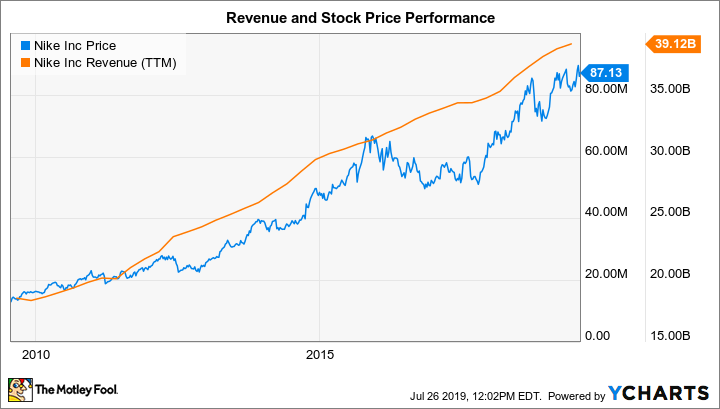

Nike (NKE +5.40%) has been a very rewarding investment for shareholders. Over the last five years, the stock has more than doubled. The brand is hotter than ever due to rising demand for sneakers, which is further evidence that the athleisure trend is continuing to gain momentum.

The strength of that trend is pushing Nike and other athletic wear brands to partner with stars outside of sports, such as celebrities and social media influencers, on exclusive sneaker lines, which allows the top brands to tap into the widespread following celebrities have on social media.

Here's a look at five things that should continue to drive growth at Nike.

The new Nike ZoomX shows the sneaker giant merging lifestyle and performance features into one silhouette. Image source: Nike.

1. Increasing health awareness

Nike's revenue and profits have steadily climbed over the last decade. One key factor pushing the swoosh brand is the increasing interest in active lifestyles, particularly among millennials.

There is plenty of research that highlights the benefits of regular exercise. A growing interest in sports activities and fitness programs explains in part why the athletic apparel industry has steadily grown over the past decade and is expected to continue growing for the foreseeable future. Morgan Stanley expects the market to reach about $355 billion in sales by 2021, representing a single-digit annual growth rate.

2. Demand for athleisure will continue to drive sales

With athleisure looking like a trend that is here to stay, demand for sneakers is increasingly being driven by fashion tastes as much as for performance. This trend is pushing Nike and its peers to collaborate with celebrities to design exclusive sneaker styles, which helps increase demand.

Adidas has collaborated with Kylie Jenner, Beyonce, and Kanye West, while Nike has tapped the creative thinking of Travis Scott, Justin Timberlake, and luxury designer Louis Vuitton, just to name a few.

3. Wooing customers with a flurry of releases

Nike's Triple Double strategy, which involves cutting in half its production time to double the speed with which it releases new products, should make it a go-to destination for those who want the latest styles. The strategy allows it to keep up with shifts in style preferences and lower the amount of unsold merchandise sitting on store shelves, boosting margins.

4. More styles should fuel demand

Nike is also doubling down on innovation. There is strong demand coming from those who want a good running shoe and from others who just want a shoe for everyday wear. Nike is starting to create new styles that meet both needs.

One example is the recent launch of the Air Max React 270, which fuses the popular Air Max lifestyle sneaker with Nike's React cushioning technology designed for runners.

In the year ahead, it will also launch a new cushioning system called Joyride, which management believes has the potential to be successful for both performance and lifestyle.

5. Margin improvement should fuel earnings growth

Nike is in a great position to see further margin improvement, as a result of its enhanced supply chain efficiency and speed-to-market initiatives. But digital sales will likely be the key factor that pushes margins higher.

More sales are coming from direct channels, including company-owned stores, apps, and Nike.com. Sales from direct channels increased 16% last year, with sales from digital apps growing the fastest at 35% year over year.

Digital sales from both company-owned and partnered channels are on track to make up 30% of total revenue by 2023. Management sees digital driving the majority of sales over the long term. This should continue to lift Nike's gross margin, which has already been improving.

NKE gross profit margin (TTM) data by YCharts.

What about the stock?

All the signs point to Nike being a larger and more profitable business in five years. But where does that leave the stock price?

Its P/E ratio has steadily expanded over the last decade and now is at 30 times this year's earnings estimate.

It's tough to say with confidence where the stock will be in five years because a lot depends on investor perception of the company's long-term growth potential, and what's going on with the broader stock market at that time.

Overall, I believe the strong demand trends for athleisure, the supply chain improvements, and the growth in digital channels should drive solid gains on the top and bottom lines. Analysts currently expect Nike to grow earnings 15% annually over the next five years. That's enough to make a promising investment for the long haul.