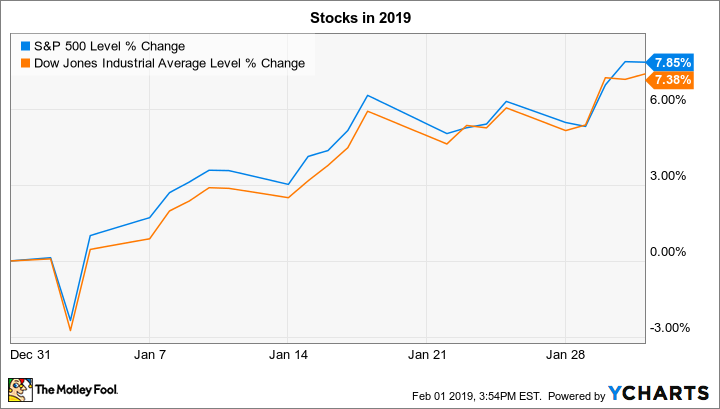

Stocks rose last week to complete the strongest January in decades, as both the S&P 500 (^GSPC -0.23%) and the Dow Jones Industrial Average (^DJI 0.18%) gained more than 1% to put early 2019 returns at about 7%.

Fourth-quarter earnings season remains in high gear over the next few days. Here, we'll look at the metrics that could send shares of Disney (DIS 0.20%), iRobot (IRBT -2.61%), and Dunkin' Brands (DNKN) moving in the trading week ahead.

Check out the latest Dunkin' Brands, iRobot, and Disney earnings call transcripts.

Disney's box office results

Investors have some big questions heading into Disney's fiscal first-quarter earnings report on Tuesday. The media and entertainment giant recently concluded a strong 2018 that marked its seventh record outing out of the past eight fiscal years. However, that success has raised the bar so high that letdowns are becoming more likely.

Management said back in November that Disney's strong theatrical showing last year, which included hits from Lucasfilm, Marvel, and Pixar, could mean that earnings in that division fall by as much as $600 million in the first quarter. The good news is comparisons get easier as the year progresses and as Disney releases its bigger films in the 2019 slate.

Meanwhile, look for the company to talk up the success of its parks and resorts segment, and perhaps to announce a further stabilization of subscriber losses in the pay-TV business. The two biggest initiatives to watch for 2019 are the integration of the massive 21st Century Fox assets and the launch of Disney's direct-to-consumer streaming service. Both moves come with promising growth prospects, but also serious financial risks.

iRobot's costs

iRobot predicted a strong holiday season for its robotic cleaning devices when it posted third-quarter results in late October. The company had good reasons for that optimism, given the robust demand management had seen in recent months. Sales jumped 29% in the third quarter as profitability rose to 51% of sales from 50%.

Image source: Getty Images.

iRobot's latest lineup of devices probably fared well over the peak consumer shopping period, but we'll find out on Wednesday whether that success was enough to meet executives' target of 16% sales growth to $381 million. Hitting that mark would allow iRobot to crack $1 billion of annual sales for 2018.

Profitability will be another key figure to watch, since the holiday season can be brutally competitive. Management forecast a small step lower for gross margin, but a bigger fall would show that aggressive price cuts were needed to keep inventory moving. Looking forward, investors will be interested to hear how CEO Colin Angle and his team see tariff costs affecting the bottom line in 2019, following an expected $5 million hit to profits in late 2018.

Dunkin' Brands' premium coffee sales

Dunkin' Brands' shareholders have good reasons to follow its report on Thursday. The coffee giant has several major growth initiatives in the works, including the national rollout of its premium espresso-based drink platform. That move put the chain into more direct competition with Starbucks, which recently posted a strong quarter powered by growth in its core beverage sales. We'll find out this week whether Dunkin' Brands enjoyed better momentum in the period, too.

The coffee and snack specialist's bigger project involves transitioning into a fully national enterprise and pushing behind its roots in the Northeastern United States. Thus, look for management to spend plenty of time this week discussing the economics of its latest crop of store openings. These new units need to generate strong returns if the company is going to hit its long-term goal of doubling its store count over time.