Real estate investment trust (REIT) Medical Properties Trust (MPW +0.76%) is primarily focused on owning hospitals. So far 2019 has been a very active year for the landlord, which has inked a larger than anticipated number of deals to grow its portfolio. There's a good reason for the heightened activity, but it raises some questions for investors looking at the REIT today. Here are some key issues you need to think about before buying Medical Properties Trust.

1. Focusing on hospitals

There's nothing inherently wrong with owning hospitals. Some of the largest and most diversified healthcare REITs include the niche in their broadly diversified portfolios. The problem here is that Medical Properties Trust is not a diversified healthcare REIT -- it basically only owns acute care asset (81% of rents). In other words, if you are looking for a healthcare REIT to provide broad exposure to the sector, this is not the best choice.

Image source: Getty Images

In addition to the focus on hospitals, Medical Properties Trust also has a high concentration of assets with its largest tenant. Steward Health Care accounts for roughly 30% of the company's rent roll. That's a lot of exposure to just one customer, even though it is down from 40% at the end of 2018. That said, the company currently gets about 25% of its top line from foreign assets, with a goal of hitting about 30% or so over time. So while the company is decidedly focused on owning acute care assets and has heavy exposure to just one occupant, it does provide some geographic diversification. That's not enough to change the big picture, but it is worth noting. So only step in here if you want to focus on hospital assets.

2. Taking advantage of an opportunity

So far 2019 has been a very active year for the REIT. Through the first six months or so Medical Properties Trust was able to buy more new assets than it had projected for the full year. This is leading to swift growth in the portfolio and should be a long-term benefit, assuming the hospitals it buys perform as expected. The company asks itself how important the assets it buys are to the communities they serve, and believes its recent acquisitions are vital facilities that won't be closed any time soon. So there's no particular reason to doubt the properties are worth buying. And with a portfolio of over 300 hospitals, the closure of any individual property won't likely be a major headwind.

The bigger worry here is actually around Medical Properties Trust. During Medical Property Trusts' second-quarter 2019 conference call, CFO Steve Hamner ended his comments by saying:

When considered with the lowest cost of equity capital in our history, the unprecedented expansion of hospital investment opportunities in the developed world and MPT's unquestioned position as the leader in this market, we are very enthusiastic about the likelihood that we will continue to deliver some of the strongest growth in the REIT world.

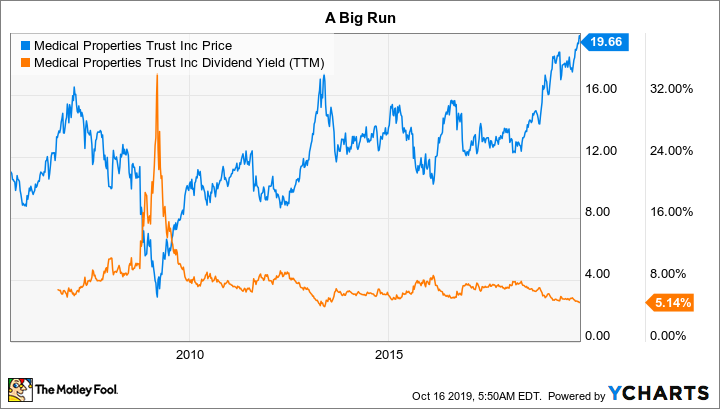

So acquisition-led growth will likely continue, which is great. But as an investor, the first 12 words of that quote should cause you to pause for a second. The stock is currently worth more than it has ever been worth before. That's allowed the REIT to sell shares to raise cash for acquisitions. It is also taking advantage of the low interest rate environment to issue debt at compelling rates, noting that Medical Properties Trust's debt is not investment grade-rated. There's a lot of demand for high-yield assets right now, and Medical Properties Trust is taking advantage of it. As long as it buys good assets, the new equity and debt should be manageable. However, as an investor, is it worth buying this REIT near all-time highs?

3. The yield is high, but...

The big attraction here is Medical Properties Trust's 5.3% yield. That's high on an absolute basis when you consider an S&P 500 Index fund only yields around 2% and Vanguard Real Estate ETF's yield is just 3.1%. However, 5.3% is close to the lowest Medical Properties Trust's yield has ever been (the flip side of the historically high stock price).

The dividend, meanwhile, is backed by annual increases since 2012. However, go back a few more years and you'll see that the REIT cut its dividend by 25% during the 2007 to 2009 recession. Also, as noted above, the balance sheet here is not investment grade-rated, which means the credit rating agencies think there's some financial risk here. And here's the big kicker: In the second-quarter, adjusted funds from operations (AFFO), which is similar to earnings for an industrial company, was roughly $0.25 per share -- just enough to cover the $0.25 per share dividend. That's a 100% AFFO payout ratio. Through the first half the payout ratio was 98%. And the dividend was just increased again, which will likely mean the high payout ratio remains in place.

A high yield is great, but only if it can be sustained. At this point there's no reason to doubt that Medical Properties Trust will be able to keep paying, but a high payout ratio and a below-investment grade credit rating are not positive attributes. Add in the history of a dividend cut, and most dividend investors should be a little worried about the sustainability of the dividend. That's doubly true as the REIT is shifting its growth plans into high gear. A small misstep could be all that's needed to put the dividend at risk.

Execution will be key

For most investors, Medical Properties Trust will not be a good option in the healthcare REIT space. A historically high price coupled with a high payout ratio and below-investment grade balance sheet are risks that won't be worth taking on for long-term investors who want to sleep well at night. Sticking to more diversified names would be a better choice.

That said, Medical Properties Trust does offer a high yield backed by a currently growing dividend. And with a price to projected run rate AFFO ratio (similar to P/E) of around 12.5 times or so, it doesn't look overly expensive relative to its earnings power.

Still, the price is higher than it has ever been before, so it would be hard to suggest Medical Properties Trust is cheap. Those looking to maximize yield who are willing to watch their portfolios very closely may want to do a deeper dive. But compare the REIT to other, more diversified options before hitting the buy button.