The shift from coal to natural gas in the United States has been devastating to the coal mining industry. Having used leverage to bulk up just before coal demand and prices started to fall, industry giants Peabody Energy (BTU +0.00%) and Arch Coal (ARCH +0.00%) ended up taking a trip through bankruptcy court. Now back on their feet, this pair is joining forces in the prolific Powder River Basin region. Should investors be happy or worried about this deal?

Coal hits the skids

Not all coal is created equal, with some providing more energy than others. In addition, some coal burns less cleanly than others. And, to top it all off, location matters as well. Coal that has to be moved great distances ends up being more expensive to use because of transportation costs.

Image source: Getty Images.

Complicating these facts is the ongoing shift toward cleaner fuel options. Although solar and wind are an important factor, the biggest impact on coal has been the shift to natural gas, a cleaner-burning carbon fuel. Gas plants are less expensive to build, quicker to complete, and are easier to, for simplification sake, turn on and off as demand ebbs and flows. They are, generally speaking, a better complement to intermittent renewable power sources on top of being cleaner than coal plants.

So, over the last decade or so, coal has been losing ground to other power options. That's meant a broad decline in demand for coal and, as an added benefit, relatively weak pricing. But like I said, not all coal is created equal. Some regions have been hit harder than others, with the Powder River Basin among the worst because of the type of coal it produces and its distance from end customers.

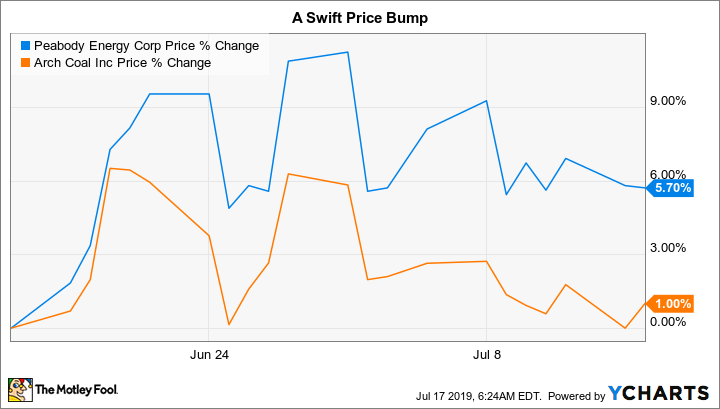

Peabody Energy and Arch Coal are big players in the Powder River Basin region. Both stocks rose when the news of the plan to work together in the region hit Wall Street. Clearly, investors like the idea of this joint venture.

What's the plan?

The two companies are contributing their operations in the region to a joint venture that will be owned 66.5% by Peabody and 33.5% by Arch. The deal involves the North Antelope Rochelle, Black Thunder, Caballo, Rawhide, Coal Creek, West Elk, and Twentymile mines in Wyoming and Colorado. Four of the mines are owned by Peabody and three by Arch. Peabody will run the joint venture and market the coal.

This joint venture was established for one big reason: cost. The miners believe they can reduce their combined costs by around $120 million a year. By working to keep costs low, Peabody and Arch effectively hope to maintain profitability in the region. That will allow them more leeway to compete with natural gas, which is trading near historically low levels, and give them subsidized renewable power options.

It is completely reasonable for these coal giants to try to use scale to compete more effectively. In that regard, it is an intelligent response to market conditions, which is why investors rewarded Peabody and Arch for making this call. However, merging assets facing material headwinds will only do so much. The long-term push in the electricity space remains to lower carbon emissions and the easiest way to do that is to limit the use of coal. That's a headwind that isn't going away. With other coal regions better positioned in the market (notably the Illinois Basin region on which industry competitor Alliance Resource Partners is focused), this joint venture is unlikely to save these giants from the impact of the bigger coal trends.

No game changer

At the end of the day, Peabody and Arch are making a wise decision to form a joint venture in the Powder River Basin region. However, the projected cost cuts aren't likely to change the long-term trends facing the troubled coal industry. And Powder River coal has been particularly challenged. All in, this news isn't a good enough reason to jump aboard either of these stocks.