Two strong go-to dividend stocks for retirees are energy-industry bellwethers Enterprise Products Partners (EPD +0.16%) and ExxonMobil (XOM 0.47%). But they aren't the only options retirees should consider. Magellan Midstream Partners (MMP +0.00%) and Royal Dutch Shell (NYSE: RDS-B) have higher yields and very similar businesses. Here is what you need to know about Magellan and Shell if you're retired and looking to boost the income your portfolio generates.

1. Happily stuck in the middle

Enterprise is one of the largest midstream companies in North America, with a conservative management team and a yield of 6%. Magellan is roughly a quarter the size, but is even more conservative and offers a yield of 6.5%. Enterprise is a great option, but that extra 50 basis points from Magellan could be well worth dropping down to a smaller industry player.

Image source: Getty Images.

Like Enterprise, the bulk of Magellan's revenue comes from assets backed by fee-based contracts. That means its collection of pipelines and storage assets are largely protected from volatile energy prices, with demand for oil and natural gas (and the products they're made into) the bigger driver of performance. On that front, U.S. onshore production growth is outstriping midstream capacity, providing a solid runway for growth in the industry.

Magellan, meanwhile, has long taken a conservative approach with its balance sheet, with leverage at the low end of the industry. In fact, the partnership's debt-to-EBITDA ratio is lower than Enterprise's. Magellan has also long focused on self-funding its growth projects so it could minimize the number of dilutive shares it issues -- a business model to which Enterprise is only now shifting toward. Put simply, you will not be taking on extra financial risk going with Magellan.

What you will get, however, is a 50-basis-point boost in yield and an incredible distribution record. Magellan has upped its disbursement every quarter since it came public in 2001. Enterprise has a longer streak of annual distribution increases only because it has been around longer. Distribution coverage is 1.2 times, which is good for a partnership. And while that's lower than Enterprise, the difference is partly because of Enterprise's shifting business model (a transition that is still in progress).

MMP Financial Debt to EBITDA (TTM) data by YCharts.

Looking to the future, Magellan has roughly $1.25 billion in projects on tap for 2019 and 2020. It expects that to support distribution growth in the 5% range. That's a bit higher than what Enterprise is likely to provide (again because of its transition) and roughly in line with Enterprise's longer-term historical distribution growth rate. Magellan just nixed a large project, which is partly why the units are offering such a generous yield (historically it has yielded less than Enterprise). But management has a solid history of success and it deserves the benefit of the doubt right now since it is highly likely to find new ways to continue growing over time. If you are looking to maximize your income in retirement, Magellan is a great option today.

2. An alternative giant

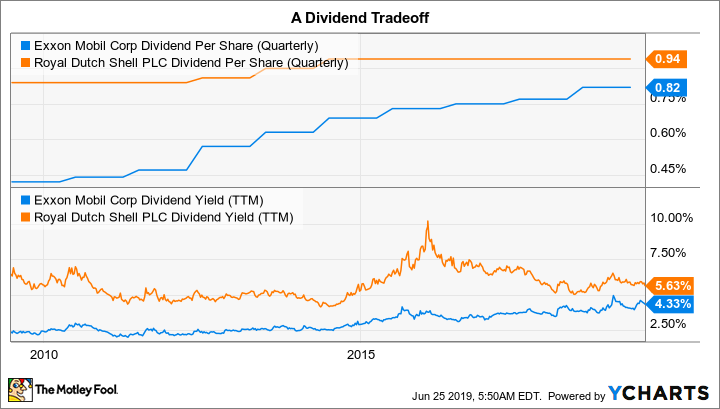

Exxon is one of the most conservative integrated oil giants around, focused on low levels of debt and a balanced portfolio of assets spanning the upstream, midstream, and downstream energy sectors. With a roughly 4.5% yield, it is a great option for risk-averse investors. However, if you want to maximize your dividend income, Shell's 5.6% yield should also be alluring.

For starters, Shell is one of the few companies that can compete with Exxon's size and reach. And while Shell has a long history of using debt more aggressively than Exxon, it also typically carries materially more cash on its balance sheet. Based on first-quarter 2019 balance sheet data, long-term debt is roughly 10% of Exxon's capital structure and it holds around $4.5 billion in cash. Shell's debt is roughly 30% of its capital structure and it has $23 billion in cash. Although Shell's debt isn't outlandish, adjusting for the cash drops long-term debt to a more comforting 20% of the capital structure.

And, for investors who think long-term, Shell might actually have a portfolio edge over Exxon. Exxon is focused on carbon fuels. Shell is branching out into electricity, so it can participate as the world moves away from carbon fuels. Shell has been more aggressive than Exxon at shifting its business to fit better with long-term trends lately. If global warming's impact on the energy industry worries you, then Shell might be the better bet -- and you'll collect a higher yield along the way.

XOM Dividend Per Share (Quarterly) data by YCharts.

The one place where Shell falls well short of Exxon is dividend growth. The dividend hasn't been increased since 2014, when oil prices nosedived. However, Shell didn't cut the dividend, either, and has been performing quite well recently. Still, the lack of growth may keep some income investors away. That's an understandable decision, but investors looking to maximize income today would do well to strongly consider the higher yield combined with Shell's diversification into electricity. Those two factors might be enough to tip the needle back in favor of Shell.

Using your nest egg wisely

When you hit retirement, you shift from building a nest egg to living off of what you have saved. For many retirees, that means a focus on dividend-paying stocks like Exxon, Shell, Enterprise, and Magellan. All of them are great options. That said, if you are looking to maximize income today, Magellan and Shell offer higher yields and similar risk profiles. You might just find that you like them better than the industry bellwethers they compete against.