What happened

Shares of the cannabis-consulting and real estate company MariMed (MRMD 1.00%) spiked by as much as 14.8% on Monday on average volume. What's driving this sudden surge?

MariMed's shares are marching higher today in response to the news that the company acquired New Jersey-based BSC Group, a cannabis firm that specializes in "competitive licensing, consulting, and operations management across the country."

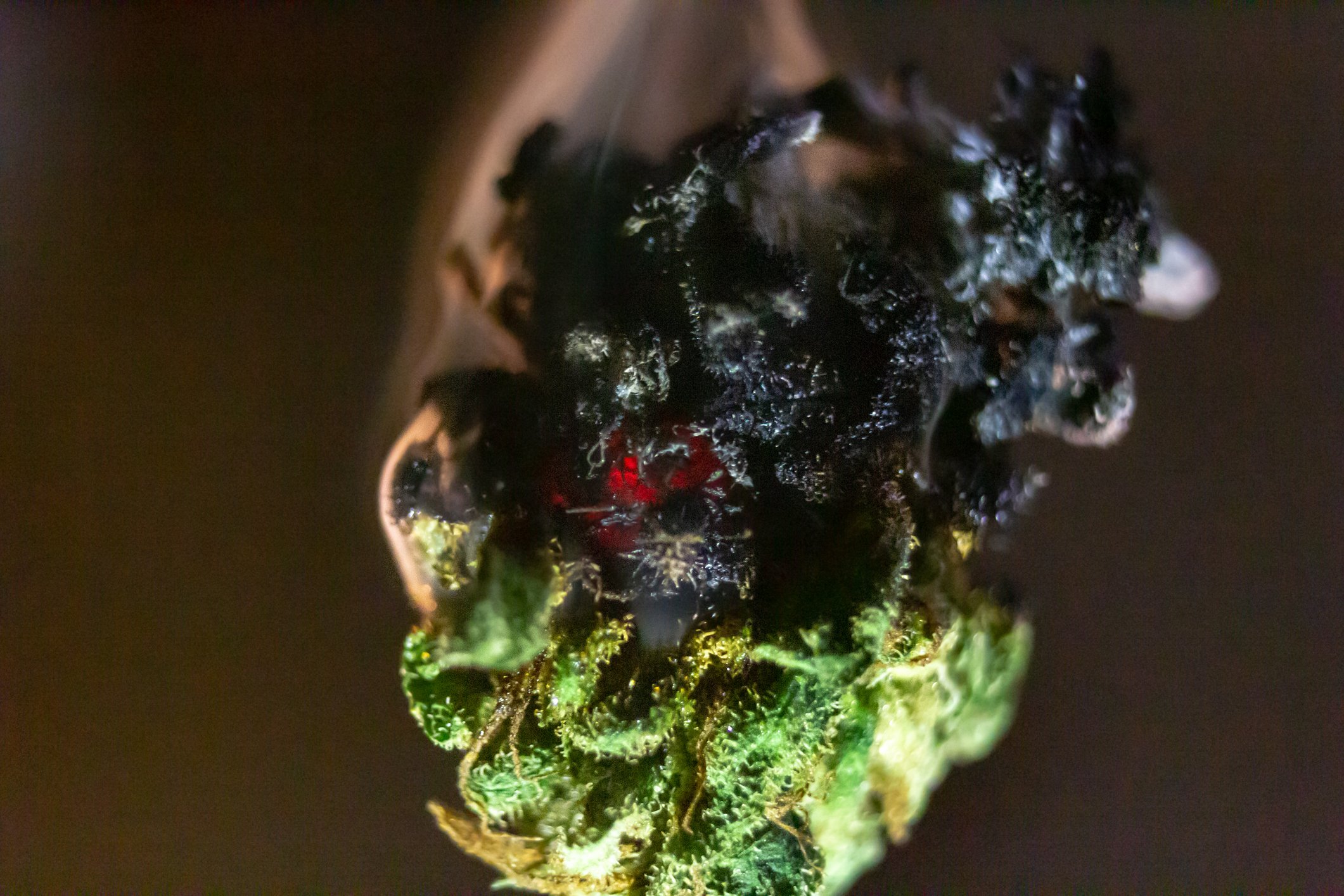

Image source: Getty Images.

So what

This acquisition is important because New Jersey lawmakers are considering a bill that would legalize recreational cannabis in the state. Although the bill has been delayed by disagreements over the proposed tax rate on recreational marijuana, New Jersey does appear to be inching closer to becoming the next state to end prohibition. To this end, MariMed seems to be positioning itself to become a key player in this new market through its acquisition of BSC Group.

Now what

MariMed has been steadily building out its U.S. presence, and this latest acquisition underscores this point. But that doesn't mean its stock is a great buy at current levels.

The company still faces two major issues, after all. First, MariMed and other U.S. cannabis companies are operating under a continually evolving legal landscape at the state level, and the long-awaited end to prohibition at the federal level may not materialize under the current administration. As such, MariMed's upside is probably going to remain somewhat limited until these legal issues are favorably resolved.

Second, MariMed's last stated cash position of about $5 million is a serious problem that investors shouldn't take lightly. The company trades on the over-the-counter market, which dramatically curbs its ability to raise capital via the public markets.

That said, MariMed is particularly well positioned to benefit from the end of prohibition in the United States, when and if this seminal event comes to pass. This speculative pot stock, therefore, might be worth putting on your watchlist right now.