IRAs have some pretty valuable tax advantages, such as allowing investors to grow and compound their investments without having to worry about capital gains or dividend taxes each year. So high-dividend stocks that take full advantage of this benefit can be especially smart IRA investments.

Real estate investment trusts, or REITs, are especially well positioned to benefit from the tax advantages of an IRA. Here's a rundown of why this unique type of stock is a smart choice for IRA investors and of three REITs that are worth a look right now.

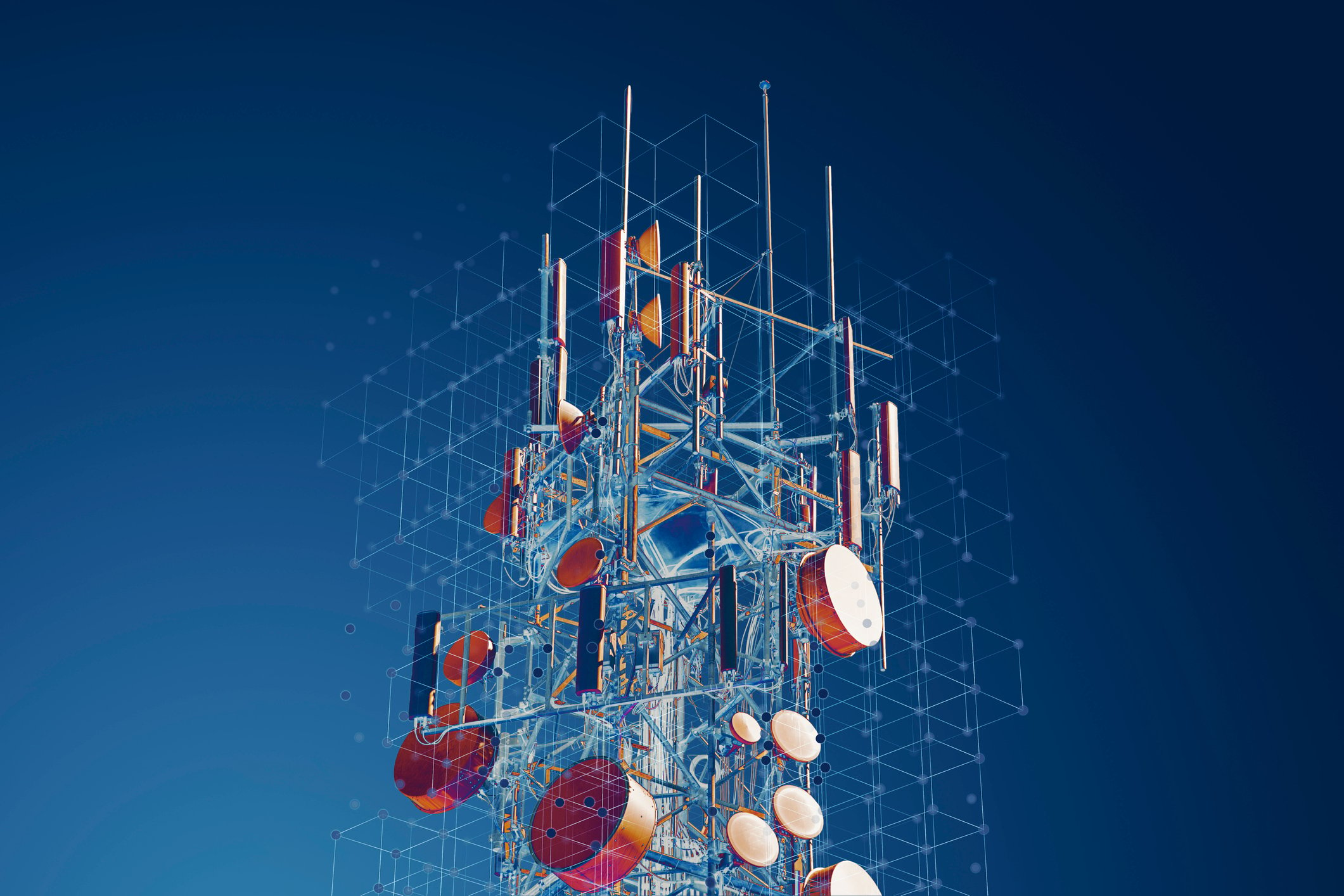

One of these stocks invests in warehouse properties, which could be a big beneficiary of the e-commerce boom. Image source: Getty Images.

Why REITs are great IRA investments

In a nutshell, REITs are especially good at taking advantage of the tax-free compounding available in an IRA.

To be classified as a REIT, the company must pay out at least 90% of its taxable income to shareholders, in addition to meeting a few other requirements. If it does this, the REIT's profits will not be taxed at the corporate level. This is a big advantage over most other dividend-paying stocks, whose profits are effectively taxed twice -- once at the corporate level and then again when they are paid out as dividends to shareholders.

The caveat is that REIT dividends generally are taxed as ordinary income, as opposed to most other dividends, which receive preferential "qualified dividend" tax rates.

However, dividend taxes are not an issue if you hold stocks in an IRA. So by owning a REIT in your IRA, you get the benefit of no corporate taxation and you get to avoid paying income tax on the REIT's distributions. If you reinvest your dividends, this can be a pretty powerful recipe for compound returns over time.

Built for steady compound growth

Realty Income (O +0.46%) is perhaps my favorite overall dividend stock in the market. This 4.1%-yielding REIT owns freestanding retail properties, and there are two reasons why it is a consistent dividend-growth machine year after year.

First, Realty Income's tenants are generally recession-resistant as well as e-commerce-resistant. For example, dollar stores are a large portion of the company's portfolio, and these businesses not only tend to thrive during recessions when Americans become more bargain-conscious, but they also offer bargains and convenience that are often unmatched by online competitors.

Second, Realty Income's properties are all net leased to their tenants. This means that the tenants agree to cover the variable costs of owning the property -- specifically property taxes, building insurance, and most maintenance items. Plus, these leases generally have long initial terms (15 years or more), with annual rent increases built in. All Realty Income has to do is put a tenant in place and enjoy year after year of predictable, growing income.

Profit from the next 50 years of e-commerce growth

Industrial REIT Prologis (PLD 0.16%) is one of the world's largest owners of "logistics" real estate, with about 771 million square feet of space all around the world. The company uses the term "logistics real estate" to describe properties such as warehouses and distribution centers. Top tenants include companies like Walmart, The Home Depot, DHL, UPS, and of course, Amazon.

The big reason to love Prologis is that it stands to benefit tremendously from the rise of e-commerce and the general increase in global consumption that are expected to gradually take place over the next few decades. E-commerce sales are expected to rise from about $2 trillion globally in 2017 to more than $3 trillion by 2020. And e-commerce needs about three times the distribution space of brick-and-mortar retailers.

A great business for any economy

The largest REIT in the market, American Tower (AMT +0.02%), owns a portfolio of more than 170,000 communications sites worldwide. Picture those massive cellular towers you drive by on the side of the road -- that's the type of real estate American Tower invests in. This can be a great recession-resistant type of real estate. After all, people continued to use their mobile devices during the Great Recession, so American Tower's revenue stream should continue to consistently grow in any economic conditions.

Despite its size, there's still a considerable amount of growth potential for American Tower. For starters, the upcoming wide-scale rollout of 5G technology should be a steady driver of demand growth going forward. And although American Tower has 170,000 towers in its portfolio, there's lots of room for expansion in some key international markets.