What happened

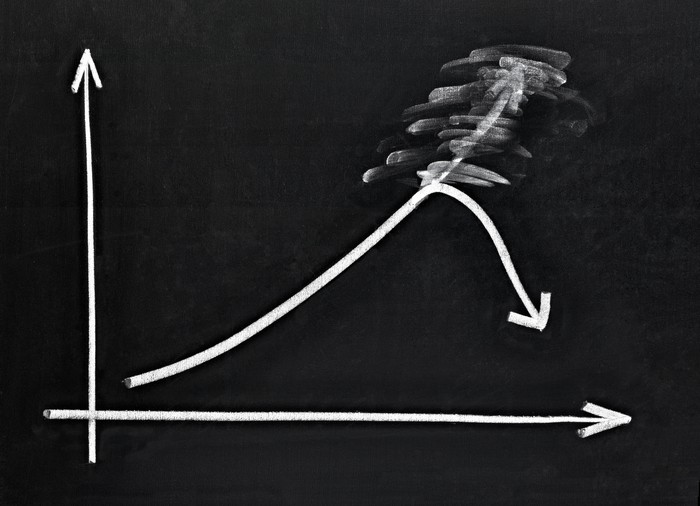

Six days after reporting fiscal second-quarter 2020 earnings so strong they sent its stock up 27% in a day, shares of connected car and location-based services provider Telenav (TNAV +0.00%) are heading in the other direction -- they've retreated 5% as of 11:10 a.m. EST Wednesday and were down closer to 17% earlier in the day.

So what

What sparked that early-day panic?

Image source: Getty Images.

Late last night, Telenav filed a form NT 10-Q with the SEC, indicating that it "is unable, without unreasonable effort or expense, to file its Quarterly Report on Form 10-Q for the period ended December 31, 2019 within the prescribed time period."

As the company explained, "subsequent" to reporting its earnings last week, Telenav had "further reviewed and updated its reporting of revenue related to its agreements with Grab Holdings, Inc. and certain of its subsidiaries." This review appears likely to change the revenue and earnings Telenav reported for the most recent reported quarter -- and potentially the earnings guidance that management provided in its earnings report as well.

Now what

Telenav's audit committee now believes that the company "has a material weakness in its internal control over financial reporting as of September 30, 2019 and December 31, 2019 related to a design deficiency in the Company's review controls over unusual or non-recurring and significant transactions." Management will now attempt to fix this problem, and "to file as soon as practicable its Quarterly Report on Form 10-Q for the three months ended December 31, 2019."

Until that happens, however, investors can't assume that the surprise profit Telenav reported last week was real -- or that the stock price bump Telenav received was deserved. Investors today are reacting with appropriate caution to that assessment.