The Dow Jones Industrial Average crossed the 25,000-point threshold for the first time ever Thursday, just under one year after it hit 20,000. While this is certainly a psychological milestone for investors, it's important to take a step back and think about what this means. Specifically, the Dow isn't even close to being a perfect representation of the stock market, and 25,000 is just an arbitrary level with little actual significance.

The flaws of the Dow

The Dow Jones Industrial Average, also known as the DJIA or simply "the Dow," is a stock index that tracks the performance of 30 of the largest U.S. companies. Its components today include Apple, American Express, and Johnson & Johnson, though the index does drop fading names and replace them with rising ones periodically.

Image Source: Getty Images.

While it's certainly in the headlines more than other stock indices, there are two major flaws with the Dow that limit its usefulness as a measure of the market.

First, and most obviously, the Dow only tracks 30 stocks. As of this writing, there are 5,141 publicly traded stocks on the NYSE and NASDAQ exchanges. Of those companies, 2,332 have market capitalizations greater than $1 billion. The point is that the Dow only reflects a small sampling of the market.

Second, the Dow is a price-weighted index, which means that higher-priced stocks have a greater effect on its level. For example, Goldman Sachs trades for just under $260 as of this writing, while fellow Dow component ExxonMobil trades for about $87. This means that Goldman Sachs' share movement has roughly three times more impact on the Dow's performance, even though it is only about one-fourth of ExxonMobil's size. And given the small size of its sample, it can be heavily influenced by the performance of just one component. For example, if Apple reports a blowout quarter and shares jump 20%, the effect of that on the index can make it seem like the market broadly is doing much better than it actually is.

Just one piece of the puzzle

Therefore, while it may be the best-known of the major stock indices, the Dow does not provide the best picture of the overall market. The S&P 500, for example, indexes 500 of the country's largest companies, and (like most other major indices) is market-cap weighted instead of price weighted. The Russell 3000 is a broad index of large, medium, and smaller companies, and could be viewed as providing the best measure of the health of the entire market.

However, the Dow's thousand-level numbers tend to capture most of the attention. "The Dow is a figurehead of the market, but not a good barometer of it," says Bankrate.com chief financial analyst Greg McBride. "The S&P 500 is a much better market indicator, and it recently crossed 2,700 for the first time. But that just doesn't have the same ring to it."

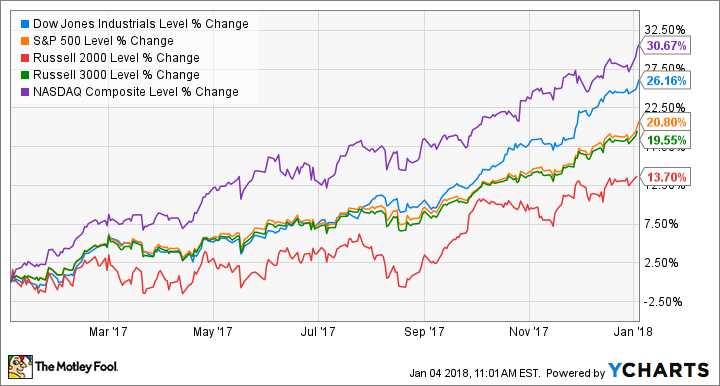

In fact, the Dow has significantly outperformed some of the other major stock indices, as I wrote about a month ago when the index first crossed 24,000. Specifically, indices that track smaller companies and value stocks haven't done nearly as well as the Dow over the past year. However, as the chart below shows, tech-heavy indices like the NASDAQ have outpaced it.

The point is that there are several stock indices that can give you a much better idea of how the market is doing than the Dow. Which one is the best is debatable, but it's fair to say that the Dow isn't it.

What Dow 25,000 means, and what it doesn't

In addition, it's important to point out that 25,000 is just an arbitrary number, and doesn't represent the price of any individual asset. In the grand scheme of things, it's no more significant than when the Dow crossed 24,000 for the first time, or 23,000, or 22,871 for that matter.

What it does indicate is that these 30 companies have performed quite well over recent years. It was Jan. 25, 2017, that the index crossed the 20,000 mark for the first time. That's a 25% gain in just under a year, and the index has roughly quadrupled since it hit the bottom of its Great Recession trough in March 2009.

Take it with a grain of salt

The bottom line is that when the Dow hits a milestone number for the first time, take it with a grain of salt. Regardless of whether the index surpasses 26,000, 28,000, or even 30,000 later in 2018, it's important to not read too much into the headline numbers.