When Oprah Winfrey bought 10% of Weight Watchers (WTW +0.00%) in October 2015, many assumed her connection to the brand would help it gain customers. That happened once the celebrity became a spokesperson for the brand, sharing her personal weight loss story.

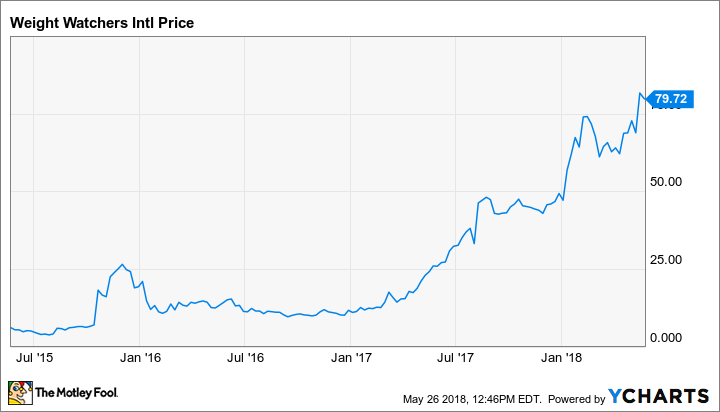

The gain in subscribers that Winfrey brought to Weight Watchers has led its stock price to increase from $6.79 on the market day before her buying into the company was announced to a closing price of $79.72 on May 25, 2018. It's a stunning turnaround, and the former talk show host deserves credit for reigniting interest in Weight Watchers with its core membership of women, but that's only a part of why it has achieved these heights.

Image source: YCharts.

Why is Weight Watchers winning?

Weight Watchers closed its first quarter of 2018 with a record 4.6 million subscribers, a 29% year-over-year gain. It also saw total paid weeks rise by 27% and revenue climb by 24% to $408 million. You can credit Winfrey for bringing customers in and raising overall awareness of the brand, but her association with the product can't make them stay.

Credit CEO Mindy Grossman and her team for revamping the Weight Watchers brand to make it more modern. By adding digital options for meetings and support, the company has stopped being a weight-loss brand for an older generation.

"Member engagement has been incredible with members staying longer than ever before," said Grossman in the earnings release. "Average retention is now well over nine months."

Weight Watchers offers tools to help people lose and manage their weight. Image source: Getty Images.

The new program

Retention is the company's most important metric. Winfrey's fame and influence over her audience can get them to try the product -- maybe any product. What it can't do is produce the results that lead people to stick with the program.

Grossman explained during the company's Q1 earnings call that its success comes from changes made to its WW Freestyle program. She called it the company's "most flexible, livable program ever," before going into a broader explanation.

"Ahead of our winter season, we enhanced our highly successful and effective SmartPoints system by expanding 0-point foods from only fruits and vegetables to more than 200 delicious, satisfying foods which encourage members to eat healthier," she said. "Across the world, our members are realizing weight loss that meets or exceeds that from our prior program."

You have to deliver

Winfrey has proven to be the rare celebrity who can induce behavioral change from her audience. Because the former talk show host is both relatable and charismatic, her endorsement gave Weight Watchers a boost.

The company, however, could have squandered any benefit it got from "the Oprah Effect" by offering a product that did not meet the needs of its new customers. It didn't, and that makes its turnaround one you can bank on.

This isn't a company using a gimmick to create short-term success. Instead, Weight Watchers is using its gimmick -- Winfrey's endorsement -- to bring in people who then become devotees of its program. That's a foundation for long-term success, positive word of mouth, and repeat business driven by the company delivering what it promises.