What happened

Shares of Lyft (LYFT 1.84%), the country's No. 2 ridesharing service, got a reality check in April after the stock fell sharply following a surge on March 29, its opening day. Skepticism about the company's future mounted as it's still losing close to $1 billion a year, and investors also reacted to rival Uber's filing for an initial product offering (IPO).

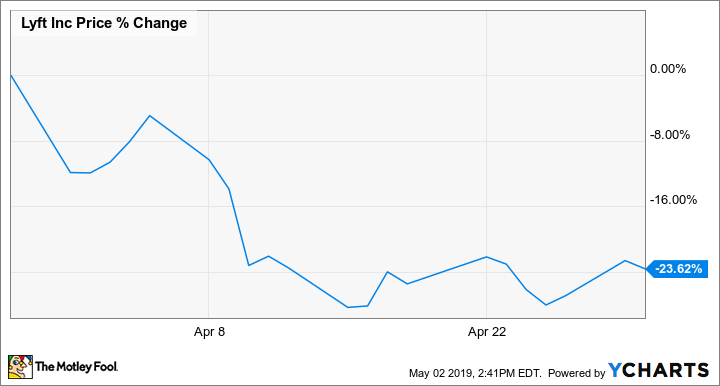

The stock gave up 24% over the course of the month, according to data from S&P Global Market Intelligence. As the chart below shows, the shares fell sharply at the beginning of the month and stayed down from there.

So what

Lyft stock fell quickly after its March 29 IPO. In fact, that day the stock closed down 9% from its opening price and gave up another 10% on April 1, as investor enthusiasm waned and analysts began initiating coverage on the stock with most rating it "neutral," often understood as a euphemism for "sell."

Image source: Lyft.

The stock actually recovered those losses, moving back above its $72 IPO briefly that week, but then crashed again the following week after news broke on April 11 that rival Uber was set to file for its IPO. Lyft stock lost 11% on April 10 as investors responded to that upcoming IPO. Uber's IPO will not only take the attention off Lyft, and could prompt some investors to trade in their Lyft shares for Uber, the industry leader; it will also give the company billions more to play with as it looks to drive growth in the U.S. and around the world.

From there, Lyft shares hovered around $60 for the rest of the month.

Now what

May is set to be another big month for Lyft since the company will release its first-quarter earnings report after the market closes on May 7, and investors will have to respond to Uber's debut on the market, which should take place within the next couple of weeks.

For the earnings report, analysts see Lyft's revenue clocking in at $740.2 million and expect a loss per share of $1.81. With Lyft's first earnings report as a public company coming out and Uber set to start trading, Lyft stock's volatility is likely to continue.