What happened

Shares of Under Armour (UAA +0.35%)(UA +1.97%) climbed 55.8% across the first half of 2018, according to data from S&P Global Market Intelligence. After big sell-offs in 2106 and 2017, the footwear and apparel company's stock rebounded in response to two solid quarterly reports, new product unveilings, and some changes to the company's management structure.

Under Armour published its fourth-quarter report on Feb. 12 and its first-quarter report on May 1. Sales and earnings for both periods came in ahead of Wall Street's expectations.

Image source: Under Armour.

So what

The two quarterly reports published by Under Armour in 2018 showed a return to sales growth and painted the picture of a stabilizing business in the U.S. market. In May, the company unveiled additional versions of Golden State Warriors star Stephen Curry's latest shoe line, and it was also revealed that Under Armour president Patrik Frisk had purchased $500,000 of company stock.

Shares then continued to gain ground in June following the courtside debut of the new color editions for the latest version of Curry's signature shoe line: the Curry 5. Under Armour then benefited from the Warriors' dominant performance in the NBA Finals.

It was the third championship in the last four seasons for Curry and the Warriors. The team's stacked roster and dominant performance against the Cleveland Cavaliers suggest there's a good chance that Golden State will return to the finals next year and continue to put up strong performances. Curry is Under Armour's most important celebrity endorser, so if he sustains his high profile, it's good news for the company.

Now what

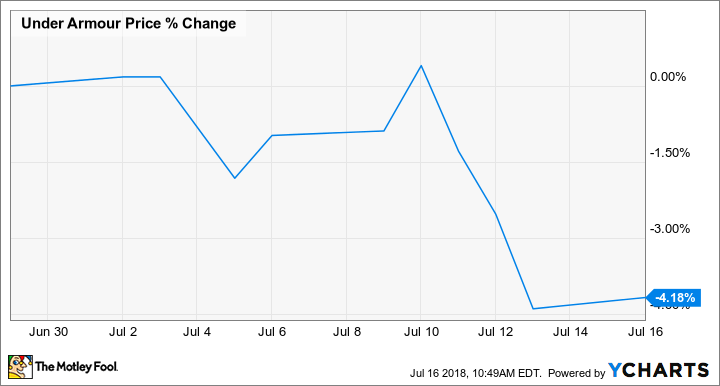

Under Armour's stock price has cooled off a bit in July. The chart below tracks its movement in the month through the time of this writing.

The Under Armour brand has struggled in recent years and is having trouble winning favor with teenagers and other young consumers. Whether the company can continue to turn around its sales in the U.S. and take advantage of growth opportunities in key international markets like China are points to watch going forward.