Lowe's (LOW +0.20%) earnings results are often overshadowed by those of its more successful peer, Home Depot (HD +0.27%). That trend held up in the retailer's most recent report as the company announced weaker sales growth and lower profitability than its main rival.

Still, Lowe's stock shot higher after the company announced that it had convinced Marvin Ellison, a former Home Depot executive, to take over as CEO.

Outgoing CEO Robert Niblock and his team held a conference call with analysts during which he discussed that leadership transition while putting the latest results into context. Here are a few highlights from that chat.

Image source: Getty Images.

The spring delay hurt the business

Lowe's has built a very strong seasonal business over the years, with approximately 35% of Q1 and 40% of Q2 sales historically driven by outdoor categories. With more rain and snow in the first quarter than we've seen in 12 years and the coldest April since 2007, outdoor products were certainly impacted.

-- Niblock

Like Home Depot did a week earlier, Lowe's blamed the weather for slowing growth. Comparable-store sales gains were below 1%, or well lower than the 3.5% target the retailer had projected for the year. Customer traffic dove by 3.7%, too. Home Depot, by comparison, grew sales at a 4% pace as customer traffic fell by 1%.

The drop was only temporary, though, since customers returned to both businesses in the first few weeks of May. In fact, Lowe's executives said sales have been jumping at a double-digit rate over the last few weeks, and so they expect to recover just about all of the business they lost during the unusually cold April period.

Bright spots

We continue to execute on our strategic priorities, including enhancing our digital presence.

-- Chief Customer Officer Michael McDermott

Management highlighted a few operating wins they managed, including positive comps in its indoor sales categories and a 20% boost in the e-commerce business. Lowe's also made progress in its efforts to appeal to professional customers. That industry segment has played a big role in Home Depot's growth, and Lowe's is eager to steal market share in the niche.

There are plans in place to continue pressing each of these strengths, including by upgrading the e-commerce shopping experience; the digital channel makes up about 5% of sales today, compared to 6% for Home Depot.

Profitability

We made progress in stabilizing gross margin. Throughout the year, we plan to expand our application of new pricing and promotion analytics tools to ensure that we're competitive on highly elastic traffic-driving products while increasing profitability across less elastic items.

-- McDermott

Three months ago, executives said they weren't happy with Lowe's profitability trends, given that gross margin had declined as the retailer cut prices to keep sales chugging along. Their efforts to fix this problem yielded quick results, as the metric expanded slightly in the first quarter.

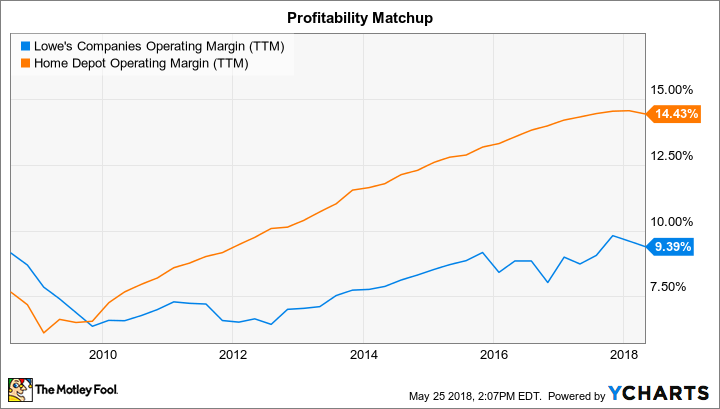

LOW Operating Margin (TTM) data by YCharts.

However, costs rose as a percentage of revenue, mainly because of a hiring bump that Lowe's executed to prepare for a sales spike that was delayed by the colder weather. As a result, operating margin dipped to 8.4% of sales, compared to 13.6% for Home Depot.

Meet the new boss

Marvin [Ellison] is an experienced retail CEO and a 30-year industry veteran with expertise in complex omnichannel environments. He has a deep appreciation for Lowe's culture, people, and customers, which makes him the ideal person to serve as this great company's next leader. I'm confident that this will be a smooth transition.

-- Niblock

Marvin Ellison spent a dozen years working at the top ranks of Home Depot's leadership, and it wouldn't be a stretch to say that he played an important role in the retailer's operating success in the key years after the housing-market crisis.

With experience in Home Depot's logistics segment, followed by his heading up the entire U.S. store division, Ellison is ideally suited to challenge his former company. "Attracting Marvin is a great win for the entire Lowe's team," executives said. Home Depot has to be at least a little concerned that the sales and profitability gaps it routinely puts up against Lowe's might be threatened by this management shift.