What happened

Shares of Teradyne (TER +13.41%) rose as much as 10.8% early Thursday morning, boosted by a strong fourth-quarter earnings report. The maker of automatic testing tools used by manufacturers of semiconductors, circuit boards, and wireless networking modules crushed Wall Street's expectations, set optimistic targets for the next quarter, and added $1 billion to its share buyback program.

So what

Teradyne's fourth-quarter sales rose 26% year over year, landing at $655 million. Adjusted earnings increased by 40% to $0.88 per diluted share. Your average analyst would have settled for earnings near $0.79 per share on revenue in the neighborhood of $612 million.

Looking ahead, management set its first-quarter earnings guidance at roughly $0.91 per share, assuming revenue of approximately $690 million. For this period, Wall Street had been expecting earnings closer to $0.62 per share on sales near $551 million.

The board of directors also set aside another $1 billion for share buybacks, expecting to consume $250 million of that budget in the next quarter alone.

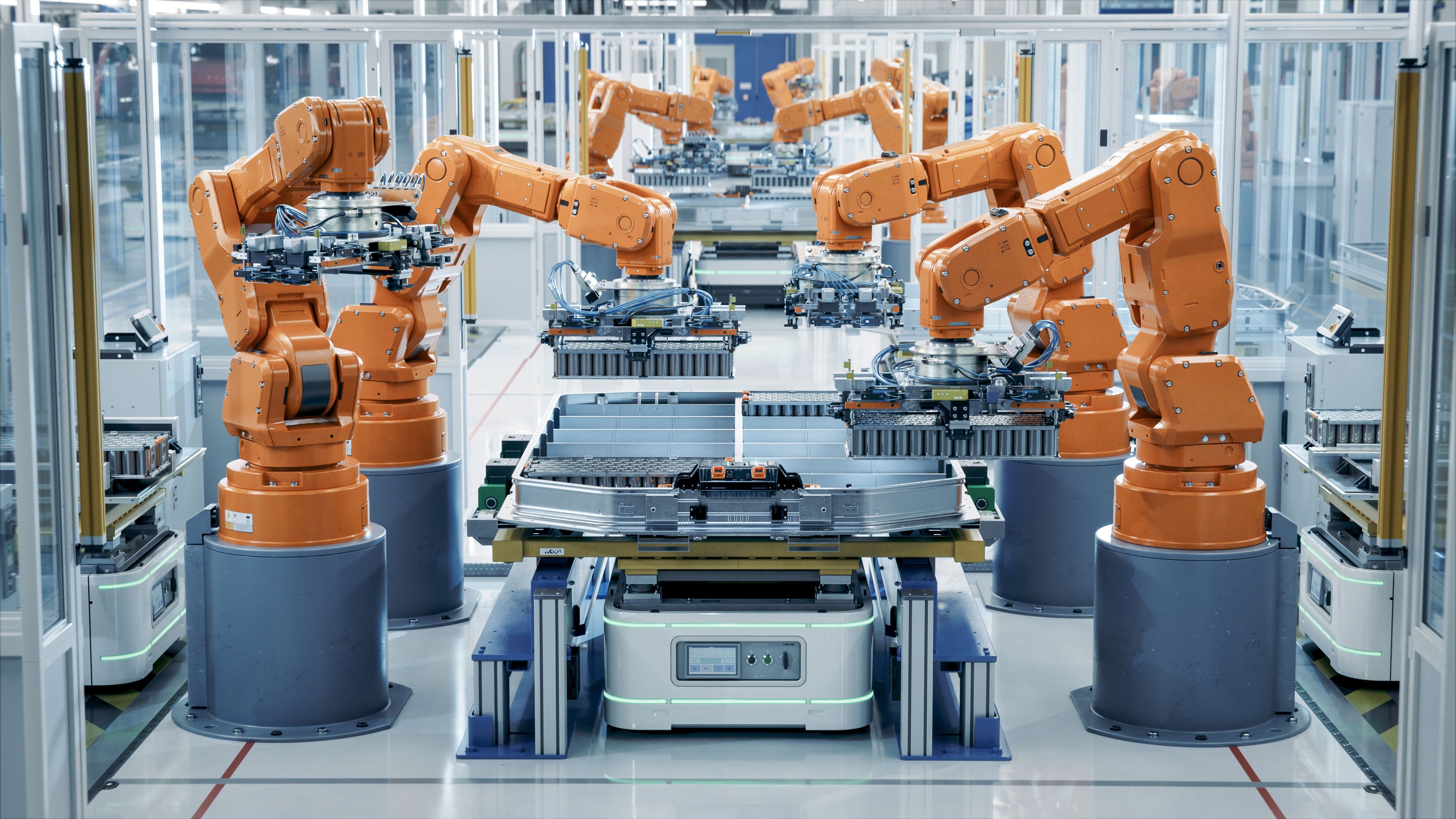

Image source: Getty Images.

Now what

These impressive results were due to surprisingly strong orders from makers of memory chips, wireless networking modules, and 5G wireless systems. Industrial automation is taking a break from infrastructure investments until the Chinese-American trade wars wind down, but that hardly even mattered in the face of fantastic growth across several other markets.

It's no surprise to see investors embracing Teradyne's strong earnings report, especially since the boosted buyback policy indicates that the company's management sees its own stock as a worthwhile investment. Shares have now soared 131% in 52 weeks, earning every penny of that gain via a string of impressive beat-and-raise reports.