What happened

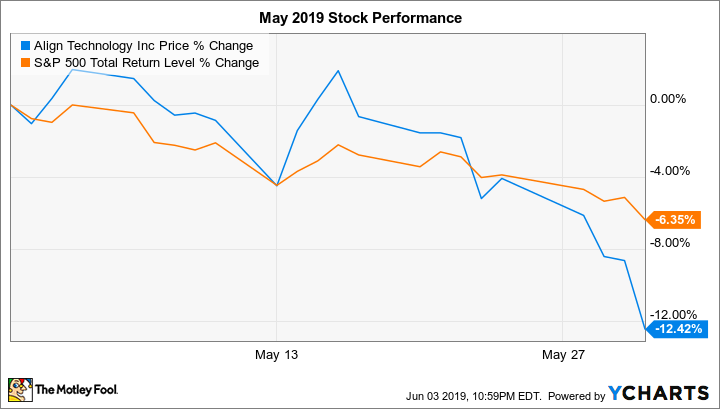

Shares of Align Technology (ALGN 0.69%), the maker of the clear plastic Invisalign dental retainer, fell 12.4% in May, according to data from S&P Global Market Intelligence.

This performance isn't as bad as it might seem at initial glance, as the S&P 500, including dividends, dropped 6.4% last month.

Image source: Getty Images.

So what

We can attribute Align stock's subpar performance last month largely to poor overall market conditions.

As is typical during market sell-offs, high-flying, highly valued stocks were generally the hardest hit -- and Align is such a stock. Investors lightened up on these type of stocks and loaded up on solid and stable dividend payers.

Data by YCharts.

Align stock's downturn last month follows its 14.4% rise in April, thanks to the company's release of first-quarter results that pleased the market. In the quarter, revenue rose 25.6% year over year to $549 million, while adjusted earnings per share declined 23.9% to $0.89, driven by impairments and other charges related to the closures of the company's U.S. Invisalign stores. Adjusted EPS beat the $0.83 Wall Street was expecting.

In the bigger picture, Align stock's May drop was relatively minor, as it's gained 46.9% in 2019 through June 7.

Data by YCharts.

Now what

There seems to be no reason to change whatever investing course you've chosen for Align stock based on its performance last month.

For full-year 2019, Wall Street is expecting Align's earnings growth to slow to 11.2% year over year, but then accelerate to 30.7% next year.