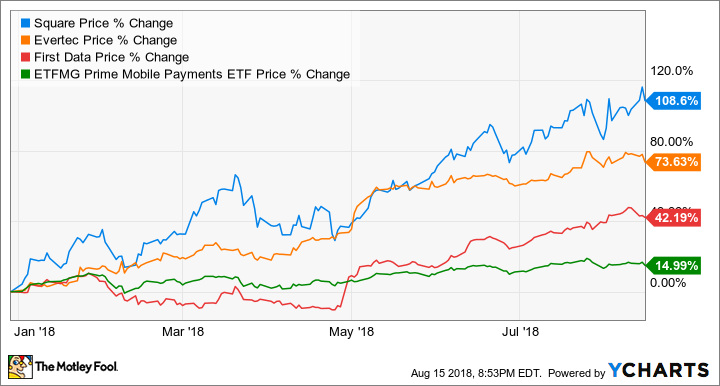

The PureFunds ISE Mobile Payments ETF (IPAY -0.54%) is one of the only ETFs dedicated to following the payments industry. Given that this industry has produced some of the stock market's biggest winners over the past few years, such as Mastercard and PayPal, it is hardly surprising that the fund has beaten the S&P 500 index since its inception. Since the beginning of the year, the Payments ETF is up 15%, which is more than double the gains of the index's 5.7% increase.

Which individual stocks in the ETF's portfolio have done the heaviest lifting? This year, so far, that honor belongs to First Data Corp. (NYSE: FDC), Evertec Inc. (EVTC 0.49%), and Square Inc. (SQ -1.57%). That's after screening for companies in the fund's portfolio that trade on a domestic stock exchange and have a market cap greater than $1 billion. Let's take a closer look at all three to see why these companies' stocks have appreciated so far this year.

First Data: Up 42.2%

First Data is one of the largest global payment processing companies, and offers point-of-sale (POS) solutions to over 6 million retail locations and network services to 4,000 financial institutions. In 2017, the company processed 93 billion transactions across 100 different countries.

Lately, the company has been driven by the runaway success of Clover, its cloud-based POS solution designed for small businesses. In the company's second quarter, Clover processed $65 billion in total payment volume on an annualized basis, representing a 50% increase year over year. Clover drove First Data's solid Q2 results, in which the company saw 11% increases in both its revenue and adjusted EBITDA.

It's not all a bed of roses for the company, however, as its balance sheet still needs improvement: First Data currently has $18 billion in net debt on its books. On the company's second-quarter earnings conference call, management stated that free cash flow was being used to primarily to pay down this mountain of debt, and that debt levels have modestly decreased since the beginning of the year. Unfortunately, every dollar being devoted to debt is a dollar that cannot be used on research and development or sales growth. Given the situation the company is in, it is absolutely the right decision as reducing debt will give First Data more financial flexibility and save on interest expenses. But for now, the debt remains a chain around the company's financial neck.

Up a whopping 108%, Square is the payments industry's biggest winner of the year thus far. Image source: Square Inc.

Evertec: Up 73.6%

Evertec is a Puerto Rican-based payment processing company with a presence in 26 Latin American and Caribbean countries. Last year shares fell after strong hurricanes swept through the region, disabling several of the area's economies, including Puerto Rico. This year, shares have rebounded as the company is seeing "stronger post-hurricane spending" and "improving volumes" in Puerto Rico.

In Q2 of 2018, Evertec's revenue grew to $113.3 million, a 10% increase year over year, and its adjusted EPS rose to $0.46, a 5% increase year over year. Last year, Evertec also acquired PayGroup, a Chilean-based payment processor, for $40 million, greatly strengthening its competitive positioning in the region and opening up almost the entire South American continent to the company. The acquisition also allows Evertec to cross-sell each of the legacy companies' services to each set of customers.

On the back of this acquisition, Evertec saw 48% revenue growth in Latin America in its second quarter. Best of all, the company raised its full-year guidance and is now expecting 14% to 20% adjusted earnings per share (EPS) growth in 2018. Evertec's strong regional market presence, a price rebound from natural disaster-induced lows, and industry tailwinds have certainly proven to be a potent combination this year.

Square: Up 108.6%

The idea for Square originally came to Twitter Co-founder and CEO Jack Dorsey when he was with a friend who expressed frustration about not being able to sell a product because he was unable to accept card payments. What started as a cheap and mobile solution for small business owners to accept electronic and digital payments has turned into so much more. Square now offers a robust ecosystem that offers small businesses services that have been historically very difficult for them to obtain. Square's suite of services includes Square Capital, a microloan platform; Caviar, a restaurant delivery and order-ahead service; and Cash app, a digital wallet that allows users to make P2P payments and even buy bitcoin.

The company's second quarter of 2018 was its fifth consecutive quarter of accelerating revenue growth. In Q2, Square's adjusted revenue rose to $385 million, a 60% increase year over year, and its adjusted EBITDA grew to $68 million, an 87% increase year over year. With those types of numbers, it's easy to see how the company's stock price has appreciated so much this year.

Square continues to focus on its three primary types of clients: service-based businesses, retailers, and restaurants. Combined, these three types of businesses make up 85% of its customer base. Square has designed specific POS solutions for each of them. Its latest, Square for Restaurants, is already showing signs of growing acceptance.

Final thoughts

Before investing in a company, it's important to look at the organization's fundamentals and not just its recent stock price action. Sometimes a company's share price goes up because its market share, revenue, and earnings are all growing and showing signs that its success might continue for years. I believe Square is such a company today.

Other times, a company is simply undervalued, whether due to a singular event like a devastating hurricane or perhaps by being perennially underestimated. When the market grasps this type of company's intrinsic value, its stock price moves up in kind. I believe this is why the stocks of First Data and Evertec have shown such strength this year.