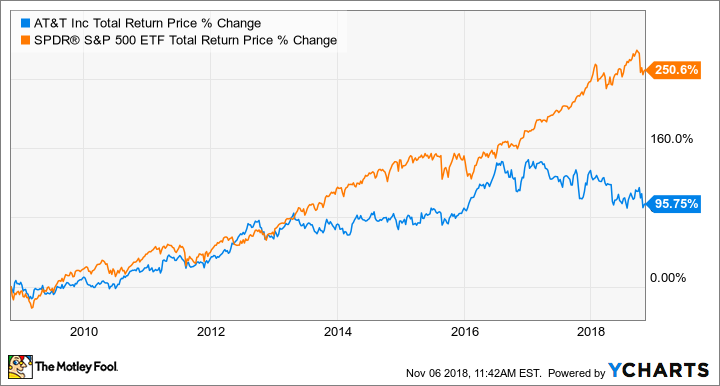

AT&T (T 1.10%) stock has languished over the last decade, with its share price climbing just 13% while the S&P 500 has nearly tripled over the stretch. The telecom giant's performance looks better when its dividend component is factored in, but shares have still lagged far behind the broader market.

T Total Return Price data by YCharts.

Intense competition in the mobile wireless space and the acceleration of cord-cutting have tamped down AT&T's sales, earnings, and share price, but the soggy performance also means that the stock trades at less than nine times this year's expected earnings and packs a big dividend.

Shares yield roughly 6.4% based on the current stock price, and it's unlikely that the company will suspend its payout in the near future. AT&T has delivered annual payout growth for 33 years running and the cost of covering its forward payout comes in at a reasonable 66% of trailing free cash flow. The stock certainly has appeal for income investors, but does it have the potential to deliver for those seeking more explosive growth?

Image source: Getty Images.

Avenues to strong returns

AT&T's current wireless, wireline, and television offerings aren't likely to be big earnings growth catalysts, but the company does have some promising opportunities on the horizon. With a strong brand and a wireless network that trails only Verizon in terms of subscriber count, AT&T is positioned to benefit from the rollout of 5G and trends like the Internet of Things. AT&T's 5G network could allow it to reclaim performance advantages compared to less-expensive competitors like Sprint and T-Mobile, increase pricing power, and reduce churn.

AT&T is already finding some success in getting categories of connected devices like smartwatches and connected cars on board with its network. Not counting phone or tablet subscriptions, AT&T added 3.75 million new connected devices to its network in the September quarter, and the increased speeds and functionality enabled by 5G will likely spur adoption for connected cars, wearables, and other Internet of Things technologies.

AT&T should also benefit from the Time Warner integration on a variety of fronts. With an expanding global market for entertainment, Warner's core film and television business is operating against a favorable backdrop and has the potential to be a reliable earnings catalyst. Bringing Warner's HBO platform into the corporate fold has already allowed AT&T to offer the premium video service as a perk to subscribers of its unlimited mobile wireless services, and the acquisition should cut down on carrier costs for DirecTV and open up other new bundling opportunities.

The company is also using the Time Warner merger to expand its advertising business. Using data from its wireless network, AT&T is able to get a better idea of what advertisements are likely to appeal to a given audience. It can then slot in these tailored ads into TV programming instead of using pre-selected spots.

Based on internal research, management expects that delivering ads through its new platform could dramatically improve targeting efficiency and result in rates that are between three and five times higher than it would get through standard cable distribution. It also plans to extend this service beyond Time Warner content and offer it to third-party networks, so it's possible that the new ad approach will turn into a big winner for the company.

What's holding AT&T back?

AT&T's core wireless and television offerings are under pressure due to pricing wars with competitors and shifting consumer habits. The September quarter saw the company add 69,000 post-paid phone subscribers and 481,000 prepaid phone customers, helping push mobile wireless revenues up 5% year over year. AT&T has now increased post-paid phone subscriber count in three consecutive quarters -- notable because it saw subscriptions in the category decline from 2014 through 2017. However, tough competition in the space means that investors can't count on consistent subscriber additions or rate increases. Mobile wireless EBITDA margin fell from 42% in the third quarter of 2017 to 40% in this year's period, owing to pricing pressures and the company losing 420,000 tablet customers in the quarter.

The outlook in TV land is even less exciting. AT&T completed its $65.4 billion acquisition of satellite television provider DirecTV in 2015, making it America's largest paid-TV provider and creating new opportunities to bundle internet, phone, and television services. However, consumers are moving away from big cable packages in favor of services like Netflix and trimmed down streaming packages referred to as skinny bundles.

The company added 49,000 net subscribers to its DirecTV Now skinny bundle but lost 346,000 net subscribers from its traditional satellite television service. The prior-year quarter saw the company lose 251,000 satellite subscriber and add 296,000 DirecTV Now subscribers, a worrying indication that growth for its streaming platform is slowing while losses for its core television offering are accelerating. AT&T's wireline business (providing wired telephone service to homes and businesses) is also likely on track to continue declining over the long term, so the company is facing some significant headwinds in each of its main business segments.

Good for what it is, but probably not a millionaire maker

AT&T does have avenues to beating expectations and snapping back from its lackluster stock performance. If trends like 5G and the Internet of Things help the company add many new connections and the Time Warner side of the business continues to grow on its own and create synergies with mobile and television services, the stock has the potential to be a market beater.

That said, investors probably shouldn't look to AT&T if their goal is to find stocks that will generate massive returns over the next decade. The stock offers a great dividend, is backed by a business that has the potential to expand in some promising directions, and trades at a modest valuation -- attractive qualities for investors who approach it with the right expectations.