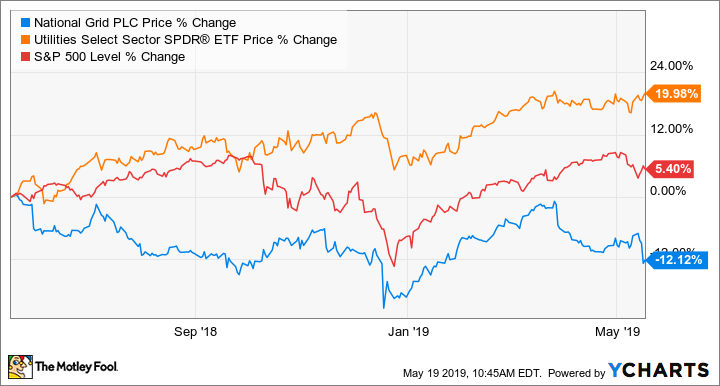

At a time when utility stocks are doing well, U.S. and U.K. utility National Grid (NGG +0.44%) has been a notable laggard. Even though it's making some impressive progress on management's objective to diversify the business with investments outside its regulated segments, there are some forces outside the company's control hanging over its stock.

Let's take a look at the company's most recent earnings report, as well as some of the issues facing National Grid and their impact over the long term.

Image source: Getty Images.

National Grid's earnings: The raw numbers

| Metric* | 2019 | 2018 | Change |

|---|---|---|---|

| Revenue | $19.56 billion | $20.74 billion | (5.7%) |

| Operating profit | $3.76 billion | $4.75 billion | (20.8%) |

| After-tax profit | $1.97 billion | $4.81 billion | (59%) |

| Earnings per ADR** | $2.90 | $6.97 | (58.4%) |

DATA SOURCE: NATIONAL GRID EARNINGS RELEASE. EPS = EARNINGS PER SHARE.

*NATIONAL GRID RESULTS ARE REPORTED IN BRITISH POUNDS AND WERE CONVERTED TO U.S. DOLLARS USING NATIONAL GRID'S ACCOUNTING STANDARD, WHICH IS A WEIGHTED AVERAGE EXCHANGE RATE FOR THE RESPECTIVE REPORTING PERIOD. FOR 2019, THE EXCHANGE RATE WAS 1 POUND = $1.31. FOR 2018, THE EXCHANGE RATE WAS 1 POUND = $1.36.

**1 U.S. ADR = 5 COMMON SHARES OF NGG.

This past quarter's results contained several one-time charges and events that weighed heavily on results. The largest of those charges related to writing down the connector development costs for two canceled nuclear power plants in the U.K. (137 million British pounds, or GBP) and resolving a labor dispute with a labor union in the U.S. (283 million GBP). Excluding these items management deemed as exceptional to normal operations, its underlying operations were mostly on par with the prior year. It also noted that lower rates of return for some of its regulated U.K. assets and U.S. tax reform dcreased underlying operating profit by about 2% compared to the prior year.

DATA SOURCE: NATIONAL GRID EARNINGS RELEASE. CHART BY AUTHOR.

What happened with National Grid this quarter?

- National Grid made a push into renewable energy development by American wind and solar power developer Geronimo Energy for $100 million. In addition, the company has agreed to purchase a 51% share in 378 megawatts of renewable energy projects Geronimo is currently developing for $125 million. This is National Grid's first foray into owning and operating power generating assets in the U.S.

- The company announced it had submitted regulatory filings with Massachusetts and New York to increase its capital spending rates in both states. It also announced it had reached an agreement with its labor union in Massachusetts for a five-and-a-half-year contract.

- National Grid is in ongoing negotiations with Ofgem (the Office of Gas and Electricity Markets in the U.K.) to establish new regulatory rates. According to management, the new framework, as written, would severely reduce the overall rate of return and doesn't encourage performance.

What management had to say

National Grid's business is facing a lot of questions in its home country right now, mostly in the form of politics. No, it isn't Brexit, but rather a recent proposal from the U.K. Labour Party to nationalize large swaths of the infrastructure, starting with the gas and electric grids. When asked about Labour's policies, CEO John Pettigrew was rather standoffish in his response.

So our position very clearly is that we don't believe that the proposal the Labour has set out are in the interest of consumers in the U.K. The key question I think to be asked is what's the problem that the state ownership is trying to solve. And from our perspective, when we look at the proposals, it's not clear to us. So the U.K. has one of the world's most reliable and safe networks, as you know. We're investing massively in the networks, the National Grid invested GBP10 billion over the last six years

Pettigrew was also asked if he thinks there is a path toward National Grid splitting into two entities in the event of a nationalization. His response:

The Board has a duty to consider valuation of the business, and it does that, as you'd expect, on a regular basis, but we don't see splitting National Grid as a response to what is currently a proposal by the Labour Party.

You can read a full transcript of National Grid's conference call here.

Looking forward

For the most part, investors are better off ignoring politics. The knee-jerk reactions from Wall Street or some talking head rarely come to fruition. When the U.K. is talking about nationalizing its electricity and gas networks and paying shareholders with government bonds, however, it may be time to pay a little more attention to the political machinations of the day. If Labour's proposals go through, then there's a good chance of an epic legal battle.

The threat of political action against National Grid has weighed on the stock recently, and as a result, its shares look quite cheap. Its dividend yield is close to 6%, which is one of the highest levels over the past 10 years. It's entirely possible that this Labour proposal is much ado about nothing. If that's the case, then the stock looks compelling. If this plan to nationalize the U.K.'s energy infrastructure materializes, though, tough times could be ahead for shareholders.