The diversified industrial giant Illinois Tool Works (ITW +0.10%) has raised its payout to shareholders annually for the last 45 consecutive years, earning itself a place on the S&P 500's list of Dividend Aristocrats. That said, income-seeking investors will be more interested in the sustainability of its dividend in the future than where it has been in the past. So let's take a look at the factors that will help us determine how attractive the stock is now as a dividend investing candidate.

Dividend yields and payout ratios

The first metrics to look at are its current yield and its payout ratio (dividend per share divided by earnings per share). Obviously, dividend investors will prefer to buy stocks with higher yields, but they'll also want to invest in businesses that have the capacity to keep increasing their payouts. All other things being equal, a company with a higher payout ratio will find it harder to boost its dividend payout.

Image source: Getty Images

As you can see in the chart below, the company's dividend yield is now around 2.4% and its payout ratio is around 53% -- a figure that's on the high end of its historical range. Moreover, note that the payout ratio has tended to spike during recessionary periods -- a natural result, as industrial companies' earnings tend to collapse during serious economic downturns.

ITW Dividend Yield (TTM) data by YCharts

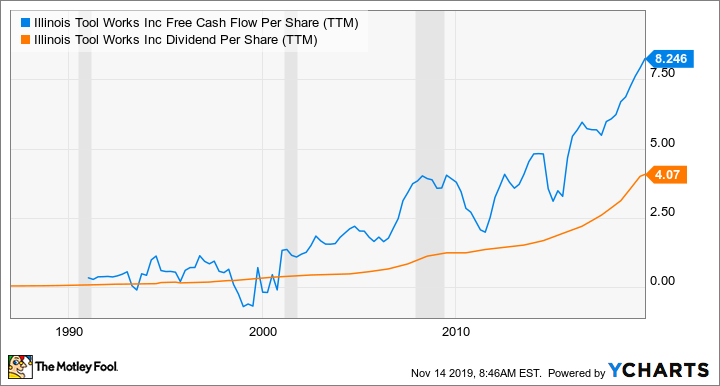

Perhaps a better metric to focus on would be the ratio of the dividend to the free cash flow per share. This is useful because industrial companies can take actions during slowdowns to improve their free cash flow such as adjusting capital expenditures or reducing inventory to match reduced demand. On this basis, you can see that Illinois Tool Works easily covered its dividend payments with free cash flow during the last recession and is doing so now as well.

ITW Free Cash Flow Per Share (TTM) data by YCharts

Putting it together, the company has a hefty dividend and it looks like it has room to increase it.

Long-term growth prospects

Among the other qualities to look for in an income stock are stable growth prospects, as no company can lift its payout indefinitely without also increasing its earnings. Stability is important too, because it suggests that the company's competitive position and/or end markets are less likely to dissipate.

A good example of a stable industry is the railroad sector. Because the major U.S. railroad operators (Union Pacific and BNSF in the West, and CSX and Norfolk Southern in the East) tend to function almost as duopolies and provide essential infrastructure for the U.S. economy, investing in railroads is a fairly safe strategy.

But what about Illinois Tool Works? Does it have long-term growth prospects and stability? I would argue that its diversity of income streams means it can compensate for any structural challenges that put pressure on one segment of its operations by growing revenue elsewhere.

To outline this point, here's a chart of the company's revenue growth by segment. Earnings tend to be relatively evenly distributed across those segments: The largest (automotive original equipment manufacturing) was responsible for 19% of profits in the first nine months of 2019, while the smallest segment provided 11%.

Data source: Illinois Tool Works

Let's say, for example, that the automotive industry falls into a protracted slump as individuals increase their use of ridesharing services and postpone buying new vehicles. Illinois Tool Works has plenty of other businesses it can invest in to generate growth. The overarching revenue driver for the company -- just as it is for railroads -- is broad economic growth. Therefore, even though all of the company's segments operate in highly competitive markets, their diversity provides it with plenty of opportunities for growth that it could pursue to offset weakness elsewhere.

A stock for dividend investors?

All told, Illinois Tool Works stock is a good option for dividend investors, but given that management aims for a payout ratio of 50% in 2023 and its current ratio is 53%, don't expect payout growth to exceed earnings growth over the next few years. Therefore, this is probably best viewed as a good dividend stock rather than a great one.