What happened

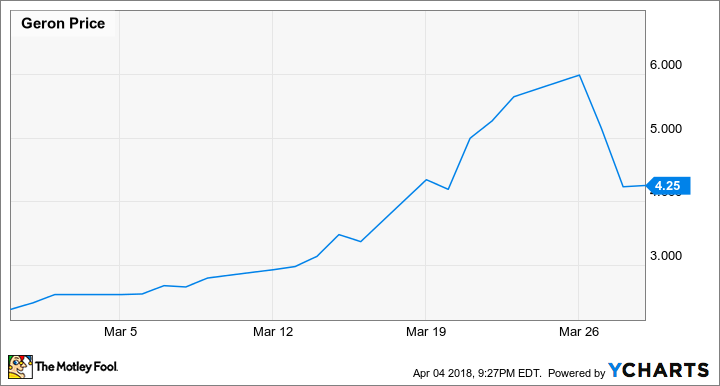

Geron Corporation (GERN -2.61%) stock rose 84% in March, according to data provided by S&P Global Market Intelligence .

Data source: GERN data by YCharts.

Shares saw significant upward momentum following the company's fourth-quarter earnings release and indications that its blood cancer drug, imetelstat, is producing encouraging trial results. Geron Corporation has a market cap of roughly $600 million, and its valuation is largely dependent on the development and marketing of imetelstat, so shares tend to see big pricing swings in relation to the compound's outlook.

Image source: Getty Images.

So what

Geron Corporation published fourth-quarter and full-year earnings results on March 16 and held a conference call in which management made comments indicating that trials for imetelstat were yielding favorable results. Imetelstat is an experimental drug and Geron's key product, and the company's shares skyrocketed following management's promising comments.

Now what

Geron is partnered with Johnson & Johnson (JNJ 0.29%) for the development of imetelstat and is waiting for a decision from the healthcare giant about whether additional testing and development will take place. If J&J opts to pursue development of the drug, Geron will receive a $135 million payment from the company and have the opportunity to receive additional, milestone-based payments.

Johnson & Johnson is due to report earnings on April 17 and is expected to give an update on its clinical trial pipeline on that date. The company has listed imetelstat among its list of potential blockbuster drugs for two years running, and Geron shares will likely see big movement depending on whether its partner once again presents a favorable outlook for the drug.