When looking for long-term investments, identifying big-picture themes and then isolating the companies exposed to those themes is a great approach. One of the most significant economic themes of this generation is the rising cost of healthcare globally but especially in the U.S. For years, healthcare costs have risen at a rate exceeding income growth. This trend is expected to continue over the next several decades as our population ages.

Technology can help the healthcare system operate more efficiently, and Cerner (CERN +0.00%) is a company with software and services that can help healthcare providers cut costs. Given its exposure to strong long-term trends, Cerner expects to grow its revenue and earnings at attractive rates, but does its strong market position and valuation support the idea of buying the stock?

Image Source: Getty Images.

Attractive growth prospects

Cerner is a leader in electronic health records and also has products and solutions for revenue cycle management, healthcare IT outsourcing, and data analytics. With its diversified mix of solutions, the company aims to be a one-stop shop for a healthcare provider's IT needs. As healthcare providers look to become more efficient in the coming years, it is reasonable to expect spending on technology to steadily increase.

Electronic health records are what the company was founded upon and still make up the vast majority of the company's revenue -- roughly 75%. However, electronic health records are a maturing industry, one expected to have one of the lowest growth rates within the healthcare IT sector. The chart below, from one of Cerner's investor presentations, shows that electronic health records should still experience an attractive 6% rate of growth, but more attractive growth can be found in revenue cycle management, data analytics, and telehealth.

Image source: Cerner.

Luckily, Cerner has exposure to all the products outlined in the above chart except for telehealth. (Investors interested in learning about telehealth should take a look at Teladoc.) Cerner has ambitions to significantly grow its businesses besides electronic records and believes that its strong position in health records gives it an easier time cross-selling additional services that providers need. Factoring in these different businesses, the company has guided investors to expect-long term revenue growth of 6% to 9%.

Expect margin expansion and buybacks

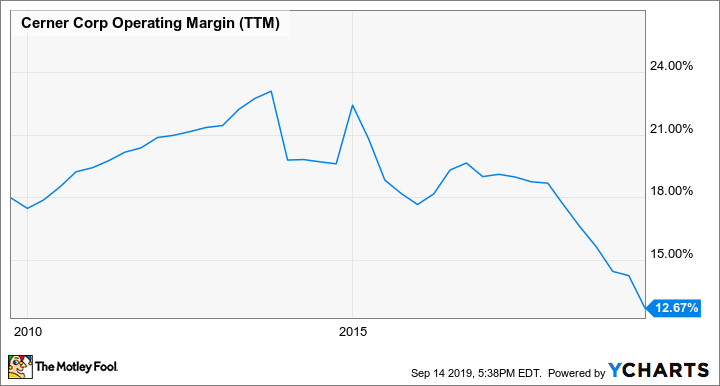

While many investors choose to focus on the revenue growth story, Cerner's bottom-line story is equally exciting. The company's operating margin peaked in 2013 at around 23% and has since declined into the mid-to-low teens as the company has invested in various businesses to spark growth. However, Cerner has signaled that its margins have bottomed and that it expects to bring operating margin back above 20% in the coming years.

CERN Operating Margin (TTM) data by YCharts

One reason Cerner is more focused on becoming more profitable is that activist investor Starboard Value has taken a stake in the company and reached an agreement to take on four board seats. Upon signing the agreement with Starboard, Cerner announced that it would retain turnaround consultant AlixPartners to help identify cost savings. The company also announced it would begin paying a dividend and buyback $1.5 billion of stock.

Given how far margins have declined, there are most likely ample opportunities to bring margins back up. Cerner has guided investors to expect operating margins to reach 22.5% by the end of 2020. If the company can execute, that would imply significant earnings growth.

A reasonable valuation

Cerner can be thought of as a tech platform focused on healthcare. In regards to valuation, Cerner's price-to-earnings ratio is in the mid-20s, which is similar to where large tech platforms in other industries trade. However, industry peer Allscripts Healthcare Solutions trades for just 15 times price to earnings, a significant discount to Cerner. Perhaps Allscripts is undervalued, although Allscripts has had choppy financial results, so the discount to other tech companies may be justified.

CERN PE Ratio (Forward) data by YCharts

Given that Cerner is a strong player within the healthcare IT industry and has attractive top-line and bottom-line characteristics, a valuation in line with that of other major tech companies is reasonable.

Is Cerner a buy?

Cerner is an interesting long-term play on technology becoming a growing partner to the healthcare industry. Diving in a bit deeper on Cerner's underlying businesses and its expectations for long-term revenue growth and margin expansion further paint a position picture. The company's valuation isn't particularly cheap, but it also isn't unreasonable. Putting the pieces together support Cerner as a buy for patient healthcare investors.

Looking ahead, investors should continue monitoring the company's execution against its desire to grow in new business areas outside of electronic health records and its ability to show margin expansion. If the company makes good on its goals and promises, expect to see the stock price move higher.