Eaton (ETN +1.41%) is offering investors a generous 3.7% yield today, well above what you'd get from an S&P 500 index fund. The stock, however, is down 16% over the past year. Earnings have been good lately, but the company operates globally in the industrial sector, which is highly cyclical. With investors increasingly concerned about worldwide economic growth, it's time to see if Eaton can sustain that dividend if it hits a rough patch.

Check out the latest Eaton earnings call transcript.

The business

Eaton operates five main businesses: Electrical products (around 33% of revenue), electrical systems and services (28%), vehicle (16%), hydraulic (12%), and aerospace (9%). It started up a sixth division in 2018 called eMobility to serve the electric vehicle market, but it remains tiny at just 1.5% of revenue. The key takeaway here, however, is that Eaton has a fairly diversified business, with operations that do well at different points in the economic cycle. That's not to suggest that a downturn won't hurt, but that the company's business is built to weather such storms.

Image source: Getty Images.

Eaton is also fairly well diversified globally, with about 54% of revenue from the United States, 22% from Europe, 12% from the Asia-Pacific region, 7% from Latin America, and 5% from Canada. Clearly the economic ups and downs in North America will have the biggest impact on Eaton's business. However, it has a broad reach that, when combined with its portfolio, should allow it to get through downturns in relative stride.

Eaton is simply too large and diverse a company to get into every nook and cranny, but that's the point. It has its business spread well enough that there's little reason to be concerned about any one segment. This also gives management the ability to actively manage its portfolio via acquisitions and dispositions, adjusting the business over time so it is positioned for long-term growth. This is a common theme throughout the company's 100-plus-year history.

To put some numbers on the results of all of this, during the deep 2007 to 2009 recession, earnings dipped into the red in just a single quarter. Trailing-12-month earnings, however, stayed in positive territory throughout the downturn. In other words, Eaton got hit by an economic hurricane and survived without too much pain because it is specifically built to withstand such blows.

What about the dividend?

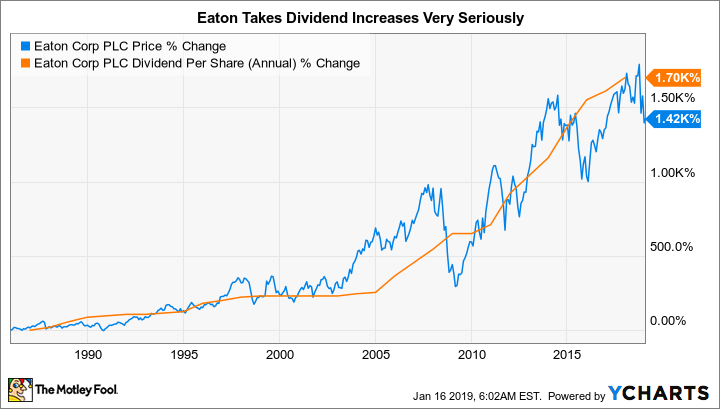

Surviving a downturn is one thing; continuing to pay a dividend throughout a soft patch is another. Eaton is currently working on a nine-year streak of annual dividend increases. It has a history of regular annual hikes stretching much further back, though. Its prior streak ended when management paused dividend hikes about a decade ago to work through the recession. Notably, though, it didn't cut the dividend. So there's a clear desire on management's part to reward investors with regular dividend increases.

Looking at the dividend today, the payout ratio is roughly 50%. That's around the level it has been in over the past couple of years, though the payout ratio has been as low as 35% over the last decade. This is not an unreasonable range for a large and diversified industrial concern. Competitors Honeywell and Emerson hover at roughly the same level.

Note that in 2009, as the world was coming out of the last recession, Eaton's payout ratio got up near 90%, which helps explain the decision to pause dividend increases 10 years ago. Clearly economic downturns have an impact, but this industrial giant has proven its goal is to make it through tough times without cutting the dividend.

Part of the reason Eaton can pay out roughly 90% of its earnings in dividends is that dividends don't actually come from earnings -- they are paid from cash flow. That's an important fact to keep in mind at any company, but Eaton has been particularly good at generating cash flow lately. Through the first nine months of 2018, cash provided by Eaton's operating activities was roughly $1.8 billion. Capital investments ate up around $400 million, leaving a massive $1.4 billion in free cash flow to cover the dividend, stock repurchases, and other things. The dividend, meanwhile, only amounted to around $870 million. Eaton has a lot of room before the dividend would be at risk.

ETN Dividend Per Share (Annual) data by YCharts.

Debt is another issue to consider when examining dividend safety, since overleveraging can force a company to make capital allocation decisions that it would rather avoid (like cutting a dividend). Looking at Eaton's balance sheet, long-term debt only makes up around 30% of Eaton's capital structure. That's a reasonable, perhaps modest, figure for any company. Looking at leverage in a slightly different way, the company covered its interest expenses more than seven times over in the most recent quarter. Debt is not a problem today.

Eaton: Steady as she goes

Every business waxes and wanes over time, and that's just as true of Eaton as any another. However, the company is well-diversified by product and region, and it has a solid balance sheet, plenty of cash flow to support the dividend, and a history of not just protecting the dividend but regularly increasing it. All told, despite being in the cyclical industrial space, Eaton looks like a very strong company that's easily capable of maintaining its dividend. If you are looking at Eaton today because of its generous yield, you shouldn't be too worried about the payout being cut.