Chinese electric automaker NIO (NIO 2.86%) said that it delivered 2,019 vehicles in September, up 14.3% from a year ago and up 3.9% from August, continuing its sales rebound in the wake of a tough second quarter.

That was encouraging news for NIO, which is believed to be running dangerously low on cash. But the company still has a lot of work to do if it's going to convince investors that all is well.

A quarter that beat NIO's expectations

Boosted by that strong September result, NIO hit a total of 4,799 vehicles delivered in the third quarter. That was 35% higher than the second quarter, up 48% from Q3 2018, and ahead of its own guidance.

NIO's sales still haven't returned to the levels they hit late last year, but they're finally back on a growth path after months of struggles.

Data source: NIO. Chart by author. Chart shows monthly deliveries of NIO's ES8 (in blue) and ES6 (in green) since the start of ES8 production in June 2018.

As you can see from the chart, NIO's recently debuted ES6, an upscale battery-electric five-passenger crossover SUV, accounted for about 87% of its third-quarter deliveries. Most of those were higher-priced "premier" and "performance" versions, with starting prices of about $69,700 and $55,700, respectively; deliveries of a "standard" version of the ES6, with a starting price of about $50,100, began in late September, NIO said.

In a statement, CEO William Li said that NIO's order list grew in September, as its recently expanded sales network got up to speed. He also said that the company expedited deliveries in September to get those SUVs out ahead of China's Golden Week holiday period -- Oct. 1 through Oct. 7, this year -- but noted that both the ES6 and ES8 will be available with new, larger battery packs starting in October, which should help sustain sales in the fourth quarter.

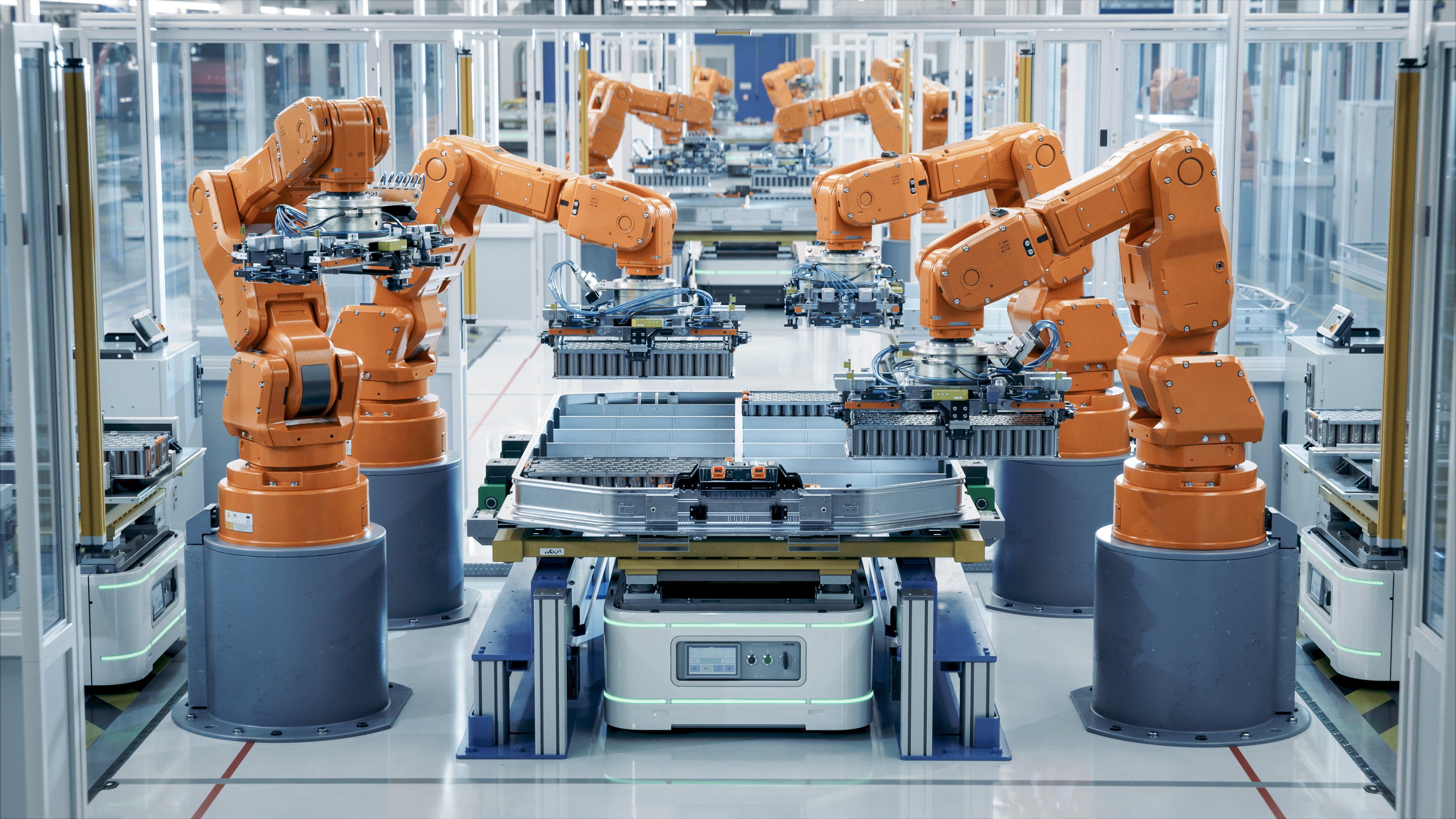

Sales of NIO's big ES8 SUV have slumped, but the company said that upgrades are on the way. Image source: NIO.

Deep financial trouble

It was a good month and a good quarter, but NIO is still a company in crisis. Its long-delayed Q2 report, released on Sept. 24, showed that it burned about $620 million in cash in the quarter as it opened a series of stores and geared up to launch the ES6. That amounted to more than half of its reserves, leaving it with just $503.4 million as of June 30.

Needless to say, investors didn't like that news.

NIO data by YCharts. Chart shows the percentage change in NIO's share price from Sept. 1 through Oct. 7.

For investors, the key question for NIO now isn't about sales nor demand for the ES6. It's whether the company can find enough cash to survive. Those questions grew louder after a key analyst, Sanford C. Bernstein's Asia-autos expert Robin Zhu, cut his price target for NIO to just $0.90 per share, saying that he thinks the company may have just "weeks" of cash remaining despite the announcement of a deal to raise another $200 million, half of it from current large stakeholder Tencent.

Zhu and his team think that NIO's options are limited: Either the company will get bailed out by a big investor like Tencent or the Chinese government (or both), or it will go into bankruptcy. Notwithstanding the company's good third-quarter sales result, that still seems like a fair assessment.