Enterprise Products Partners (EPD +4.62%) has a huge 7.7% distribution yield, exactly what a retiree needs to boost his or her cash flow in retirement. But a big yield alone is not enough of a reason to buy any investment -- which is why investors should be so excited by Enterprise. A big yield is just the start of what it has to offer today. Here's a quick primer on why Enterprise is a retiree's dream stock.

Not a commodity play

Enterprise operates in the midstream segment of the energy sector. That means it owns things like oil and natural gas pipelines, storage, transportation, and processing assets. Considered a bellwether in the sector, it is one of the largest and most diversified midstream players in North America. But the best part of this is that roughly 85% of its gross margin is derived from fees.

Image source: Getty Images.

Essentially, it gets paid for the use of its assets; the often volatile prices of oil and gas have very little effect on its financial results. Broader supply and demand dynamics are obviously issues that impact the partnership, but the still important role oil and gas play in the world underpin the business. And the current COVID-19 slump aside, demand for these fuels is still generally strong. Basically, Enterprise is a giant player in a vital energy market, but it doesn't require investors to take on all of the commodity risks inherent to owning an oil and gas driller.

Still seeing opportunities for growth

ESG-minded investors might step in here and suggest that renewable power is going to displace oil and gas. That's true over the very long term, but these fuels are integral to the global economy today. They simply can't be replaced overnight. Note that oil took roughly 100 years to displace coal as the world's primary energy source. In fact, Enterprise is still finding ways to expand its asset base, with roughly $7.7 billion worth of capital spending plans that will take it through around 2023.

That spending should keep the master limited partnership's top and bottom lines growing over the next few years. And, based on Enterprise's history, there's no particular reason to doubt that it will find even more opportunities ahead. To put some numbers on that, since its 1998 initial public offering, Enterprise has invested roughly $42 billion in ground-up construction and expansions and $26 billion in acquisitions.

Rewarding investors well

As a partnership, Enterprise passes through much of its cash flow to investors. That's one of the key reasons for the huge 7.7% yield, which dwarfs the roughly 2% you'd get from an S&P 500 Index fund today. However, there's another piece to this that's, perhaps, more compelling. Enterprise has increased its distribution annually for 22 consecutive years. It clearly takes returning cash to unitholders very seriously.

The distribution growth rate, meanwhile, has historically averaged in the low to mid-single digits. That's not huge, but it is enough to keep up with or beat inflation. So the buying power of the distribution has grown over time.

Conservatively run

Retirees will also like the fact that Enterprise is conservatively managed and, pretty much, always has been. For example, it covered its distribution by 1.7 times in 2019. Historically, 1.2 times coverage has been considered strong in the midstream industry. Put simply, Enterprise has plenty of room to keep increasing the distribution and handle any adversity that may come its way.

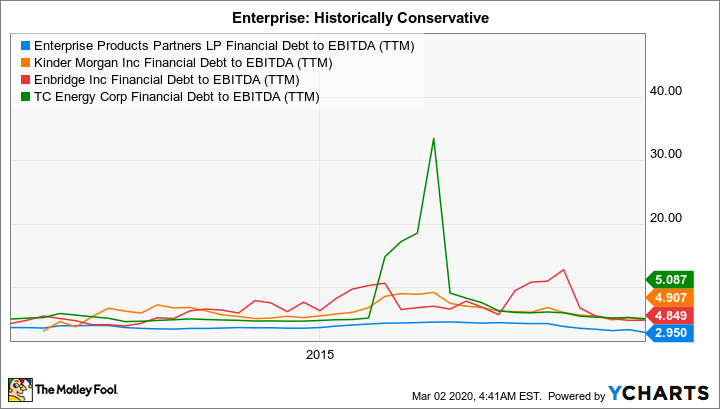

EPD Financial Debt to EBITDA (TTM) data by YCharts

But that's not the only place where Enterprise's conservative nature shows up. It also has a rock-solid balance sheet relative to its peers. This could be examined in a number of different ways, but one of the most common in the midstream space is financial debt to EBITDA, where Enterprise comes in at roughly three times. Some of the partnership's closest peers have financial debt-to-EBITDA ratios that are in the five times space, which is notably higher.

The key here, however, is that Enterprise has always tended to be conservative. Many other companies are only just now starting to rein in their use of leverage, often after being forced to cut dividends. Enterprise has long been a slow and steady tortoise and has no plans or need to change its successful approach.

Throwing the baby out with the bathwater

All in all, there's a lot to like about Enterprise, especially if you are retired and looking to maximize the income your portfolio generates. And right now is a great time to look at the midstream giant because investors are so negative about anything related to oil. In fact, Enterprise's unit price is down nearly 20% so far in 2020 and almost 45% from its 2014 highs. The yield, as you might expect, is historically high. If you can get beyond the oil connection, the price of which has little effect on Enterprise's top and bottom lines anyway, this partnership is the kind of income-producing name that can help you retire in comfort.