Check out the latest Intel earnings call transcript.

2018 was a strong year for semiconductor giant Intel (INTC +2.22%), even if you wouldn't necessarily know it from its share price. The stock rose just 2% in 2018, but that was enough to outperform in a down year for the market as a whole. Even with the tepid share-price move, Intel had a lot to celebrate from a business perspective during the year, and investors came into 2019 with high hopes for the chipmaker.

Dividend investors don't necessarily look to tech stocks as great sources of income, but Intel was among the first tech companies to pay a dividend regularly. After going a long time paying just a token dividend, Intel has embraced dividend growth recently. Although it hasn't been consistent about the timing of its payout increases, Intel's dividend policies have been a key component of the stock's total return. Below, we'll look closely at Intel to see if it's likely to deliver another dividend increase in 2019.

Dividend stats on Intel

|

Metric |

Current Stat |

|---|---|

|

Quarterly dividend per share |

$0.30 |

|

Yield |

2.5% |

|

Streak of dividend increases |

4 years |

|

Payout ratio |

38% |

|

Last increase |

February 2018 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

The big boom in Intel's dividend payouts

Intel has paid a dividend since the 1990s, but it hasn't always been nearly as big a deal for shareholders as the current payout is. For a long time, the company delivered only minimal increases, and even as recently as the early 2000s, Intel kept its payout stable at $0.02 per share over a span of several years. Even as the tech sector rebounded from tough industry conditions, Intel didn't initially see the need to share its success with shareholders through dividend payments.

Yet Intel changed its stance by the mid-2000s. The tech giant doubled its dividend twice in a short span, and it proceeded to make multiple dividend boosts at irregular intervals from 2005 through the early 2010s.

INTC Dividend data by YCharts.

That's not to say that Intel hasn't gone through some tough times. During 2013 and 2014, it chose not to offer a dividend increase as it struggled through the painful process of trying to catch up with its rivals. Having stuck to its guns as the leader in the PC chip sector, Intel largely missed out on using its development expertise to come up with chips for the rapidly growing mobile device market. Rather than making a token payment increase that would have extended a streak of nearly a decade of consecutive annual dividend hikes, Intel let it lapse by keeping its payout flat.

Moreover, the size of Intel's dividend increases has varied considerably over the years. The boost in 2018 amounted to 10%, which was double the rate of Intel's 2017 dividend hike. Even though the stock has held on to its increases from late 2017, the yield still comes in above average for the tech sector.

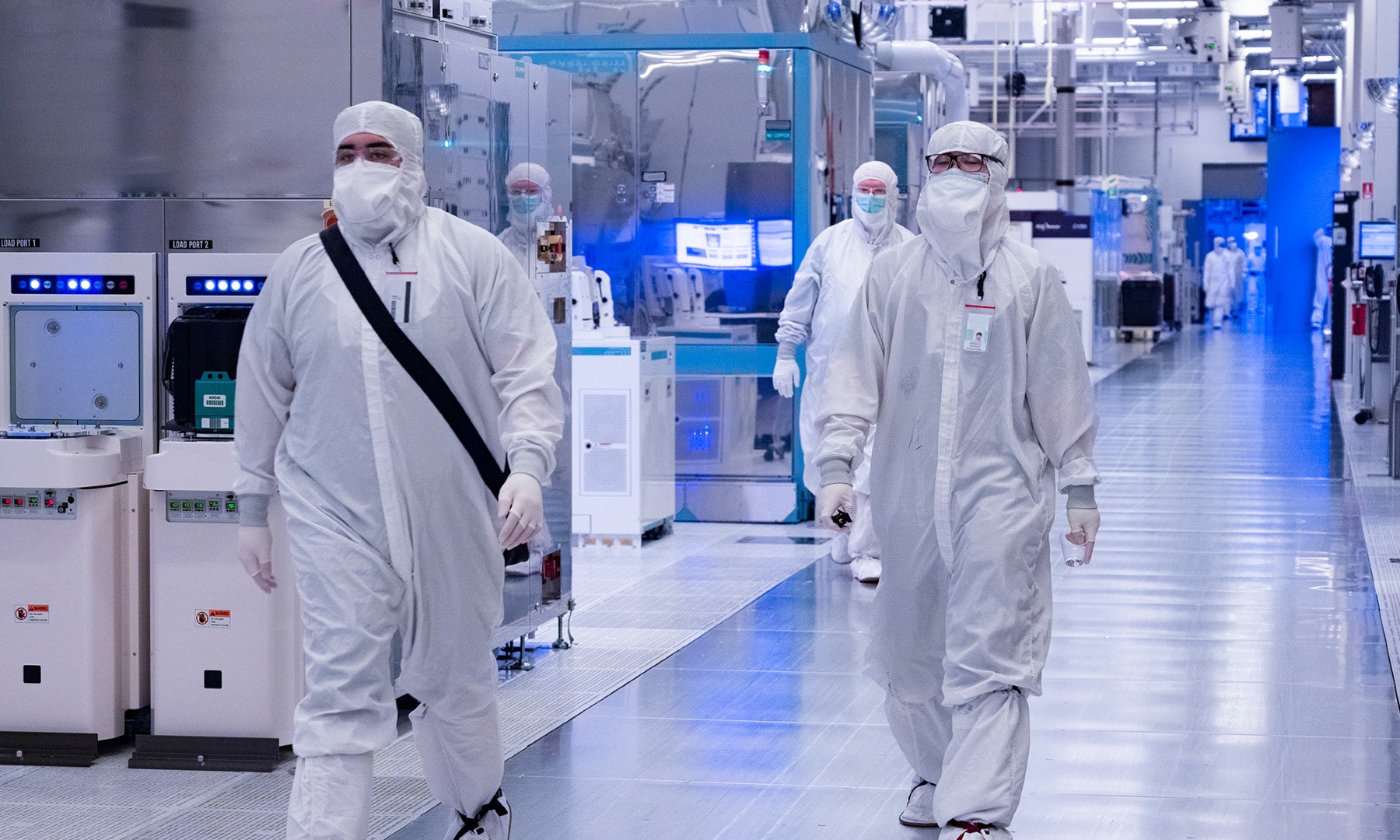

Image source: Intel.

Challenges and opportunities for the coming year

One reason for optimism among dividend investors is that Intel has seen dramatic growth in 2018. The company is on pace to deliver 30% higher earnings per share than in 2017, and that should give it a lot more room to make dividend increases while leaving it with plenty of capacity to make much-needed capital expenditures.

On the other hand, there seems to be considerable uncertainty about Intel's prospects for 2019. The company hasn't yet issued its own guidance, but those following the stock project that the chipmaker might well see almost no growth at all in EPS. Competitors appear poised to fight Intel on price as well as quality, and that could put even more pressure on profits. If Intel shares the somewhat lackluster forecast from analysts, then it could lead the company to moderate its dividend increase for the year.

Will Intel's dividend rise in 2019?

With Intel having chosen to announce its dividend increase in late January last year, many investors think that this year's boost is imminent. The ultimate decision will hinge on the company's expectations for the coming year. If it's positive about its future, then Intel could deliver another 10% boost to bring the quarterly payout to $0.33 per share. A smaller increase -- or none at all -- would send a much different signal: that it might see new threats on the horizon that could cause its earnings growth to stall out in 2019.