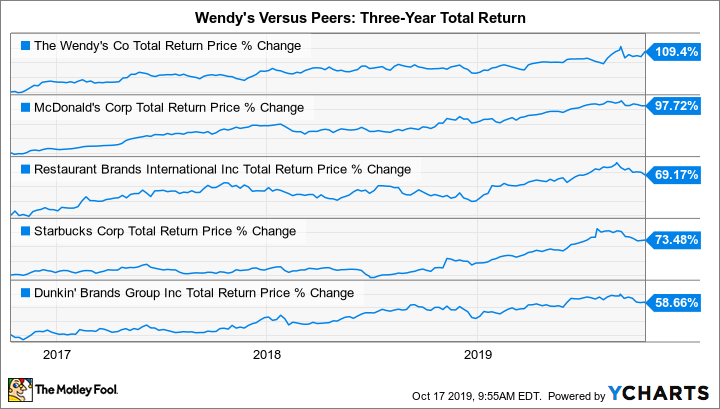

If you're not a close follower of Wendy's (WEN +1.10%), you might be unaware that it's handily bested its peer group of large-capitalization, quick-service restaurant stocks over the last three years:

WEN Total Return Price data by YCharts

This outperformance is reflected in Wendy's relatively high forward price-to-earnings (P/E) ratio of 37. Shares of McDonald's (MCD +0.40%), Burger King parent Restaurant Brands International (QSR 0.34%), and Dunkin' Brands (DNKN +0.00%) all trade at forward P/E multiples near 25, while Starbucks (SBUX +1.43%) stock can currently be purchased at 28 times forward earnings.

Following Wendy's investor day last week, one could make a case that rather than succumb to gravity, the company may actually retain its market premium over rivals, at least for a few quarters.

As my colleague Jeremy Bowman explained following the investor gathering, Wendy's added some clarity to its plan (first announced in September) to launch breakfast across its U.S. system in 2020, informing shareholders that breakfast would eventually comprise roughly 10% of daily sales, with incremental and manageable costs to franchisees.

The burger chain also announced during its investor day that it will embark on a significant global expansion next year, beginning with a European beachhead.

Image source: Wendy's.

Both of these initiatives are critical, as they represent entry into new markets for Wendy's: a new daypart market (breakfast), and, literally, new geographical markets. These are sales opportunities that Wendy's competitors have successfully plumbed for decades.

Of course, neither breakfast nor international sales constitute completely new ground for Wendy's. The organization has flirted sporadically with a breakfast menu for years, and it can legitimately boast of a brand presence in a broad array of countries.

Yet, with the possible exception of Japan, where it has 90 units, the company has never really pursued aggressive development in developed economies, choosing instead to spread a small number of international franchises (533 units out of a total of roughly 6,700 total units) across 30 countries and territories. Many of these are relatively small markets, such as Guam, El Salvador, Aruba, and Georgia (which sits at the intersection of Europe and Asia).

Relative to its peers, then, Wendy's has enormous new potential in putting down its first stakes in lucrative -- if competitive -- geographies. Its first focus will be cracking the European market over the next 12 to 18 months, where it presently has zero properties.

To understand the magnitude of this potential, consider that Wendy's currently derives but a fraction of its revenue from non-U.S. sales: Last year, the company's $519 million in sales from international franchisees represented less than 5% of total global systemwide sales of $10.5 billion.

This is the most skewed ratio of the companies in the peer group mentioned above. For comparison, Dunkin' Brands derives nearly a fifth of its annual systemwide sales from overseas. Starbucks generated 30% of total revenue from non-U.S. operations in its last fiscal year, while Canadian-headquartered Restaurant Brands International obtained roughly 44% of 2018 revenue from outside Canada's borders. McDonald's non-U.S. revenue last year amounted to a full 64% of total revenue.

The combination of meaningful global expansion and the addition of a breakfast shift to domestic franchise operations is worth quite a bit of annual value to Wendy's. While the company is on track to hit the high end of a 3%-4% year-over-year systemwide sales increase in 2019, its new long-term outlook calls for annual systemwide sales expansion of 4%-5%. This is a highly attractive growth rate for a quick-service operator, and one that perhaps only Starbucks (among its peer group) will be able to match in the coming years.

For context, also consider Wendy's relative underpenetration in terms of total locations: Its 6,700 units pale in comparison to its rivals' footprints. McDonald's most recent year-end store count of 37,800 is a truly mammoth number, yet those of Dunkin' Brands (20,900), Burger King (17,800), and Starbucks (29,300) all also far exceed Wendy's location count.

Thus, from a long-term perspective, Wendy's is not only poised to exploit new markets, it has room to accelerate global growth in the coming years to catch up to the location density of its rivals. For the near future, investors are likely willing to maintain Wendy's trading premium to accommodate this wide swath of opportunity.