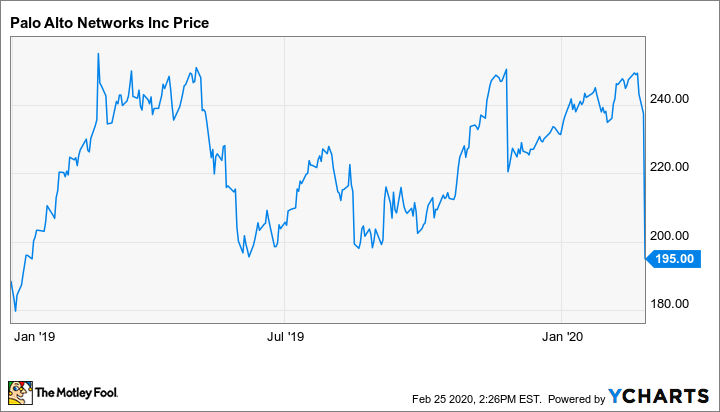

The half-year results are in for Palo Alto Networks' (PANW 6.25%) 2020 fiscal year, and they weren't quite as expected. Growth for the period ended Jan. 31, 2020, fell short of the outlook management had provided during the fall of 2019, and the tepid numbers led to a downgrade for the full-year period. Following the Monday report, shares in the company fell by double-digit percentages, erasing nearly all of the 2019 rally.

Data by YCharts.

Palo Alto Networks isn't alone in its struggles, though. Cloud-native cybersecurity upstart Zscaler (ZS 7.12%) didn't have a sunny report the week prior, either. And though the smaller, younger security outfit has traded barbs with Palo Alto Networks in the past, CEO Jay Chaudhry said he isn't worried about competition despite decelerating sales growth and accelerating expenses. But the fact is that, in addition to the legacy firms like Palo Alto that are adapting to the new marketplace, there are other start-ups trying to cash in on the massive global migration to the cloud (like Fortinet (FTNT 3.37%), for example, which had a great quarterly report).

All of this is to say that, although Palo Alto has received some criticism for its strategy of making the cloud transition primarily by way of acquisition, it's helping consolidate a market that has gotten crowded and is feeling the short-term effects of the highly competitive cloud computing cybersecurity space. All is far from lost, though, as there was still a lot to like about this latest report as well.

Image source: Getty Images.

The bad news first

Palo Alto's fiscal second-quarter 2020 revenue came in at $816.7 million, a 15% year-over-year increase and short of the 18% to 19% growth forecast a few months prior. The company's next-gen security services grew 101% in the quarter, and new services continue to be released -- like Cortex XSOAR, a new security orchestration tool that was also announced on the day of earnings. These modern business lines are still expected to expand by 79% to 82% this year; however, the firewall products division -- legacy cybersecurity that is getting pressured by the cloud -- was weak and is expected to decline 3%.

What that equates to is a full-year 2020 downgrade. Revenue growth of 19% to 20% was cut to 16% to 17% and adjusted free cash flow margin (excluding the most recent Aporeto acquisition) was lowered to 28% from 29%. The headwinds being created by customers switching from legacy products to cloud and next-gen products are expected to subside, but the short-term bump in the road was enough to send share prices in all-out retreat.

|

Metric |

Six Months Ended Jan. 31, 2020 |

Six Months Ended Jan. 31, 2019 |

Change |

|---|---|---|---|

|

Revenue |

$1.59 billion |

$1.37 billion |

16% |

|

Gross profit margin |

71.6% |

71.8% |

(0.2 pp) |

|

Operating expenses |

$1.24 billion |

$1.01 billion |

23% |

|

Adjusted earnings per share |

$2.24 |

$2.67 |

(16%) |

Data source: Palo Alto Networks. Pp = percentage point.

On to the good news

Even after spending a couple billion on acquiring smaller start-ups in the last couple of years, Palo Alto Networks ended its Q2 with $3.13 billion in cash, equivalents, and short-term investments. Management thinks the revenue slowdown will pass and is confident in its longer-term outlook for service billings to grow by about 20% a year. Thus, rather than just talking about it, management is putting its money where its mouth is. It announced a $1 billion accelerated share repurchase transaction that will commence during the current quarter. With a current market cap of $23.3 billion, that equates to a 4.3% cash yield and should provide a buoy for share prices in the next few months.

The $1 billion accelerated buyback is on top of the previous $1 billion repurchase plan from last year, of which $802 million remained at the time of the report. Palo Alto likely feels comfortable with its aggressive return of cash because, in spite of the short-term headwind, it is still well in the black as far as free cash flow generation goes -- north of $1 billion this year if the revised guidance pans out.

All said, lower-than-expected quarterly results are never pleasant, and 2020 is shaping up to be a wild year as expected, but Palo Alto Networks' divisive strategy still appears to be working. Many legacy cybersecurity stocks are being displaced by new high-growth cloud-based peers, but the leader in the industry is holding its own for the time being.