Since my Motley Fool colleague Matthew Frankel last took a stab at answering whether it was a buy, a lot has happened for Senior Housing Properties Trust (SNH +0.77%).

Unfortunately, very little of it has been good.

To be very clear, Senior Housing Properties is facing some very real challenges, and its cash flows are going to be pinched for the foreseeable future while management works through its troubles, which include a significant reduction in rents from one of its biggest tenants, a mountain of debt it must reduce, and a collection of properties it could continue to struggle to monetize.

Until cash flows and the balance sheet improve, there's too much risk that it's a dividend trap. Image source: Getty Images.

Let me not bury the lede: Senior Housing Properties doesn't look like a buy right now, whether you're looking for dividends or hunting for value. Simply put, there remain too many problems that management must fix before investors should risk any capital in this senior housing REIT.

Getting into (the sick) bed together

Back in November, my colleague pointed out a number of reasons why Senior Housing Properties wasn't a good buy, including its large debt -- particularly its debt-to-capital, which is now above 55% -- and the risks it would face if one of its major tenants ran into financial trouble.

Well, guess what happened recently? One of its biggest tenants, Five Star Senior Living (FVE +0.00%), has run squarely into financial trouble.

And in order to avoid a worst-case scenario of Five Star going into bankruptcy proceedings, it seems that Senior Housing Properties management and board has made a bit of a "deal with the devil you know" to mix metaphors. In April, it entered a definitive agreement to essentially wipe out its existing agreements, and replace them with management agreements for all 261 of Senior Housing's properties currently run by Five Star, which will cut the aggregate monthly rent Five Star pays by $6.4 million. That's a nearly $77 million per year cut in cash flows.

In exchange, Five Star will issue the equivalent of 51% of its shares outstanding in new stock, of which 34% will be owned by Senior Housing Properties post-issuance, while Senior Housing Properties investors will hold another 51%. Combined Senior Housing Properties and its shareholders will own 85% of Five Star when the deal is finalized on Jan. 1, 2020.

There's more. Senior Housing Properties also agreed to buy $50 million in properties from Five Star, and to extend it a $25 million revolving credit facility.

Putting it all together, Senior Housing Properties made the decision to essentially exchange an ownership stake of the struggling operator -- and deal with the short-term pain it will inflict on its cash flows -- with the idea that it will gain in the long term by helping Five Star to improve its business. The company said it intended to retain its stake in Five Star "for the foreseeable future."

Cutting the the payout is only a start

The market was not a fan of this deal, sending shares down sharply the day it was announced, likely on the expectation that it would mean a cut to the sizable dividend. And that cut did come with an April announcement of a $0.15 quarterly payout, a sharp 62% reduction that, frankly, the company had no choice but to make.

SNH Dividend data by YCharts.

Here's the rub: The company's problems won't be resolved simply by cutting the payout and exchanging a stake in Five Star for lower rent. The company's mountain of debt remains a real concern that, combined with its weakened cash flows, could end up pushing its credit rating from the bottom end of investment grade, and into so-called "junk" grade.

Management has a plan to improve its debt profile, but it requires the company to offload $900 million of property by the end of 2019. As of May 16, the company had reached agreements or closed on $85 million in property sales. That's a start, but it still has a long way to go to reach $900 million by year-end.

Not a buy yet, but watchlist-worthy

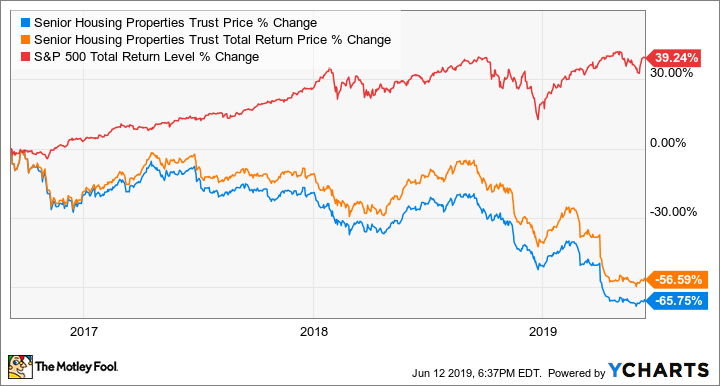

Senior Housing Properties' stock has lost over 40% of its value from the 2019 peak, while shares are down by two-thirds from the three-year high. Simply put, the market has "rewarded" the company fairly for its very real struggles.

Investors would do well to hold off for now, though. As much as it may be "fairly" priced based on its recent performance, there is much work management must do before it's worth buying. It's already made some tough decisions in cutting the dividend, and exchanging cash flows for an equity stake in Five Star. But until we see more meaningful progress on asset sales -- particularly how those asset sales will negatively affect cash flows against the improvements the proceeds net to the balance sheet -- there will be risk the dividend must get cut even further and that the share price will continue to fall.

Until management can answer those questions with demonstrable improvements in its operating and financial results, the risk of "missing out" on some upside is far smaller than the potential for continued losses if the company struggles. Better to miss out on the beginning of the recovery than jump in before the company actually starts turning things around.