfaced that former FBI Director James Comey had written a memorandum that described an alleged request that the president made seeking to halt the investigation of former National Security Advisor Michael Flynn. On the same day, Deputy Attorney General Rod Rosenstein appointed Robert Mueller as special counsel to investigate the Trump/Russia allegations.

Image source: Getty Images.

Markets recover despite a lack of resolution

At the time, investors worried that serious allegations against President Trump would lead to nothing getting done in Washington throughout his term. Those concerns once again surfaced during legislative debate on repealing the Affordable Care Act, with several Republican lawmakers eventually choosing not to vote with the rest of their party and bringing proposed measures to defeat.

Yet the impact on the stock market was fleeting. Before May had ended, the Dow was back at new record highs. That set the stage for even bigger advances once Congress scored the legislative victory on tax reform.

Perhaps most important was the fact that even though the point decline sounded scary, it wasn't that big of a drop. At the market's levels, 373 points amounted to less than 2%. In past years, 2% daily declines were relatively common. Only the market's lack of volatility recently, combined with the Dow's higher levels, made the May 17 fall seem scarier than it actually was.

What you can learn from the Dow's worst day

Investors often get burned by panic-selling following what seems like legitimately bad news, and that proved once again to be the case back in May. Even now, the Mueller investigation continues, and it's possible that new evidence will bring more troubling connections between Russia and the White House. Long-term investors, however, should focus more on the fundamentals of the companies whose stocks make up the market. That way, when the economy does well, your portfolio will also prosper -- especially in a year as strong as 2017 was.