Airline stocks had a rough first quarter, due to a combination of rising oil prices, worries about potential overcapacity, and the looming threat of a trade war. However, Delta Air Lines (DAL -2.62%) put some of these worries to rest on Tuesday, reporting strong unit revenue growth and solid profitability for the first quarter.

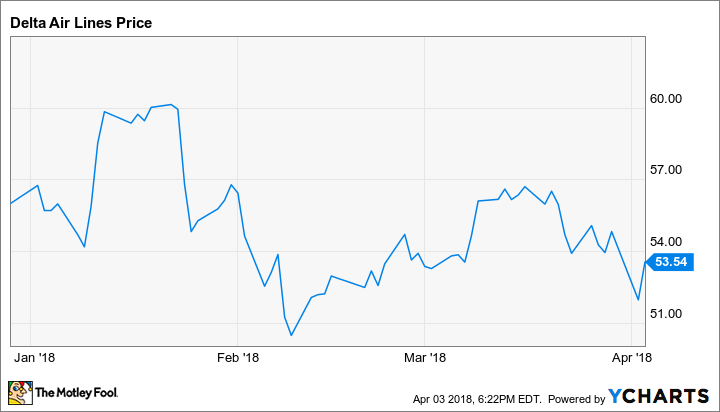

Despite this good news, Delta Air Lines stock ended Tuesday down about 4% year to date. This has created an intriguing buying opportunity, due to Delta stock's absurdly low valuation.

Delta Air Lines year-to-date stock performance. Data by YCharts.

Delta updates its forecast again

Back in January, Delta Air Lines projected that adjusted earnings per share would reach $0.60-$0.80 in the first quarter, compared to $0.77 a year earlier. Management forecast that revenue per available seat mile (RASM) would rise 2.5%-4.5% year over year, but that this would be more than offset by a jump in fuel prices to $2.05-$2.10 per gallon (up from $1.71 per gallon) and a 2%-4% increase in nonfuel unit costs.

During the quarter, the unit revenue environment improved even more than expected. At an investor conference last month, Delta said that RASM was likely to rise 4%-5%, exceeding the initial forecast.

This improving revenue outlook more or less canceled out a $0.05 a share Q1 earnings headwind related to new accounting rules that went into effect for 2018. Meanwhile, a slightly lower fuel price forecast ($2.00-$2.05 a gallon) offset a modest increase in Delta's nonfuel unit cost guidance to the upper half of the previous range. As a result, Delta narrowed its adjusted EPS forecast range to $0.65-$0.75.

On Tuesday, Delta Air Lines confirmed this updated Q1 EPS forecast. RASM rose 5% year over year last quarter, offsetting cost headwinds related to unusually severe winter weather along the East Coast. This represents the strongest unit revenue growth Delta has achieved in any quarter since 2014.

Good news for Delta's new earnings guidance experiment

Delta Air Lines seems to be on track to deliver Q1 adjusted EPS comfortably within the forecast range provided back in January. That bodes well for its decision to begin providing full-year EPS forecasts starting with 2018.

Delta seems to be on track to achieve its 2018 earnings per share target. Image source: Delta Air Lines.

Historically, while many airlines have offered quarterly forecasts for certain business metrics, they haven't published quarterly EPS projections -- let alone annual EPS guidance. Fluctuations in fuel prices, competitors' capacity, economic activity, and even the weather can all impact an airline's earnings. Thus, the general consensus was that EPS was impossible to forecast with any precision.

Nevertheless, Delta provided initial 2018 EPS guidance of $5.35-$5.70 at its investor day last December. In conjunction with its Q4 earnings report, the company boosted that guidance range by $1 to $6.35-$6.70, incorporating the benefit of corporate tax reform. Meeting the first-quarter EPS forecast is the first step toward achieving this full-year outlook.

This stock is dirt cheap

Analysts currently expect Delta Air Lines to report full-year EPS of $6.36 for 2018, near the bottom of the company's guidance range. Based on its Tuesday closing price of $53.72, Delta stock trades for less than nine times that estimate and just eight times the high end of the company's 2018 EPS guidance range.

As investors grow comfortable in Delta's ability to achieve its earnings targets, the stock should start to move toward a much higher valuation. Considering that most of the benefits of Delta's productivity initiatives and fleet renewal will hit the bottom line in 2019 and 2020 -- boosting future earnings power -- the stock could potentially rise 50% in the next year or two.