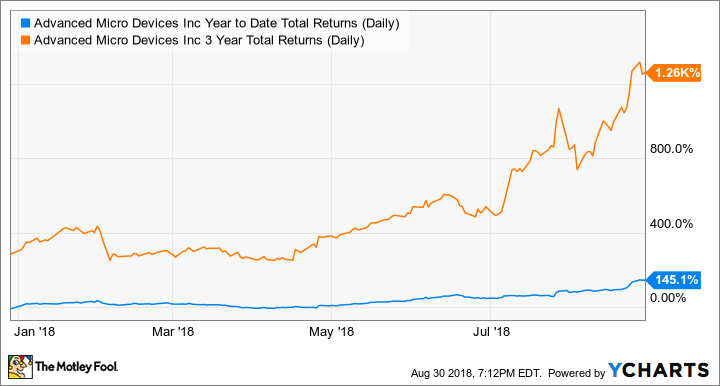

Advanced Micro Devices (AMD 11.40%) has been on an absolute tear -- the stock is up a whopping 144% in 2018 as of this writing and an incredible 1,260% over the past three years. Recent chip innovations have spurred huge optimism in AMD's growth prospects, leading the stock (and its valuation) to incredible heights.

AMD Year-to-Date Total Returns (Daily) data by YCharts.

But has AMD's stock peaked? Or is the company's recent surge just the beginning?

Taking on Goliaths

AMD has long been the only competitor to Intel (INTC 0.69%) in CPUs (central processing units), and Intel has long had a dominant near-monopoly on that market. AMD also makes GPUs (graphics processing units), where the company lags dominant GPU maker NVIDIA (NVDA 0.71%). As recently as just a few years ago, AMD was struggling with its technology roadmap, losing money every year from 2013 through 2016.

The situation got so bad that the company implemented a restructuring plan in 2014 -- and another in 2015! Restructuring plans are generally supposed to "rip off the bandage" and get things going in the right direction quickly, so to have two in two years certainly says something.

But things changed when the company hired Lisa Su as CEO in 2014. Under her leadership, the company refreshed its Ryzen CPU product line and its Radeon Vega GPUs and reentered the server market with a new server CPU called EPYC.

Is AMD's growth just getting started? Image source: Getty Images.

But Su's biggest move was her big bet to skip 10 nm technology and go straight for 7 nm chips. Lower-nanometer semiconductors can fit more transistors on a single chip, leading to better performance.

Recently, AMD announced its 7 nm designs were on track, with products slated to come out late this year. Meanwhile, Intel has struggled with its 10 nm technology (equivalent to AMD's 7 nm), delaying its rollout numerous times. Intel now says its 10 nm chips won't come out until the holiday season of 2019. So AMD has gone from being a laggard to having a one-year lead.

Not only that, with artificial intelligence and cloud computing growth boosting overall demand for GPUs, even if AMD remains a No. 2 player to NVIDIA, there's a chance for EPYC and Vega chips to grow as these industry applications grow.

How big?

Investors have obviously gotten the message, bidding shares up to sky-high valuations of 52.5 times forward earnings and more than 30 times forward enterprise value to EBITDA. Each is more than double the valuation the stock garnered just a few months ago.

AMD PE Ratio (Forward) data by YCharts.

However, it's possible these valuations are justified. The PC CPU market alone is expected to be a $30 billion market by 2020, and the graphics market is forecast to reach $10 billion by that time.

Meanwhile, AMD's total revenue for its computing and graphics segment was only $2.2 billion for the first six months of 2018 (the company lumps Ryzen and Vega together). That means AMD currently has only around a 10% market share, with only one formidable competitor in each segment.

Should AMD grow to, say, a 25% combined market share, the company could more than double revenue to $10 billion just from those segments.

Then there are the data center, autonomous vehicles, and artificial intelligence markets, which should combine for another $40 billion in total by the 2020s. Right now, EPYC is grouped in with the company's enterprise, embedded, and custom chip business, and that segment made only $1.2 billion in the first six months. That annualizes to just a 5% market share.

Though competition is fierce, with not only NVIDIA but also other tech giants making their own custom chips, it's not unthinkable that the 7 nm EPYC could strongly grow this segment; EPYC contributes minimal revenue today.

What could the company earn?

Assuming the company can generate $10 billion in computing and graphics revenue and $5 billion in enterprise and embedded revenue, and if it expands its operating margin from 8.7% last quarter to 18%, which is the high end of its long-term target range, AMD could earn $2.7 billion in operating income in a few years.

That's less than 10 times today's market capitalization of $24.5 billion, which means AMD could very well end up looking quite cheap, even after the recent surge.

But be cautious

Now, those projections are extremely uncertain and also based upon a very successful next few years. Any hiccup on the path could be met with a nasty correction. However, for those with diversified portfolios, it's not crazy to buy AMD today. As NVIDIA's eye-popping run over the past few years has shown, multibagger gains in chip companies are not impossible.