Walgreens Boots Alliances (WBA +0.00%) released its first-quarter results of fiscal 2020 on Wednesday, and things aren't off to a good start for the pharmacy retailer.

For the quarter ending Nov. 30, 2019, the company's adjusted earnings per share (EPS) of $1.37 fell short of the $1.41 analysts expected. Sales of $34.34 billion rose 1.6% from last year but were also just shy of expectations of $34.6 billion. Retail sales were down 2.2% from a year ago but the company notes that was mainly a result of tobacco products, which Walgreens has de-emphasized. Comparable retail sales excluding tobacco products and e-cigarettes were up 0.8%.

The company did have a strong performance over the Black Friday weekend with online sales in its U.S. retail division seeing 45% growth from the prior year while revenue in its international segment rose by 25%.

Although it wasn't a strong quarter for Walgreens, the company left its guidance unchanged for fiscal 2020 as it still expects to see flat growth and these latest results don't change that.

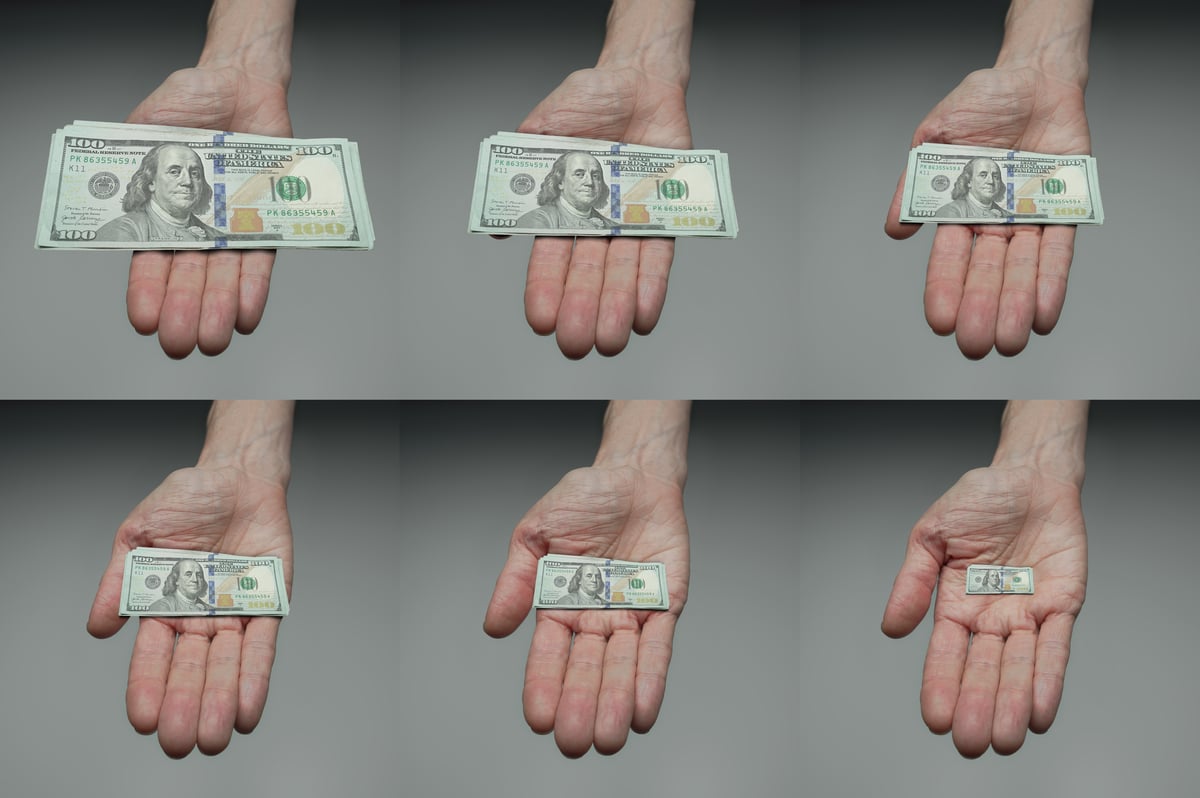

Image source: Getty Images.

Still on the right track

The company's Executive Vice Chairman and CEO Stefano Pessina believes the company is still on the right path despite the less-than-stellar results: "We are confident our strategic plans are the right ones to drive long-term sustainable growth going forward." The company is optimistic about its Transformational Cost Management Program as it continues to make progress with Walgreens still expecting to achieve annual cost savings of at least $1.8 billion by fiscal 2022.

Shares of the healthcare stock were down more than 6% Wednesday morning as a result of the earnings release.