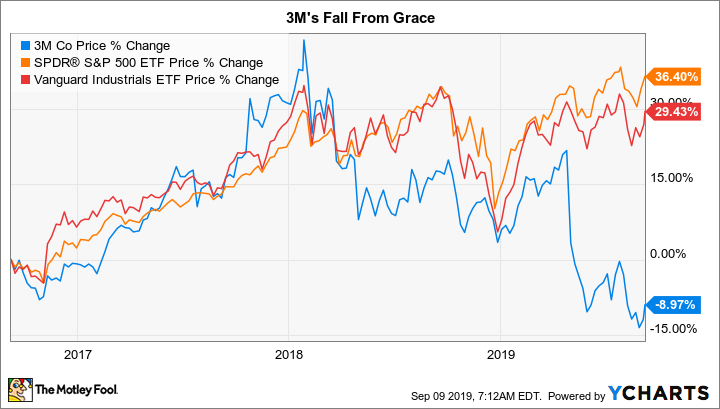

The stock of 3M Company (MMM +5.09%) is down nearly 14% so far in 2019 versus a roughly 20% gain for the S&P 500 index. The industrial giant's laggard performance is actually a longer theme, with the stock starting to head generally lower in early 2018 while the S&P continued to rise. At this point, 3M is 36% below its early 2018 peak. On the surface, this looks like a great buying opportunity, but you need to dig a little further into what Wall Street is seeing before you consider jumping aboard.

A good price?

The first thing to consider about 3M today is its price. Yes, it has fallen hard in a relatively short period of time. Not only is it lagging well behind the S&P 500 index, but it is also drastically underperforming the industrial peer group, using Vanguard Industrials ETF as a proxy. Vanguard Industrials ETF is up 20% so far in 2019 and, like the S&P, continued to head higher while 3M's stock has sunk lower and lower.

Image source: Getty Images.

The dividend yield on 3M's stock, meanwhile, has moved higher and higher as the stock has fallen. Today, the yield is a notable 3.5%, near the highest level in a decade. In fact, the yield is toward the high end of the company's historical range looking back all the way to the late 1980s. It is also well more than the roughly 2% an investor would get from an S&P 500 index fund.

The yield should clearly be enticing to income investors, but it also hints at something more. Using yield as a valuation tool, it also looks like value-oriented investors should be interested in what this industrial goliath's historically high yield is telling us. In fact, price to sales, price to earnings, price to cash flow, and price to book value, the traditional valuation metrics investors look at, are all below their five-year averages today.

Although this all looks great, you need to keep digging before you hit the buy button.

There's a reason for the low price

There are two main issues to keep an eye on at 3M today. The first is core to its industrial business, which is cyclical in nature. Although 3M's product line is vast and includes consumer oriented products, it sells a lot of what it makes to other companies. So, when the economy turns lower, and companies pull back, 3M's top and bottom lines suffer. This isn't a huge deal over the long term, but it is something you need to keep in mind today.

The current economic expansion is one of the longest on record. That suggests that a downturn is likely to happen sooner rather than later. With the U.S. locked in a trade dispute with China and global economies already slowing down, the risks of a recession seem to be rising.

This risk comes into clearer focus when you look at 3M's own business. During the first-quarter 2019 conference call, management was pressed on its short-cycle businesses, which it admitted were performing poorly. These businesses generally start to weaken before bigger problems arise in the economy and were partly responsible for the company lowering its guidance for the year. In response to the weakness, 3M did exactly what you would expect, it worked to control the things it could control (costs and production levels). It was able to announce some success on that front during the second-quarter conference call, but noted that it was still facing difficult conditions in key markets (for example, China and automotive). Although there's been no recession call yet, 3M is dealing with a difficult business environment and its results have been less than inspiring. It could get worse if economic growth continues to soften.

The second big issue to watch is litigation. 3M is facing legal issues on two fronts: respirators and chemical contamination. There are obviously a lot of details to each case, but the story is roughly the same: The company is being accused of selling faulty products. It took a first-quarter pre-tax charge of $548 million, or $0.72 per share, because of these troubles. Full-year 2018, in the meantime, included legal charges of $1.57 per share. There is a material risk that 3M's legal costs continue to rise from here as it works through these unfortunate matters. If things get worse on this front, the costs could easily become very big numbers.

Some industry watchers are making dire predictions. For example, the legal expense risk has been estimated to be as high as $6 billion. And the notion of a dividend cut, after more than six decades of annual increases, has even been brought up. These are Wall Street analysts making educated guesses, which could easily prove misguided. The company's balance sheet remains strong (debt to equity is just 0.16 times and it covers trailing interest expenses 20 times over) as well. But the negative projections here highlight the very real risk that 3M is facing today.

Wait this one out

3M has a storied history behind it. It also appears to be relatively cheap today. But it is facing a difficult operating environment that likely has a higher chance of getting worse than it does of getting better. And on top of that, 3M is facing potentially significant legal costs. For conservative investors, it's better to err on the side of caution with 3M today. More-aggressive types might want to put it on their watch list, but the litigation wildcard should be enough to keep it there until the valuation gets even more attractive or the litigation outcome is more clear. For those watching 3M, note that the yield spiked to around 4.8% during the 2007 to 2009 recession. That suggests there is likely to be more downside here if the current expansion ends, but also hints at a price that might balance out risk and reward at this industrial giant.