If you've entered your retirement years, then your investment goals have likely shifted from wealth accumulation to living off of the wealth you have created. That, in turn, likely means you're looking for a mix of dividend income and safety. Here are these Motley Fool investors' choices of three high-yield stocks that offer just that, by providing customers with services they simply can't live without: AT&T Inc. (T +2.02%), NextEra Energy Inc. (NEE +2.92%), and Duke Energy Corporation (DUK +1.86%).

The original widows-and-orphans stock

Rich Smith (AT&T Inc.): If you're looking for a stock that's safe to retire on, I can't think of a better choice than AT&T, the original widows-and-orphans stock.

I mean, seriously, folks, does anyone really think AT&T is going away? In one form or another, this business has been in business since its original incarnation as Ma Bell way back in the 19th century. As AT&T per se, it's been around since 1984, earning profits and paying out dividends (and raising those dividends) all along the way.

Today, AT&T stock pays its shareholders a massive 6% dividend yield, but that dividend requires just 41% of total profits to maintain. On the one hand, that lends assurance that AT&T can easily afford to maintain its dividend. On the other hand, it leaves the company plenty of room to raise its dividend as the company grows.

If you are retired, then it's time to live off of your nest egg. Image source: Getty Images

Speaking of growth, analysts who follow AT&T expect it to keep on growing at a respectable 8% rate. Relative to its lowly 6.5 P/E ratio, that gives AT&T a PEG ratio of only 0.8, which makes AT&T a bargain-priced stock in addition to a generous dividend stock. If you're contemplating retirement and looking to buy a stock that will let you sleep soundly at night, AT&T seems a fine choice to me.

A stock bound to be a bright spot in retirees' portfolios

Sean Williams (NextEra Energy Inc.): investing as a retiree can be challenging at times, because you want reasonable income potential and the opportunity to see your investment increase in value, but you'd also prefer well-below-average volatility. Finding this mix isn't always easy in a stock, but electric utility giant NextEra Energy provides just that.

The stability that NextEra can provide for retirees is a function of the "product" it offers. Electricity is a basic need if you own or rent your home. With few exceptions, electricity demand tends to be consistent from one year to the next for existing customers, and is expected to increase as an aggregate over the long run as the U.S. population grows.

Furthermore, NextEra's traditional electricity business -- i.e., electricity generated by nonrenewable energy -- is regulated. Though this might seem like a hassle when it comes time to raise rates, it's actually a good thing. By being regulated, NextEra's traditional electricity operations avoid wholesale electricity price fluctuations. This, along with electricity being a basic need, sets a pretty stable cash-flow base that management and investors can lean on in the years to come.

But there's far more to NextEra than just the fact that it provides a recession-resistant product. It also happens to be the "greenest" of all electric utilities. NextEra has made more combined investments in wind and solar power than any of its competitors around the country. While these investments haven't been cheap, they've allowed NextEra to lower its long-term generating costs, putting it a step ahead of its peers. Between 2017 and 2020, the company's four-year renewable energy backlog is expected to range between 10,100 megawatts and 16,500 megawatts, a majority of which will be wind power and wind repowering projects. This green energy segment is unregulated, which isn't an issue since low-cost renewable energy production is often in high demand.

When all is said and done, NextEra Energy has grown its book value in each of the past 22 years; is considerably less volatile than the broader market, as measured by its beta; and is currently paying a market-topping 2.7% yield. It's an ideal stock for retirees to consider.

A boring high yield stock

Reuben Gregg Brewer (Duke Energy Corporation): Duke Energy is one of the largest electric and gas utilities in the United States. It offers retirees a dividend of roughly 4.4%, which is more than twice what you would get from an S&P 500 index fund. And it has increased its dividend each year for 13 consecutive years. From a dividend yield and history perspective, investors looking to supplement Social Security should like what they see.

That said, inflation is a key risk for retirees because it erodes your buying power. But Duke has plans to invest $37 billion in its utility business between 2018 and 2022. It expects this spending to drive 4% to 6% earnings growth through 2022, which should lead to dividend increases of a similar magnitude. While you shouldn't be expecting huge dividend hikes from Duke, the historical rate of inflation growth is around 3%, so the utility has retirees covered here, too.

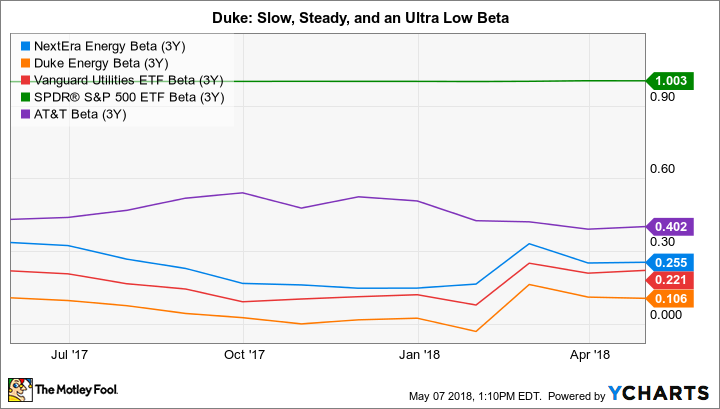

NEE Beta (3Y) data by YCharts.

One of the last issues that often worries retirees is stock market volatility. Duke has an incredibly low beta, a measure of volatility relative to the broader market, of 0.1. That suggests that Duke's stock is 90% less volatile than the S&P 500 index. That sounds like a sleep-well-at-night investment.

With a relatively high yield, a solid history of rewarding investors with yearly dividend increases, concrete plans for continued earnings and inflation-beating dividend growth, and a relatively low level of volatility, Duke would make a great cornerstone investment for a retiree's portfolio. It probably won't be an exciting investment -- but really, that's the point.

Giving them what they need

The strength behind the businesses of AT&T, NextEra, and Duke is that they provide customers with things they need. In fact, most would find it difficult to live without the services this trio offers. That's a nice backdrop for investors to think about when looking at the dividend-paying and dividend-growth opportunities these companies provide retired investors. Add in strong yields and low relative volatility, and I'm confident that retired investors will find that at least one of these companies could have a place in their portfolio.