What happened

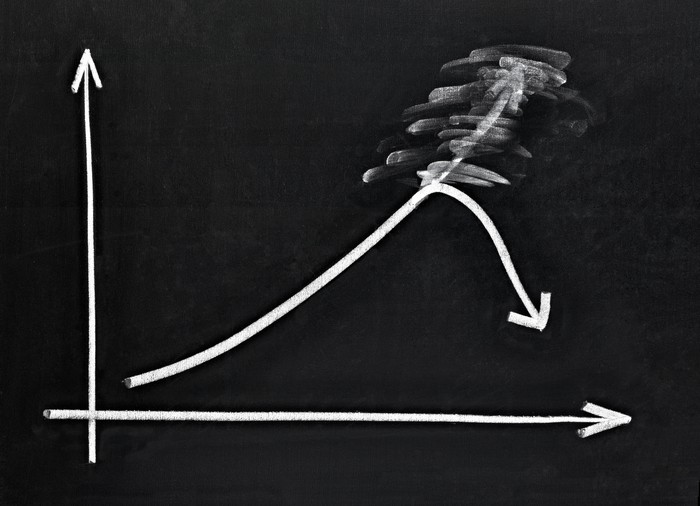

Shares of consumer products giant Unilever (UL +1.12%) (UN +0.00%) tumbled to close down 9.1% on Tuesday -- and it has only itself to blame.

In an update filed as a Form 6-K filing with the SEC today, Unilever warned investors "that it expects underlying sales growth for 2019 to be slightly below its guidance of the lower half of its 3-5% multi-year range."

Image source: Getty Images.

So what

It gets worse.

Unilever went on to describe "challenges" it is facing in certain markets, including an "economic slowdown in South Asia" and unspecified "trading conditions in West Africa." As a result of these conditions, management is forecasting that sales growth next year, too, will be weak. In the first half of 2020, growth "will be below 3%" and "full year underlying sales growth is expected to be in the lower half of the multi-year range," missing its target for full-year sales growth.

Management wasn't more specific on that latter point, but noted that any growth the company does enjoy "will be second-half weighted."

Now what

For context, according to S&P Global Market Intelligence data, analysts had been forecasting that Unilever would report sales of $58.3 billion this year, and grow that number to $60.7 billion. Now it looks like Unilever will miss both those targets.

The good news is that Unilever somehow expects that despite the sales shortfall, "earnings, margin and cash [will not] be impacted" -- at least not in 2019. With analysts forecasting full-year earnings of $2.55 per share, though, that still leaves Unilever stock trading for a pricey 22 times earnings in a no-growth environment.

No wonder investors are scared.