Since coming out of the Great Recession, the U.S. housing market has exhibited surprising strength, with home prices rising 51% from the bottom. That puts prices at peak levels, or 1% above where they stood in 2006 before the industry crumbled.

The housing boom has helped lift Lowe's (LOW -0.68%). Consumers turned to the big-box home improvement center to purchase appliances, catapulting it into the forefront of the industry, as well as for paint and other household goods.

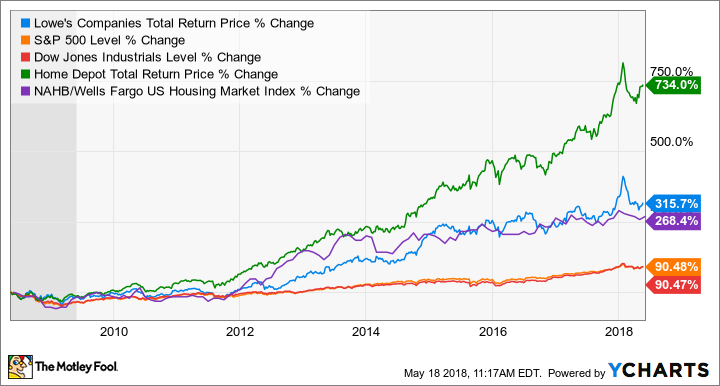

Yet despite the rising tide generally lifting all boats, Lowe's hasn't done nearly as well as it could have. Over the past decade, while Lowe's stock handily outpaced the market indexes with its total return of almost 300% compared to 90% gains for the Dow Jones Industrial Average and S&P 500, it only just outpaced the NAHB/Wells Fargo Housing Index, which rose 268%, and trailed far behind rival Home Depot (HD -0.47%), which surged seven-fold over the time period.

LOW Total Return Price data by YCharts.

It wasn't a bad performance, but despite some category-leading growth, it still did not enjoy the same level of support as did its rival. Let's take a look at why and whether Lowe's can pick up the slack moving forward.

A sunny disposition

Part of the issue is regional coverage. Lowe's tends to have fewer stores in states with warmer climates, while Home Depot is the reverse, which gives it an edge, as construction activity can occur for longer periods of time.

For example, Home Depot has 232 stores in California; Lowe's has less than half that number. Lowe's also has almost 300 stores in Canada while Home Depot has 182.

Another primary difference between the two is their targeted customer. Although the professional contractor is key to both businesses, Lowe's tilts more toward the homeowner while Home Depot has greater exposure to the pro market. The latter's executive VP of U.S. stores told analysts last year that although pros make up just 3% of Home Depot's customer base, they spend about $6,500 annually, which represents about 40% of the home improvement center's total revenue.

The homeowner, not the professional contractor, has long been Lowe's focus. Image source: Lowe's.

Fewer, but bigger purchases

Lowe's relies more heavily on big-ticket purchases for its revenue growth, with appliances accounting for 11% of total revenues, making it subject to the vagaries of the consumer spending environment. In contrast, Home Depot generates most of its sales from smaller items that generate repeat purchases, such as indoor garden sales, its largest segment, which make up more than 9% of total sales.

Moreover, where Lowe's derives 45% of its annual revenue from just four departments, no one segment accounts for more than 10% of Home Depot's revenue. That makes Lowe's much more susceptible to weakness in discretionary consumer spending, which will see large, expensive purchases put on hold during such times. Home Depot's cumulative, smaller purchases insulates it better from such vagaries.

However, over the past two years, Lowe's bought Central Wholesalers, a prominent East Coast maintenance, repair, and operations (MRO) distributor, and Maintenance Supply Headquarters, an MRO distributor to the multifamily housing industry. Both acquisitions show that Lowe's is serious about closing the pro gap with its rival, and it's starting to pay off.

In 2017, lumber and building materials sales grew 12% as a direct result of increased pro customer demand, and the segment now accounts for 14% of total revenue.

But the homeowner is still a key component of its business, which is why fashion fixtures make up 9% of its revenues.

A big question mark

Because Home Depot stock has grown so fast over the past decade, the potential for it to continue generating outsized returns for investors is likely diminished. Lowe's, on the other hand, though it has been a laggard in comparison, has made a number of smart moves and acquisitions to position it to capture growth from both the do-it-yourself market as well as the professional market.

Although Lowe's and Home Depot are comparably valued by the market at around 23 times trailing earnings and 18 times next year's estimates, and Lowe's is actually expected to grow its earnings somewhat more than its rival, management is only expecting sales to grow 4% this year while operating profits are expected to decline.

Investing $20,000 in Lowe's stock today would require the home improvement center to generate returns in excess of 18% annually for the next 23 years to turn that initial investment into $1 million.

While Lowe's threw a wild card into the mix by hiring J.C. Penney CEO Marvin Ellison to take the helm from retiring Robert Niblock, we'll have to wait and see how that plays out as, from his days at J.C. Penney, he has a reputation as more of a stay-the-course executive rather than a bold-moves type. He did spend 12 years in senior operations roles at Home Depot and served as its executive vice president of U.S. stores, so he is well-versed in the home improvement business, but there may not be enough spark there to turn Lowe's into a major growth engine.