Technology companies are becoming the blue chips of the 21st century. That being said, not all tech is created equal. There's consumer versus enterprise tech, software versus hardware, and a variety of different hardware technologies.

Two large-cap dividend payers in the hardware space are Intel (INTC 1.77%) and Seagate Technologies (STX). Today, let's look at which is the better place for your investment dollars.

Intel or Seagate? Image source: Getty Images.

What Intel and Seagate do

Intel is the undisputed leader in central processing units (CPUs), which are the core processors of both personal computers and data centers. However, in recent years, Intel has diversified its business, buying up field programmable gate array chip maker Altera in 2015 and self-driving car software maker Mobileye in 2017. Intel also has a smaller segment dedicated to storage memory, including NAND flash and a new type of memory called 3D XPoint.

Seagate, on the other hand, is mostly in the business of hard disk drives (HDDs), where it had the largest market share last year, at 40%. HDDs are the cheapest form of storage technology today, but HDDs are also being replaced in many applications by NAND flash. Still, the HDD business should be around for some time to come. With only three main players -- Seagate, Western Digital, and Toshiba -- Seagate should be able to milk profits from HDDs even as the business slowly declines over time.

Seagate has also made investments in an attempt to future-proof itself. It invested $1.3 billion in Toshiba Memory Company (TMC), which was taken private by a Bain Capital-led consortium in early 2018. TMC makes NAND flash, so Seagate does have some exposure to the NAND market. Seagate also has a small investment in Ripple, which created the Ripple cryptocurrency (XRP) and distributed blockchain ledger.

Check out the latest earnings call transcript for Intel and Seagate Technologies.

Recent results

Both Intel and Seagate are affected by global technology demand, which is currently going through a soft patch. Yet looking over the past couple years, Intel's growth has clearly been superior, and its dominant 80% processor market share has afforded it higher margins as well.

INTC Revenue (Quarterly YoY Growth) data by YCharts.

Thus, it appears Intel is the superior-quality company.

Winner: Intel

Valuation

Of course, it's not just the quality of the company but also the price you pay as an investor. Turning to the forward PE and enterprise value-to-EBITDA multiples, Seagate appears the cheaper of the two, though just barely.

INTC PE Ratio (Forward) data by YCharts.

Both companies' valuation metrics are fairly low, meaning the market is predicting little to no growth for both in 2019. While the slight edge would go to Seagate, these valuations are so close that I'm going to call this category a tie.

Winner: Tie

Payout ratios

Both companies are also large, mature cash cows, meaning that while you may not see much in the way of eye-popping revenue growth, each company does return lots of cash to shareholders via dividends and share repurchases.

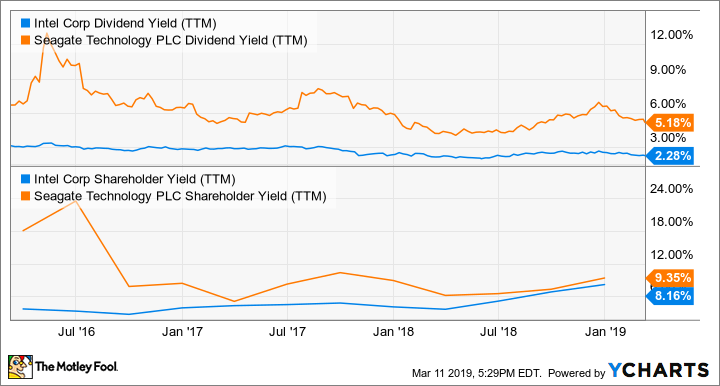

INTC Dividend Yield (TTM) data by YCharts.

Seagate has a much larger dividend yield at 5.18%, while Intel's dividend is less than half that at 2.28%. However, dividends aren't the whole story; Intel returns a greater portion of its cash flow to shareholders in the form of share repurchases. That's why its shareholder yield -- which counts dividends and repurchases combined -- is much closer to Seagate's. That should allow Intel to grow its share price and the dividend faster than Seagate over time. Still, Seagate does maintain a slight edge here.

Winner: Seagate

Threats and risks

Both companies also have risks to watch out for. Intel recently hit a snag by falling behind competitors in the race to manufacture 10nm chips. Competitor Advanced Micro Devices already has 7nm chips (equivalent to Intel's 10nm) out to market and looks poised to take some market share. Meanwhile, Intel says its 10nm chips will finally be ready by the holiday season of 2019.

At the same time, Seagate is battling a slow decline in its main HDD business. Nevertheless, in today's data-centric economy, demand for cheap storage should last for a while. Over the long term, however, Seagate will likely need to adapt with new products and/or services.

Since Intel's risk is more of a near-term hiccup and Seagate's seems like a larger long-term problem, Intel seems the safer of the two over the long haul.

Winner: Intel

Intel for safety

With two wins to one, Intel comes out the victor here, as it appears to be the safer pick. However, for those seeking a bit more yield and upside, but with a bit more risk, Seagate could be interesting. Its dividend is high, expectations are low, and it does have the Ripple investment. Still, most investors should probably stick with the stability and diversity of Intel.