So the fourth-quarter earnings report from Caterpillar (CAT 1.57%) has come and gone, and the fears of a slowdown in sales to China were confirmed in its guidance for flat sales in 2019. That said, based on management's overall outlook and the midpoint of the EPS guidance range for 2019, the rest of the company's operations have pretty solid prospects, and the stock now trades at about 10 times forward earnings. Is it time for value investors to start taking a position in Caterpillar?

Caterpillar's earnings

As ever with a cyclical company like Caterpillar, it's important to focus on the change in earnings at a segment level as much as the absolute profit level. While most of the media attention will focus on the highly visible Construction Industries segment, it's worth noting that the Resource Industries and Energy & Transportation segments were the real drivers of higher profits in the most recent quarter -- it was the same story in Caterpillar's third quarter as well.

|

Fourth Quarter |

Segment Profit |

Year-Over-Year Increase |

|---|---|---|

|

Construction Industries |

$845 million |

$8 million |

|

Resource Industries |

$400 million |

$190 million |

|

Energy & Transportation |

$1.079 billion |

$205 million |

Data source: Caterpillar presentations.

Construction Industries

The construction segment's margin came in at a disappointing 14.8% -- below the 15%-to-17% target range management gave at its last investor day. CFO Andrew Bonfield acknowledged that the usual decline in fourth-quarter margin "was greater than we expected and resulted from unplanned allowance increases and writedowns in financial products, higher manufacturing costs including higher material and freight costs, as well as inventory changes."

Management's expectation for 2019 is that price increases of 1% to 4% will more than offset cost increases, while the outlook for construction in the U.S. is described as "favorable in 2019" by CEO Jim Umpleby. Elsewhere, Europe is seen as steady but containing political and economic uncertainty, and China as flat.

There are two questions on this outlook that events will answer in 2019. On a negative note, the management of construction toolmaker Stanley Black & Decker (SWK +4.53%) recently talked of a slowing in interest-rate-sensitive sectors in the U.S., and even though Caterpillar doesn't have significant direct exposure to housing, construction activity tends to follow the housing market. On a more positive note, if the U.S.-China trade dispute takes a favorable turn, it's possible that Caterpillar's outlook will prove too conservative.

Check out the latest Caterpillarearnings call transcript.

Resource Industries

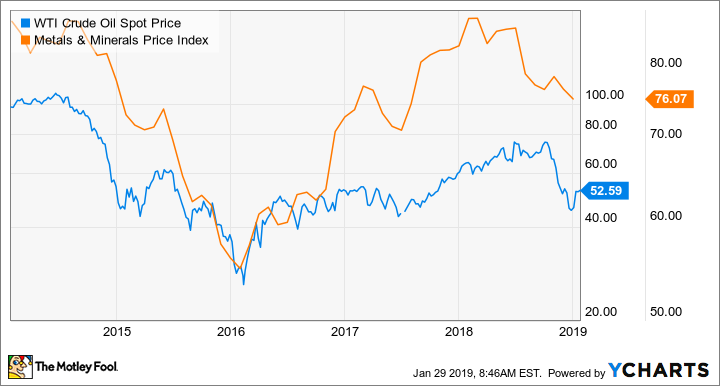

As you can see in the table above, Resource Industries is currently the smallest segment, but its cyclical recovery is crucial to Caterpillar meeting its guidance. The problem here is that metals and minerals prices have been declining in the last six months, and this calls into question the idea that miners are in the early innings of a long cycle of investment. Throw in talk of near-term weakness from companies like Cummins (CMI +0.49%) -- and Caterpillar for that matter -- and the outlook is uncertain.

WTI Crude Oil Spot Price data by YCharts.

Discussing the matter on the earnings call, Bonfield stuck to Caterpillar's general position that "the decline in resource-industries backlog was the result of several factors, including the lumpiness of mining orders and an increase in dealer inventory. Based on activities we are seeing in the market, we expect the slowdown in orders to be temporary and are expecting high mining capex in 2019 to drive high new-equipment sales for the segment."

Energy & Transportation

It's a similar story with the Energy & Transportation segment, where Umpleby believes the "recent volatility" in the price of oil will hurt demand for well servicing in the first half. Meanwhile, transportation is expected to improve in 2019, and good momentum in the U.S. economy is expected to support demand for power-generation equipment and industrial engines.

Image source: Getty Images.

Is Caterpillar stock a buy?

Management expects "modest" sales growth in 2019, and the guidance range of adjusted profit per share of $11.75 to $12.75 puts the company at an attractive valuation. Frankly, it's undemanding guidance, and there is upside potential if China's growth improves. That said, the assumption for capital spending in energy and mining may prove overly optimistic if commodity prices continue to weaken.

Caterpillar is not a stock for those nervous about the global economy or commodity prices. But if you are agnostic on the issue and/or have a neutral view on energy prices, then Caterpillar's modest expectations and forward valuation make it a good choice for value investors.