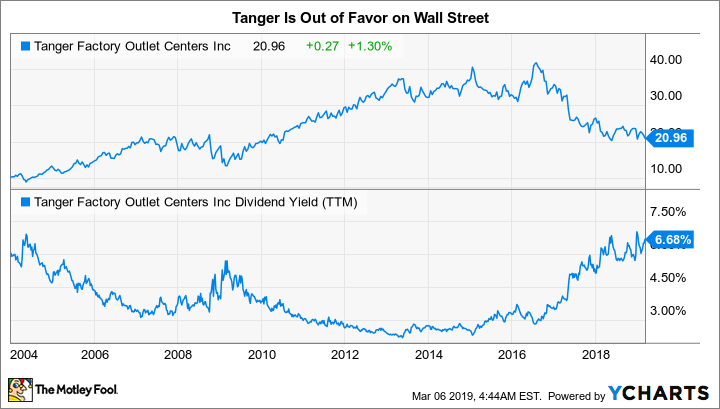

Tanger Factory Outlet Centers' (SKT 1.71%) shares are trading near 10-year lows. The real estate investment trust's (REIT) yield of 6.8% hasn't been this high since the 2007-2009 recession. Is this a buying opportunity for a company with a 25-year history of annual dividend increases, or is the so-called "retail apocalypse" claiming another victim?

It's not what you think

To understand Tanger's current state of affairs, you first need to come to grips with the media hysteria surrounding the retail apocalypse. It's not the end of retail as we know it, just a shift in the way people shop. This change feels bigger this time around because it involves the internet. But tastes and preferences adjust over time, and that is really all that's happening here. To suggest that people will stop shopping in physical stores is hyperbole.

Check out the latest earnings call transcript for Tanger Factory Outlet Centers.

Image source: Getty Images.

If you want proof of that, look no further than Amazon and its continuing shift into brick-and-mortar retail. There are plenty of other online retailers who are going down a similar path. That's not to dismiss the impact that the internet is having on the retail sector, only the hype that brick-and-mortar stores are dead. They are not, and many will continue to be housed in malls, like the 44 discount centers that Tanger owns and operates.

What is changing is the stores, with older concepts that didn't keep up with the times being replaced by newer concepts that resonate with consumers today. It's a difficult transition, with many once-dominant retailers going bankrupt (Sears is a great example), along with many smaller names. As those stores go away, however, malls are left with empty space that will take time to fill. Malls with too many weak and undesirable stores, or poor locations, will inevitably fail to adjust in time and also go dark.

So the question with Tanger isn't so much about the overhyped retail apocalypse as it is about the REIT's ability to change with the times.

On solid footing

Tanger is struggling with the changes taking shape in the retail sector. Its occupancy has fallen from 99% in 2013 to 96.8% at the end of 2018, a number boosted by seasonal tenants. The company is projecting average occupancy of as low as 94% in 2019 as another round of store closures rolls through the retail sector.

None of this is good news, and it's having an impact on the company's financial performance. Tanger is projecting net operating income to fall nearly 3% in 2019. That comes on top of weak results in 2018. There's a good reason why investors have soured on the company's stock.

The thing is, transitions like this just take time. Tanger is working hard to adjust, too, filling spaces with new tenants. Some tenants are new to Tanger, such as Carolina Pottery, and some are new to discount malls, such as American Girl. Tanger's big benefit here is that it doesn't have anchor tenants, so the loss of any individual retailer (like a Sears store) doesn't leave a giant glaring hole in one of its properties. Moreover, outlet centers are simple outdoor facilities. The cost to make a vacant space ready for a new tenant is relatively small compared to an enclosed mall. And the rental rates that lessees pay are relatively modest, as well, making outlets a low-cost and desirable place to open stores. Tanger's centers, meanwhile, are fairly well-located, often near vacation destinations -- where people's wallets tend to be a little more open than usual.

Equally important, Tanger has plenty of breathing room. The company has an investment-grade balance sheet. Total debt to total adjusted assets is just 50% (its debt covenants require that figure to be below 60%) and it covers interest expenses by a robust 5.2 times (well above the covenant requirement of just 1.5 times). Management also has roughly 75% of a $600 million line of credit unused and available. And there are no material debt maturities looming that look unmanageable.

Moreover, Tanger is only using around 55% of its funds from operations to pay the dividend. Pair that with the company's strong balance sheet, and there doesn't appear to be much risk of a dividend cut. That relatively low payout ratio, meanwhile, leaves around $100 million a year for the company to keep investing in its portfolio. That includes table stakes, like keeping the properties looking nice, but also working to bring in new concepts that resonate with consumers.

SKT Dividend Per Share (Annual) data by YCharts.

And the recent announcement that Tanger wants to open a new outlet center in Nashville suggests that it still sees growth ahead for the factory outlet niche. The timing of the opening is unclear and likely several years away, which suggests that Tanger is using the news as a signal to investors more than a promise of near-term growth. But it is a reassuring sign that the REIT isn't in survival mode, it's just muddling through a tough transition in the retail sector.

Make sure you have a strong stomach

Transitions like this aren't easy and take time. As such, Tanger is not appropriate for risk-averse investors. However, for those who can handle some near-term uncertainty, it is definitely worth a closer look. And now -- with the yield near 15-year highs and the stock near decade lows -- is a great time to take that deep dive.